Grayscale is not letting up and intends to capitalise on its resounding victory over the US Securities and Exchange Commission (SEC). The company holding the world’s largest Bitcoin fund has written to the SEC to quickly agree a solution to convert its Grayscale Bitcoin Trust (GBTC) into a Bitcoin Spot ETF, after the Court of Appeals described the regulator’s decision as “capricious”.

Grayscale stands its ground and appeals to SEC

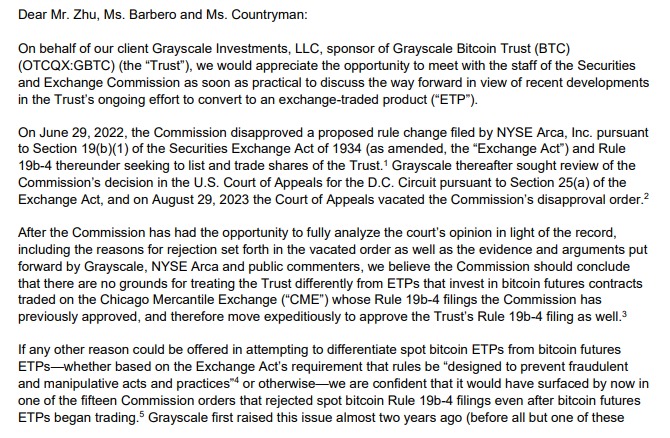

Following its stunning victory over the Securities and Exchange Commission (SEC), Grayscale is looking to build on its momentum. The Digital Currency Group (DCG) subsidiary has sent a letter to the US regulator through its lawyers to prepare for a meeting to assess “the best way forward”.

This puts further pressure on the SEC, which has so far been content at worst to reject Bitcoin spot ETF applications out of hand on the grounds of danger to investors (even though BTC futures ETFs have been approved), or at best to keep pushing back the deadlines, as it has done recently for all ETF applications, including that of the giant BlackRock.

Writing for Grayscale, Davis Polk lawyer Joseph Hall claims that investors are suffering unjustified losses as a result of the SEC’s decisions:

“

“.

“Every day that the Trust’s shares are not listed on NYSE Arca is another day that existing investors in the Trust suffer undue harm. “

Excerpt from Grayscale letter to SEC

When the Court of Appeals ruled in favour of Grayscale, the judges said that the SEC had acted in an “arbitrary and capricious” manner, in particular for failing to explain why it was granting a different ruling on the BTC Futures ETFs.

Grayscale at the forefront

As a reminder, Grayscale is not looking to create a Bitcoin cash ETF from scratch, but to convert its flagship product, the Grayscale Bitcoin Trust (GBTC), into an ETF. The GBTC, which is supposed to track the price of Bitcoin, was at a discount of almost 50% in December 2022. Grayscale’s recent victory proved that the market was waiting for a response to its lawsuit against the SEC, as this discount is now only 20%.

The GBTC is the largest Bitcoin fund in the world, representing more than $16 billion. So the transformation of the GBTC into a Bitcoin spot ETF could attract significant liquidity to BTC.

“Now that the Court of Appeals has ruled, there is no reasoning available that would distinguish a Bitcoin futures ETP from a Bitcoin spot ETP under the legal analysis previously adopted by the Commission to reject Bitcoin spot ETPs. “

This being the main problematic point for the SEC, since it does not have a priori to make a difference between these 2 types of ETF insofar as they are both 2 correlated to BTC, the SEC could possibly go back on its past approval of Bitcoin futures ETFs, according to some observers.

The SEC has until mid-October to reconsider the matter.