Bitcoin has crossed a symbolic threshold: its market capitalization now exceeds $1,000 billion. This places it as the 10th most capitalized asset in the world.

Bitcoin is now the 10th most capitalized asset in the world

Over the past 9 days, the BTC price has risen by 22%, reaching heights not seen since December 2021. With a total supply of 19,630,000 BTC, Bitcoin’s market capitalization now exceeds $1 trillion.

This ascent has allowed Bitcoin to re-enter the top 10 most capitalized assets, being overtaken by the following companies:

- Meta Platforms, formerly Facebook, with a valuation of $1,170 billion;

- Amazon, with a valuation of $1,750 billion;

- NVIDIA, which has benefited from the growing interest in artificial intelligence (AI) in recent months, with a valuation of $1,180 billion;

- Alphabet, Google’s parent company, with a valuation of $1,800 billion;

- Saudi Aramco, the Saudi oil giant, with a valuation of $2,000 billion;

- Apple, with a valuation of $2,850 billion;

- Microsoft, with a valuation of 3,000 billion.

And by 2 commodities: silver, widely used in the manufacture of electronic objects, valued at 1,200 billion dollars, and gold, mainly used as a safe-haven asset, which occupies 1st place in this ranking with a valuation of 13,400 billion dollars.

How can we explain Bitcoin’s valuation?

Bitcoin’s valuation is mainly explained by its characteristics as a store of value. Despite short-term volatility, the BTC price has been on a steady upward trend since its inception, appearing to follow a cycle of around 4 years.

The organic adoption of Bitcoin, which is growing every year with nearly 300 million BTC holders by 2023, but also halving the creation of new Bitcoins, are making the currency rarer and creating long-term buying pressure, contributing to the growth of its market capitalization.

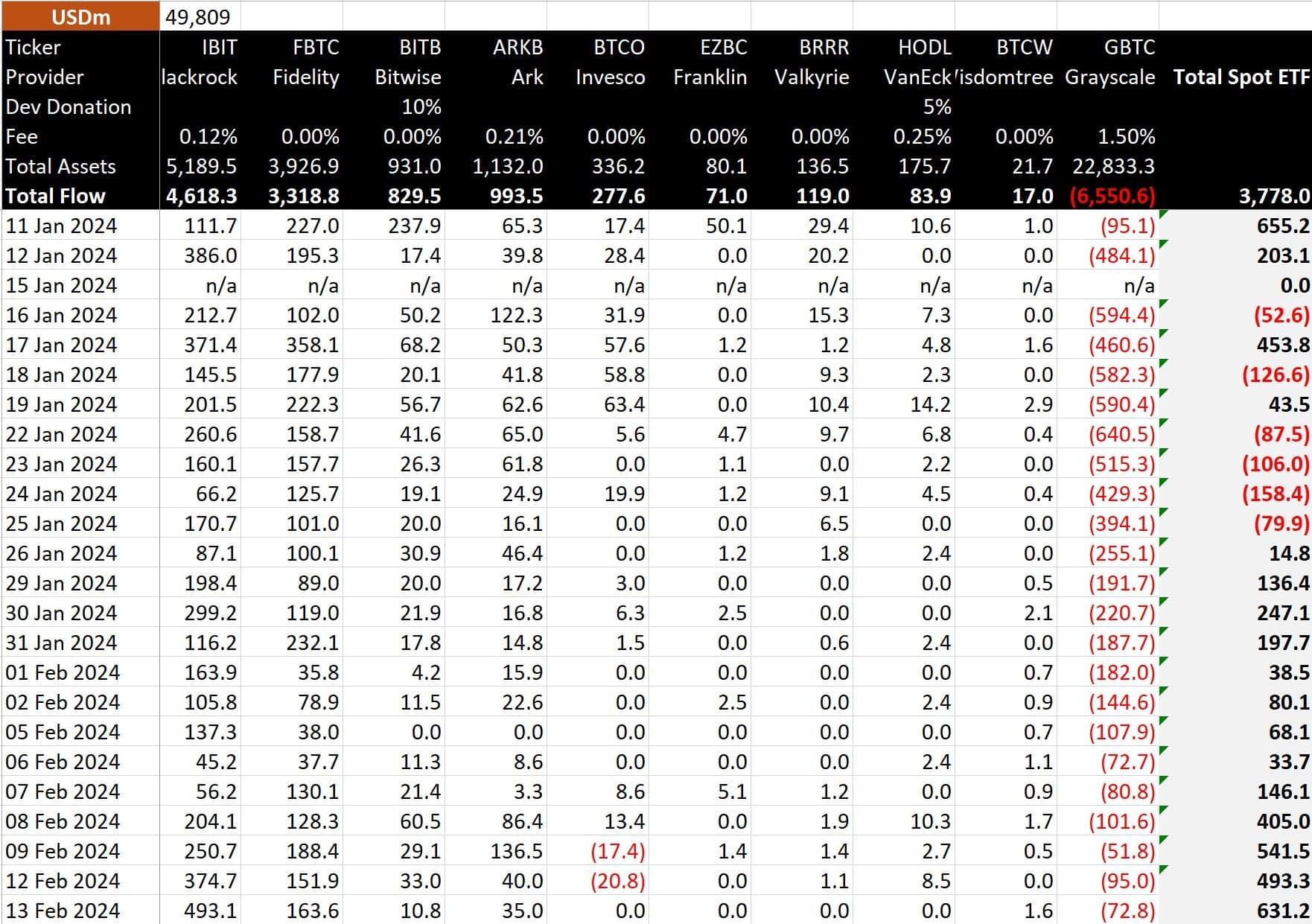

What’s more, after observing $600 million in net outflows from spot Bitcoin ETFs, over $2 billion in volumes have been recorded in the last 4 trading days alone.

Summary table of Bitcoin spot ETF volumes

Since their launch, spot Bitcoin ETFs have recorded a net liquidity inflow of $3.42 billion, propelling the BTC price to new annual highs.

Finally, the regulatory climate around the cryptocurrency market has calmed down. A year ago, the future of the market was uncertain, but today, projections are clearer.

The approval of ETFs and recent progress in the lawsuit pitting Coinbase against the Securities and Exchange Commission (SEC) provide positive indicators for the future of the cryptocurrency market.

Lastly, the ongoing repayment of Mt. Gox’s creditors and the imminent outcome of the FTX case are helping to reduce the risk of a massive sale of assets held for several years by these bankrupt companies.