Announced last November, Curve’s new stablecoin (CRV) has now been deployed on Ethereum (ETH). Dubbed crvUSD, we take a look at this innovative asset.

The Curve stablecoin is now launched

Announced a few months ago, Curve’s brand new stablecoin has just arrived on Ethereum (ETH).

As the Curve teams have explained, not everything is finalised yet, only the smart contract is online and the user interface has yet to be published:

As many figured – deployment of crvUSD smart contracts has happened!

This is not finalized yet because UI also needs to be deployed. Stay tuned

– Curve Finance (@CurveFinance) May 3, 2023

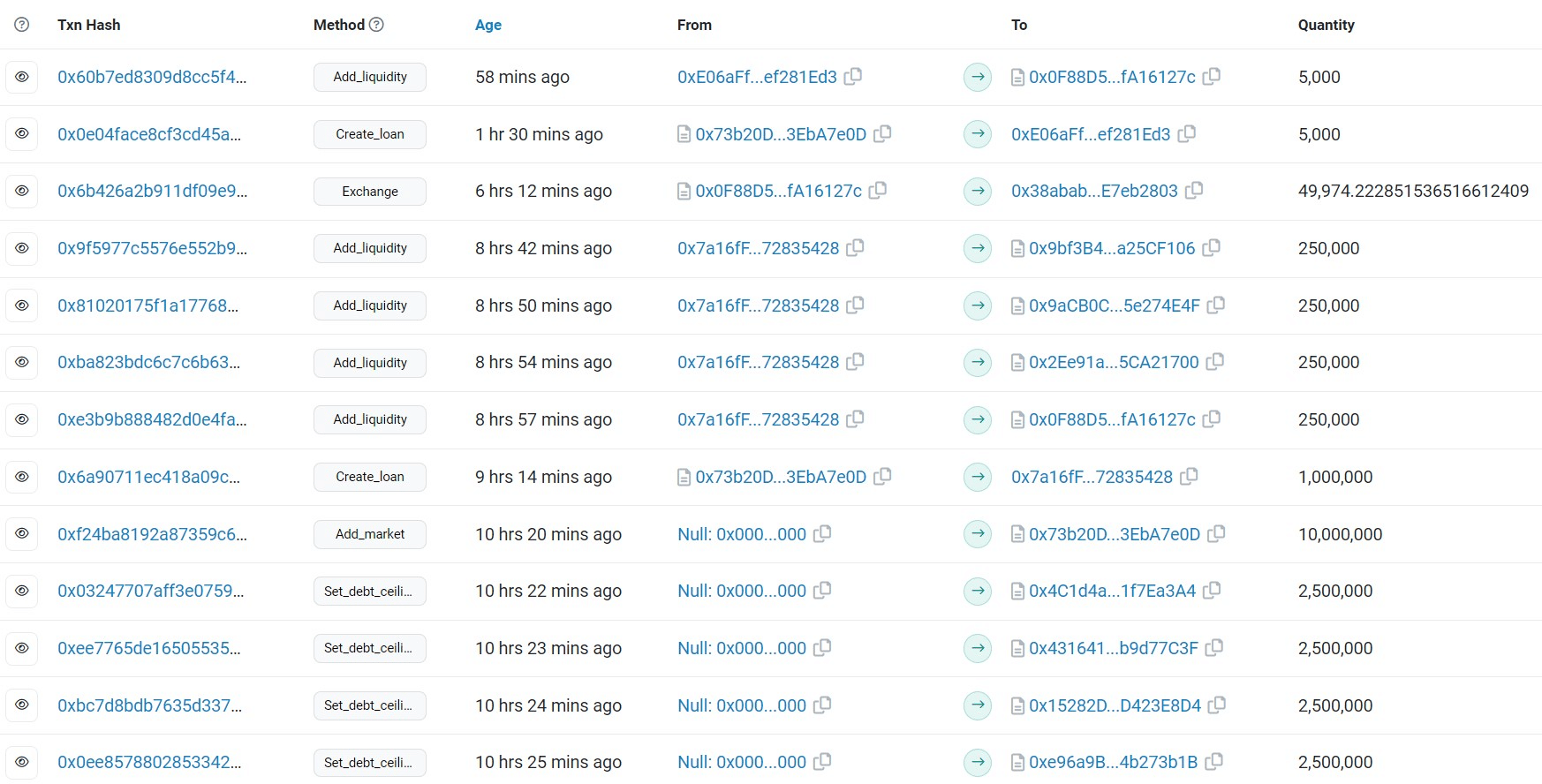

Nevertheless, the first transactions have already taken place, as we can see on Etherscan:

