As the price of bitcoin (BTC) slips above $40,000, the relative performance of ETH remains limited. Given that cash flowing out of BTC often finds refuge in ETH after a market rally, a rotation of capital would allow ether to appreciate against bitcoin once again

The BTC price is now above $40,000.

BTC exceeds $40,000

After more than a month of low volatility, the price of bitcoin (BTC) slips above $40,000, returning to the price levels recorded before the collapse of the Terra ecosystem and its token LUNA.

With nearly $80 million in short liquidations in the last 24 hours, BTC’s rise above $40,000 is the result of a series of short squeezes.

Thanks to this rise, BTC’s market capitalization now stands at $780 billion. In doing so, Bitcoin’s valuation becomes the 8th highest in terms of assets and the 13th highest when compared to a nation’s money supply.

Figure 1: Bitcoin (BTC) price

ETH does its best to keep up

The market trend hasn’t forgotten Ether (ETH), which is sustainably breaking through the $2,000 barrier and is currently over $2,200.

That said, ETH’s performance remains moderate compared to BTC’s: the ETH price was unable to hold up over the summer, slowing its growth markedly.

Figure 2: Ether (ETH) price

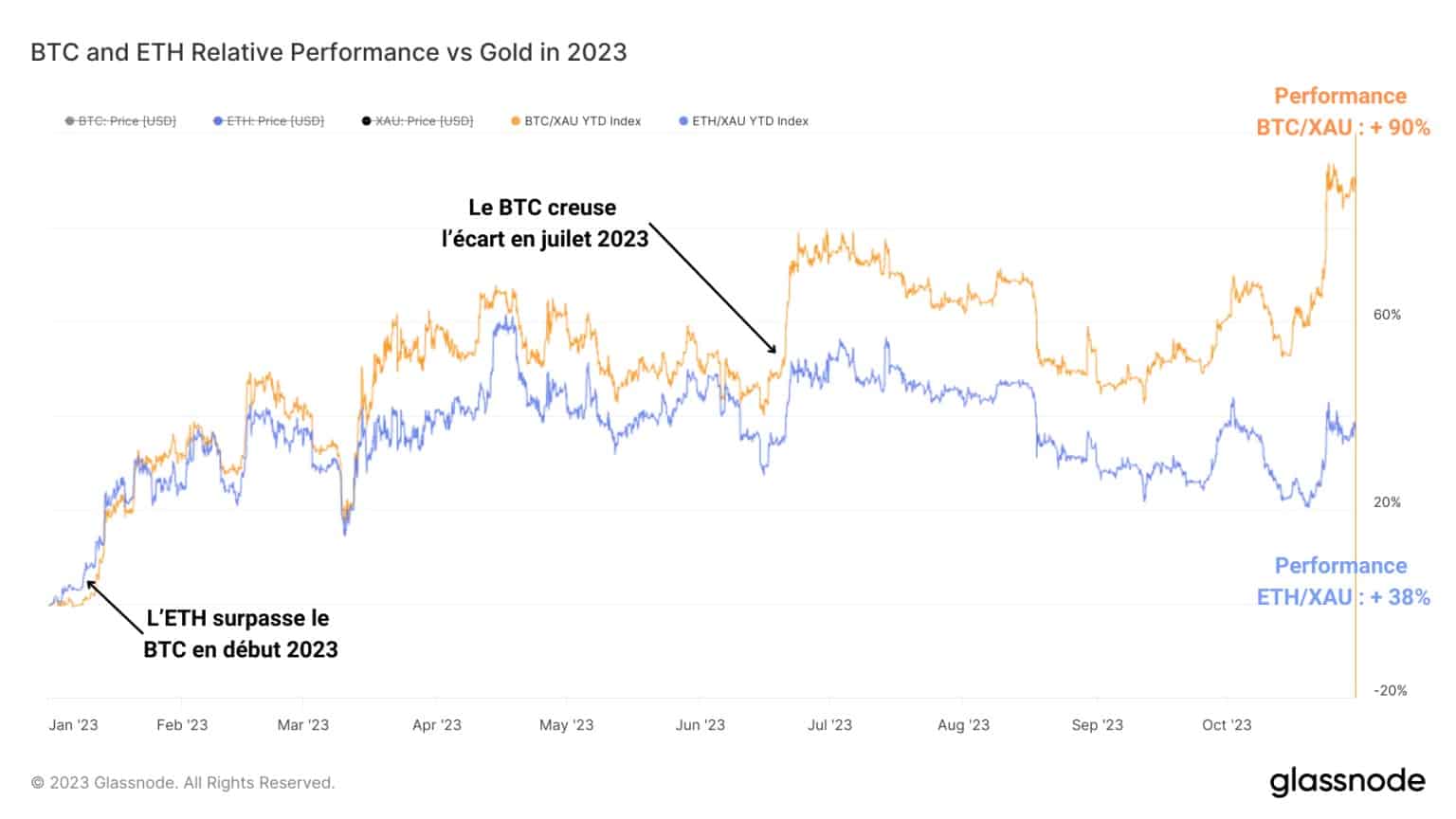

Compared with gold (XAU), BTC and ETH prices posted relative performances of +90% and +38% respectively.

