The Bitcoin price broke through the $50,000 barrier today, a threshold it hasn’t crossed for over 2 years now. BTC thus continues its upward trend, supported by growing interest in spot Bitcoin ETFs and Grayscale’s sales decline.

Bitcoin price exceeds $50,000

This hasn’t happened since December 2021: the Bitcoin price exceeded $50,000 today, around 6:20 pm.

Thus, at around 3pm, Bitcoin gained momentum around $48,000 before gaining 4.4% in just under 2 hours, taking it towards $49,950. After running into resistance at $50,000, BTC fell back towards $49,550, then climbed again to break through this major threshold for good.

Bitcoin price evolution, with today’s rise highlighted in green

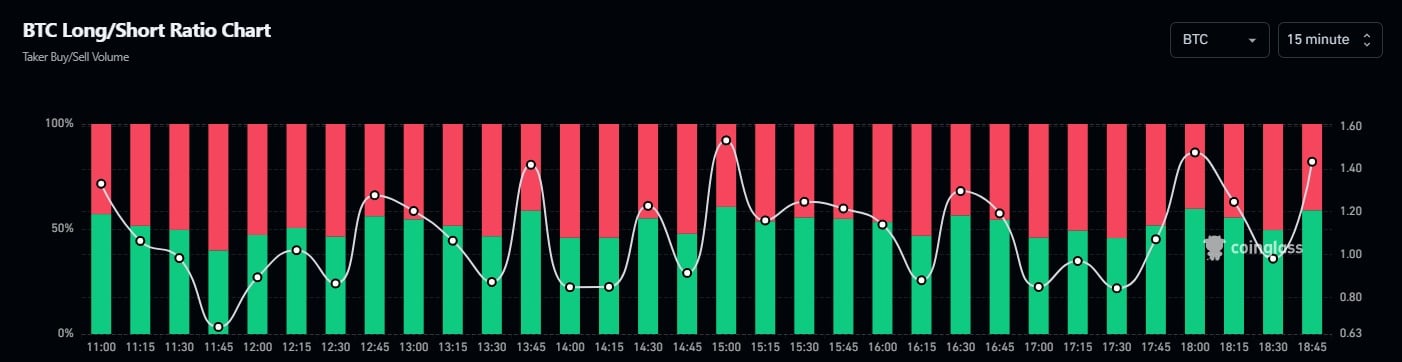

Over the last 4 hours, $94 million of short positions have been liquidated, compared with $12 million of long positions. While open interest in Bitcoin futures contracts has risen as sharply as Bitcoin’s price, investors are still positioning themselves bullishly, with 59% of positions currently placed long, even though a hypothetical correction could be on the horizon.

Long (green) and short (red) positions in Bitcoin

Although this sudden rise is in no way due to any particular news, Bitcoin’s recent uptrend coincides with Grayscale’s drop in BTC sales. Indeed, since the conversion of its former trust into an ETF, Grayscale, a subsidiary of Digital Currency Group (DCG), has suffered several billion dollars in outflows following profit-taking by its investors.

However, as we explained yesterday, these sales have fallen drastically. Grayscale now transfers only a few tens of millions of dollars to Coinbase on a daily basis, compared with $600 to $700 million on its worst days.

The decline in these sales, combined with growing interest in Bitcoin spot ETFs, which now hold 3.5% of the BTC supply in circulation, is paving the way for a rise in the king of cryptocurrencies. However, we’ll have to keep a close eye on BTC miners, who have started taking profits again since February 9.

“These inflows, coupled with the impending Bitcoin halving in 2024 and sustained high levels of illiquid supply, with more than 70% of bitcoins in the hands of long-term holders, paint an exceptionally bullish picture for the BTC price trend.”

Bitfinex report

The next event with the potential to significantly influence the Bitcoin price will be halving, which will now occur in less than 10,000 mined blocks, or just over 68 days.

For its part, the price of Ether has also climbed alongside Bitcoin, and is currently trading at over $2,600, up from $2,500 during the day.