Fundraising can be an interesting barometer for judging the health of the cryptocurrency ecosystem. On this aspect, Q3 2023 was the worst of the bear market with a steadily falling trend: let’s analyze these figures.

Q3 fundraising records poor performance

In addition to prices, there are a number of other data points on which to judge the health of the market. In the space of a week, for example, we announced redundancies from players such as Ledger, Chainalysis and Yuga Labs, testifying to a still febrile climate. Fund-raising is also a powerful indicator of ecosystem dynamics.

To analyze this, we have extracted and formatted the data provided by DefiLlama, and we can see that the 3rd quarter of 2023 is the worst in this bear market. There were 144 rounds of financing for almost $1.1 billion raised between July 1 and September 30.

This compares with nearly $2.25 billion in financing between January and March, and $1.49 billion in the second quarter.

However, one of the points we made back in May is that poor performance is essentially a question of amounts raised, rather than quantities. Indeed, although this value has also been falling since the beginning of the year, it has returned to the level of Q1 2022, when it was 135 for an amount 8.26 times higher:

Figure 1 – Total quarterly fundraising since 2022

Disappointing monthly statistics

Only one fundraising round this quarter exceeded $100 million, namely a Series C round on August 16 led by BitGo, an institutional custody provider. In total, this brings the number of financings in excess of $100 million to 5 this year, compared with 49 over the same period in 2022.

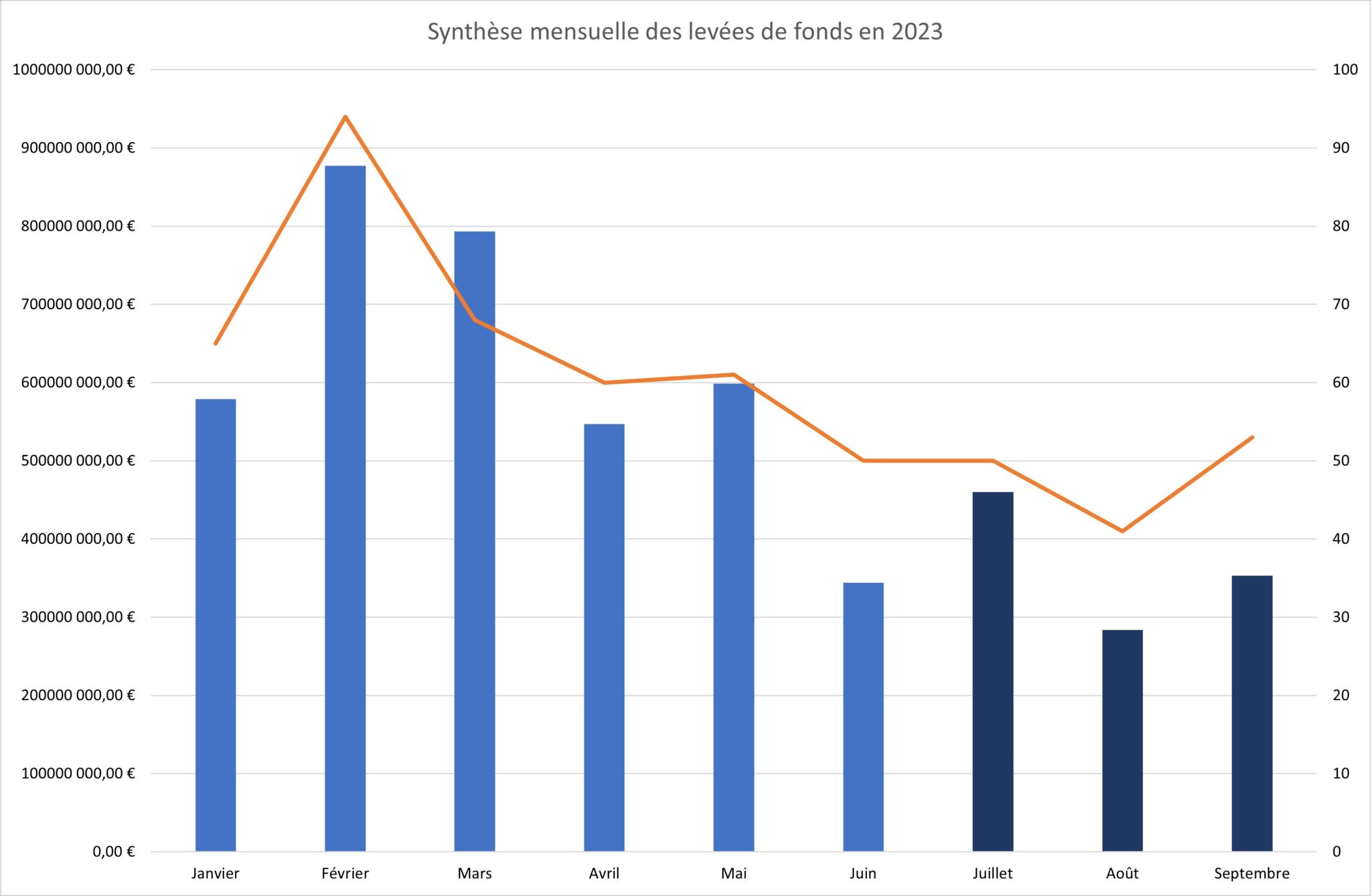

The poor performance of Q3 can also be seen at monthly level. July, August and September are respectively in 6th, 7th and 9th position for the 9 months already elapsed. This represents $460, $283.4 and $352.9 million respectively for 50, 41 and 53 fundraisings :

Figure 2 – Total monthly fundraising in 2023

Since the beginning of the year, Bitcoin has risen by almost 68%, suggesting that the worst of the bear market is behind us. Nevertheless, the state of fundraising shows that the ecosystem has not yet recovered from the fall, and investors are still skittish.

However, it’s also important to put these figures into perspective, 2022 having seen some particularly notable excesses such as the famous billion dollars raised by Luna Foundation Guard, 3 months before its blockchain exploded.

On the other hand, these data show that projects continue to be financed in spite of everything, as evidenced by the number of funding rounds, which show a more measured decline. However, these projects have to deal with less capital, a factor that can put the emphasis on value creation.