Despite ETH’s brief dominance at the start of 2023, BTC gradually gained ground, outperforming ETH throughout the year.

Note that BTC widened its performance gap with ETH over the summer, with a weaker rise and a more intense correction.

Figure 3: Relative performance of BTC and ETH versus gold

Rotation of capital between BTC and ETH

As BTC continues to rise and ETH struggles to keep pace, let’s take a look at how capital turnover between the two assets influences their price performance.

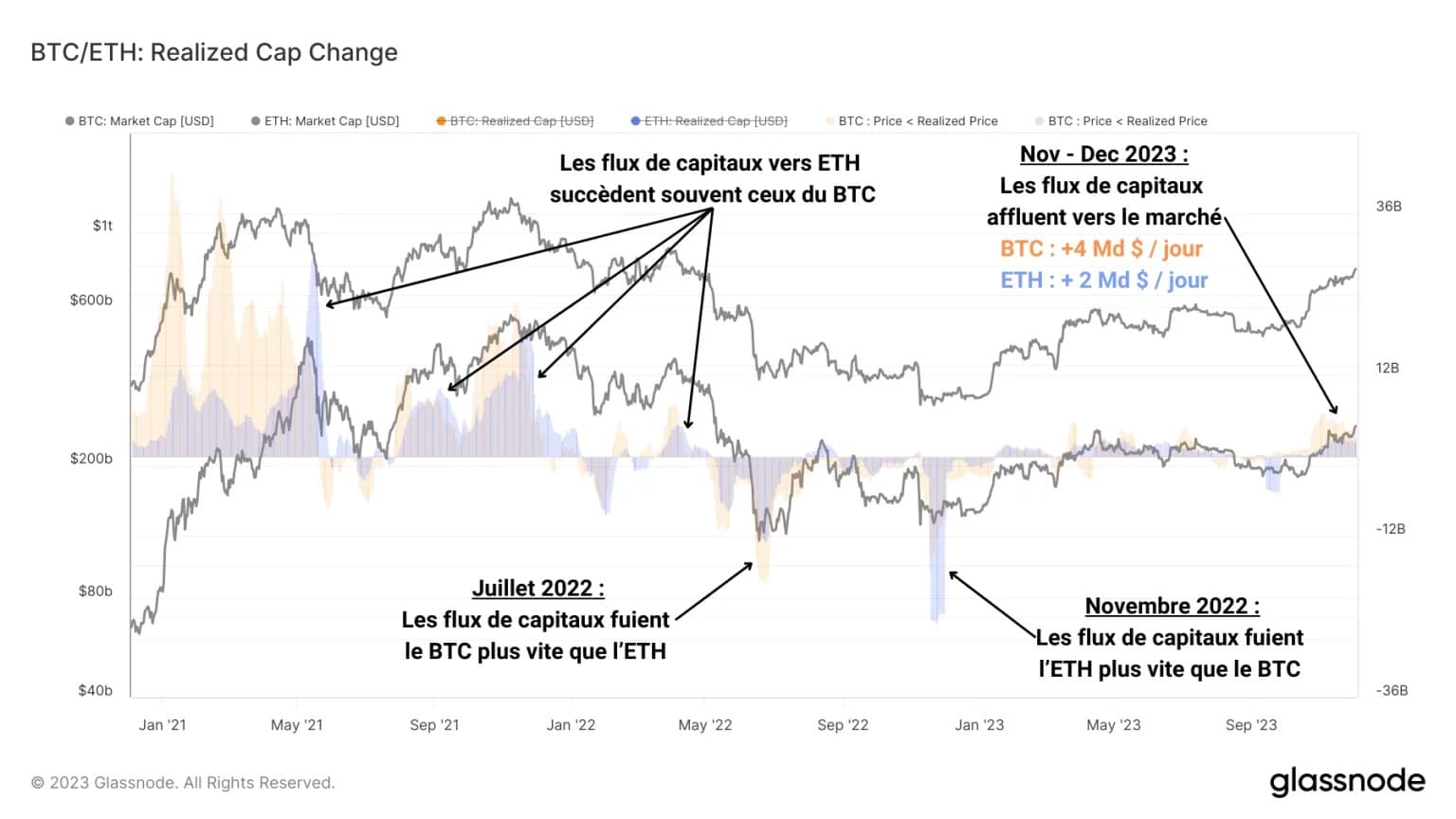

The net change in realized capitalization measures capital inflows and outflows within the BTC :orange_circle: and ETH :large_blue_circle: economies, and establishes the following facts:

- At the end of a bull market (and more generally during an uptrend), capital flows into BTC and then into ETH.

→ BTC gives the pulse of the market, ETH measures its risk appetite

- During sharp corrections in bear markets, capital flows leave BTC and ETH independently.

→ The two leaders react independently according to the market context

- Since November, we’ve seen a significant inflow of liquidity into BTC (nearly $4 billion a day). Inflows are more moderate for ETH, at $2 billion a day.