Figure 1 – Transactions on the crvUSD smart contract

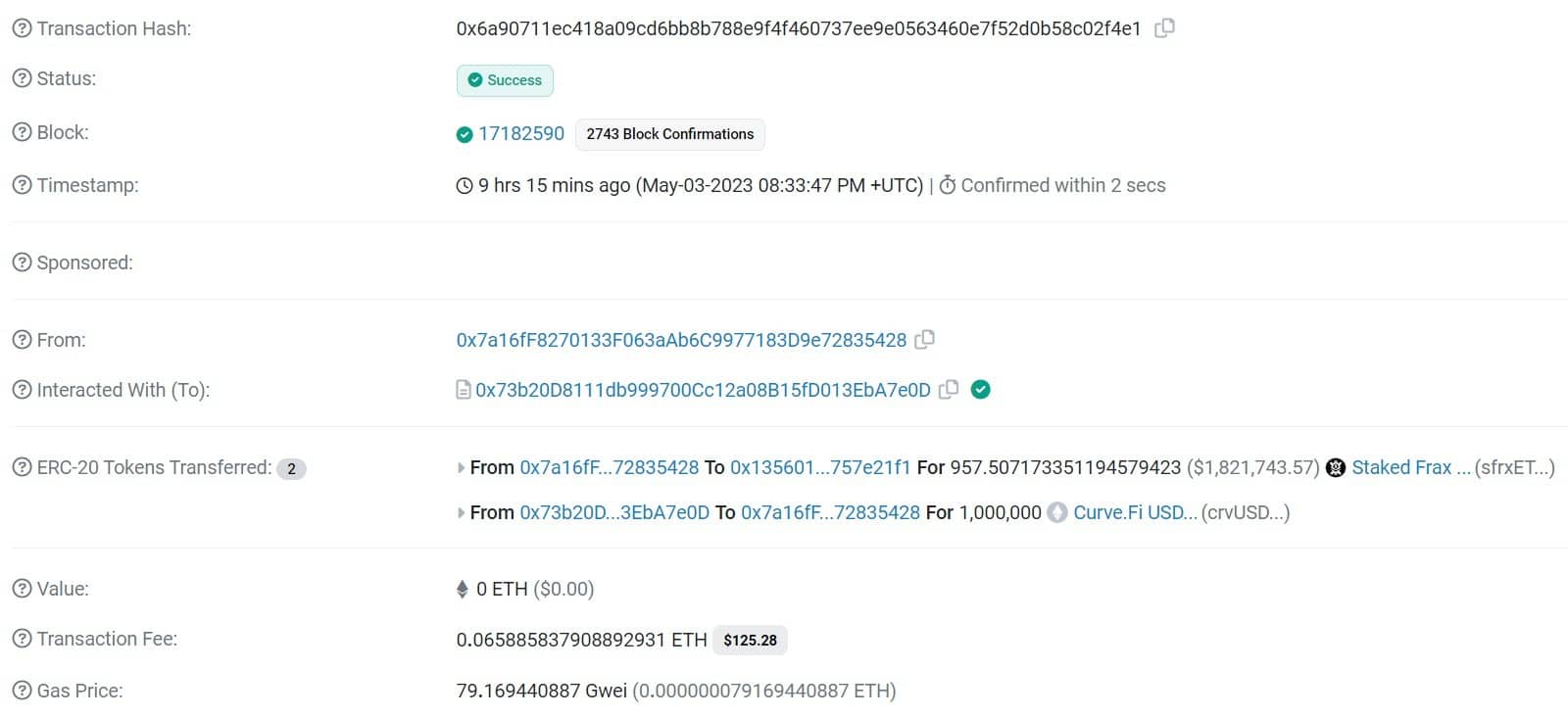

At the time of writing, we could see that more than a dozen transactions had been carried out. These include additions of liquidity, and even the opening of positions to borrow crvUSD, such as this transaction with a collateral stake of $1.8 million:

Figure 2 – Borrowing one million crvUSD against Staked Frax Ether

The innovative way crvUSD works

Like other decentralised stablecoins such as MakerDAO’s Dai and Aave’s GHO, which is still being tested, Curve’s crvUSD is based on a lending and borrowing model.

The idea is to overcollateralise your position in order to acquire stablecoin: for example, by depositing $2,000 in collateral in order to borrow $1,000.

Where crvUSD is innovative is in its liquidation algorithm. While the main decentralised debt markets liquidate positions when they are no longer sufficiently collateralised, stablecoin’s LLAMMA module offers an optimised version of this liquidation.

To take the example from earlier, let’s say an investor deposits $2,000 worth of ETH to borrow $1,000 worth of crvUSD. With a traditional model, this investor would start to be liquidated if the ETH lost more than 50% of its value.

With LLAMMA, this ETH position is gradually converted into stablecoins as the price of the asset falls. Conversely, these stablecoins will be converted back into ETH if its price rises again. The aim of this system is to absorb greater market volatility, thereby reducing the risk of capital loss.

With $4.4 billion of liquidity deposited on the protocol, Curve is the largest decentralised exchange in terms of TVL. As a result, it will be interesting to observe the uptake of its new stablecoin. Over the last 24 hours, the CRV has risen by just over 5%.