This week is a reminder that the crypto market is still facing its own demons first and foremost, the challenges of regulating crypto platforms that are still in the process of being put in place. For the annualised uptrend in the bitcoin price, it’s the resurgence of an endogenous challenge just a few days before the FED and as the market tests a pivotal chart zone.

Regulation, the challenge of the long-term uptrend

The Coinbase/Binance affairs are a reminder of how important it is for High Finance to see the cryptocurrency market acquire regulation close to the standards of traditional finance. The US financial markets regulator, the SEC, has decided to step in to force the two giants of the so-called centralised crypto sector to comply with the rules of the game in order to perpetuate their long-term hold on the US market.

In my opinion, this is yet another resurgence of a fundamental debate that does not call into question the annual upward trend in the Bitcoin (BTC) price, but rather gives it structural substance if a transparent and efficient regulatory framework is put in place in the coming months.

The crypto market is currently undergoing the same legal process as the foreign exchange market (FOREX) did in the early 2010s. At that time, regulators tackled a new market that was accessible to all traders, and only those players who agreed to play along with the regulatory framework were able to benefit from strong growth that was sustainable over the long term.

Clearly, the giants in this category (Binance and Coinbase) have every interest in being proactive and voluntarily complying with all the regulators’ requirements, as this will be the root cause of their business expansion in the long term. Indeed, the flows of high finance require this new regulatory framework to which they are accustomed in other asset classes on the stock market.

The year 2023 represents good timing for making significant progress on the regulation of cryptos, so that in 2024 we can benefit from a healthy infrastructure for the next bull run, which is sure to come as the date of the next halving approaches.

Note that in terms of stock market barometers, the BNB/USD token is testing a technical pivot zone at $250 in the short term, the price reaction will tell whether the storm triggered by the SEC is behind us or not.

Graph produced with the TradingView website and which shows the Japanese candlesticks of the NBB/USD in daily data

All eyes are on the FED next Wednesday

For the crypto market, this week of the Binance and Coinbase affairs is a decisive week from a technical point of view, and it’s a decisive week before its time. Indeed, the market’s attention is primarily focused on the Federal Reserve’s (FED) next monetary policy decision, which will be unveiled on Wednesday 14 June with a market consensus in favour of a pause in monetary tightening.

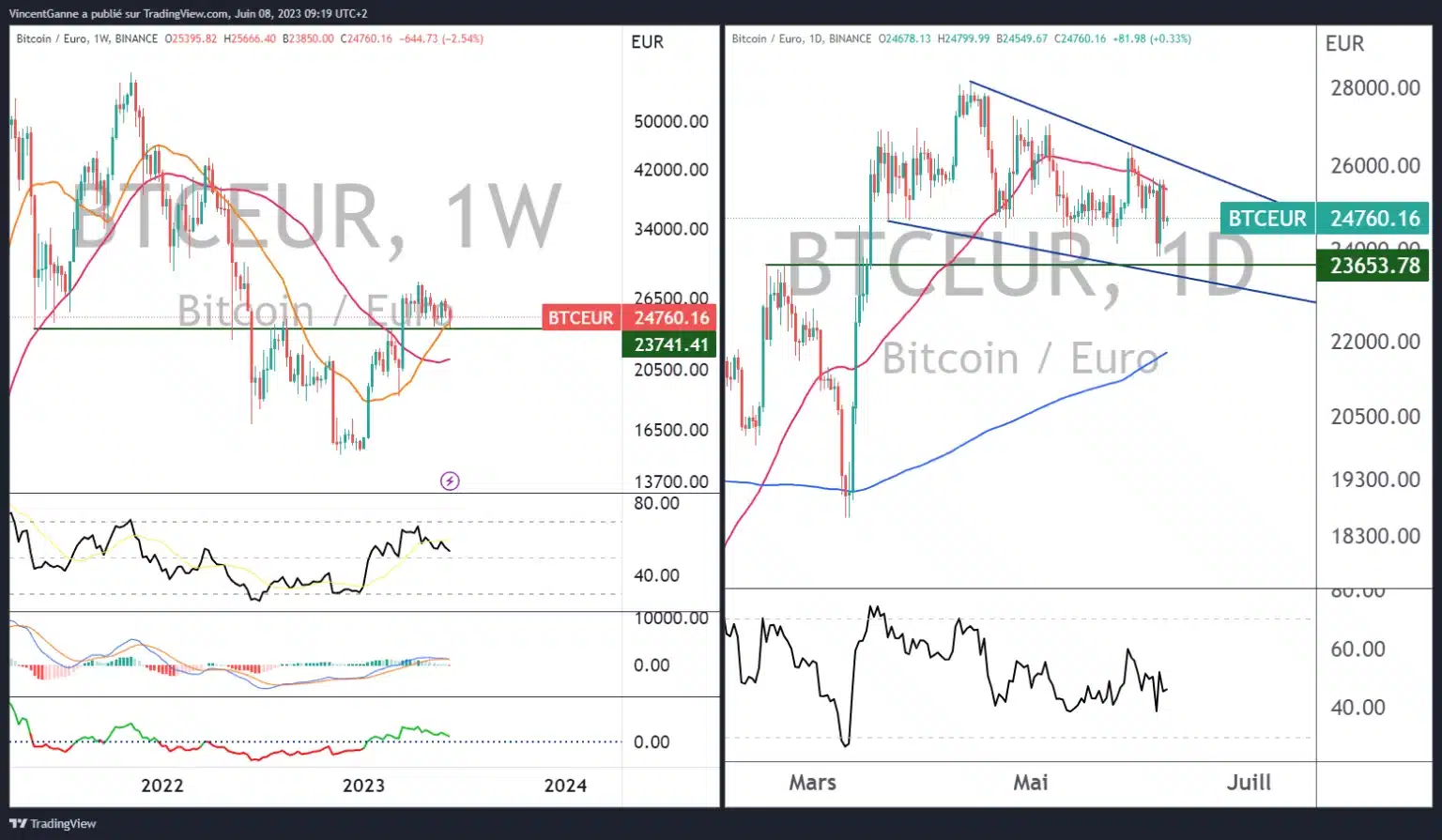

Technically, it is possible that bitcoin will not be patient until that date to make its chartist choice, as it has already been testing the pivot zone on the chart since Monday, the last one to ensure the uptrend that has been in place since the start of the year: the 23,000 and 24,000 levels on the bitcoin/euro pair.

Graph produced with the TradingView website, which juxtaposes weekly and daily Japanese candlesticks for the BTC/EUR price