→ Bias is strongly bullish, but risk appetite is moderate

Figure 4: Net change in realized capitalization of BCT and ETH

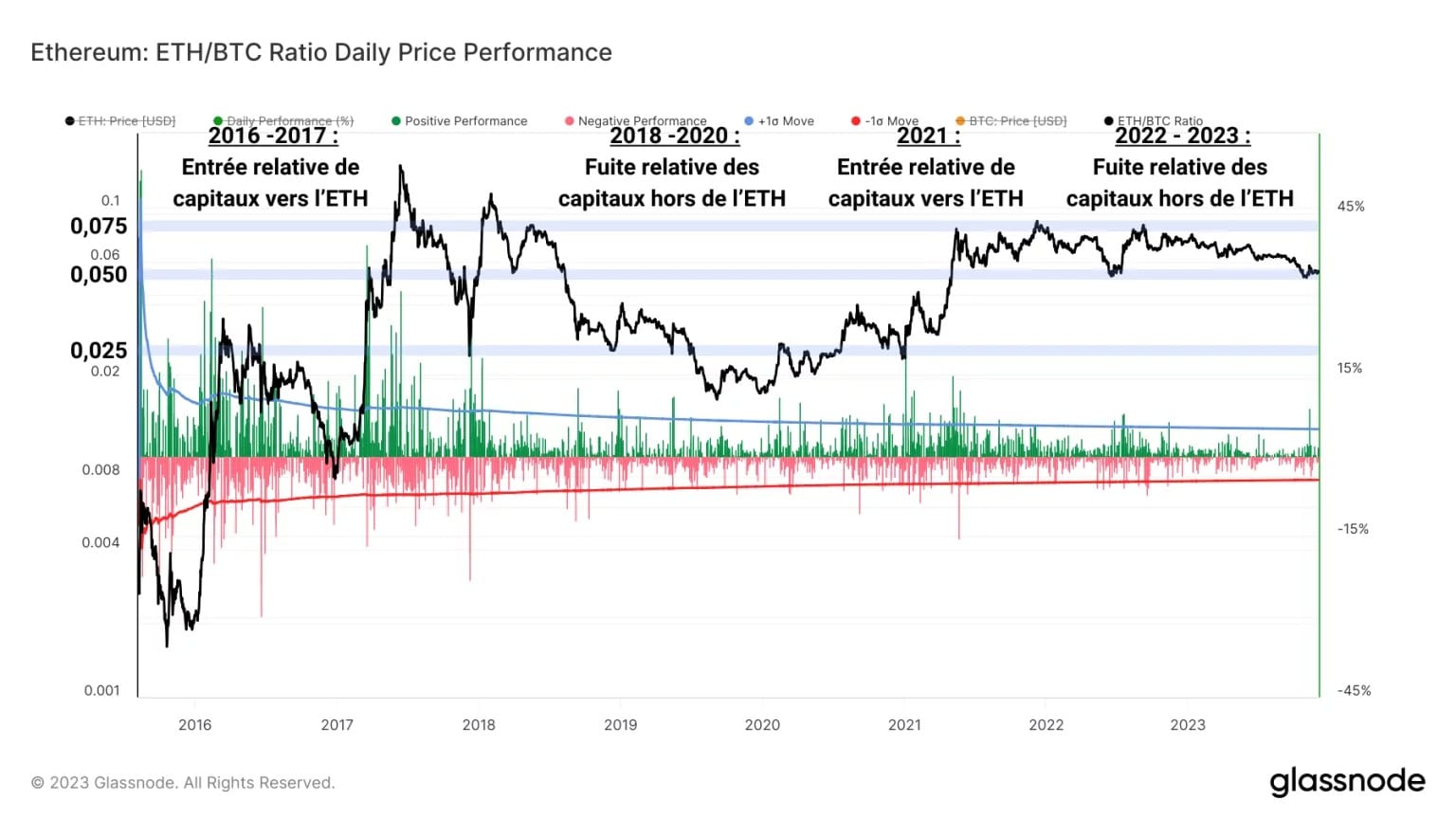

The famous ETH/BTC ratio summarizes the previous observations and illustrates the difficulty ETH may have in outperforming BTC.

Here, the higher the ratio, the more ETH appreciates against BTC, until it reaches the long-awaited “flippening” moment, when ETH should overtake BTC in terms of valuation.

Figure 5: ETH/BTC ratio

We’re a long way from that point, but we can see that the ratio now seems to be stabilizing around the 0.05 mark.

Following a relative flight of capital out of ETH versus BTC, the key today is to see if ETH could benefit from a welcome rotation of capital following BTC’s recent rise.

Summary of this on-chain analysis of Bitcoin

Finally, this week’s data suggests that the break of $40,000 is partly due to a series of shorts squeezes on the BTC derivatives markets.

Barely a month after breaking the $30,000 barrier, the recent rise confirms our previous analyses and confirms that the BTC market has entered a bull market configuration.

For its part, ETH is following the trend as best it can, but the performance gap between the two market leaders has been widening since the summer of 2023.

Given that cash outflows from BTC often find refuge in ETH after a market rally, a rotation of capital would enable ether to appreciate again against bitcoin.