As short-term investors face significant financial stress, the BTC market is currently testing a decisive pivot point. In addition, some believe that recent spending by miners is associated with a lack of short-term confidence. On-chain analysis of the situation

Bitcoin tests short-term pivot point

Relaying the downtrend that began in May 2023, the price of bitcoin (BTC) is currently close to a decisive level. Recently, the price of BTC has fluctuated between $25,000 and $27,000 with high volatility, leaving investors in doubt as to its trend.

Figure 1: BTC daily price

It is important to note that the BTC price is right at the short-term pivot point identified in our previous analysis. Continuing our study of short-term investors (STH), today we will assess how they react to such a decisive test of their conviction.

In addition, we turn our attention to Bitcoin miners to analyse in detail the latest on-chain movements in BTC held by the Chinese mining pool Poolin.

Testing the short-term pivot

The last few days have been marked by the fear created by the Securities and Exchange Comission’s (SEC) legal attacks on centralised exchanges (CEX) Coinbase and Binance, both operating on US soil.

The market seems to have absorbed the selling pressure generated by this panic, which is a rather constructive sign. If investor sentiment has been so little affected by this news, it is because the bearish bias felt during the bear market of 2021 – 2022 is now less influential.

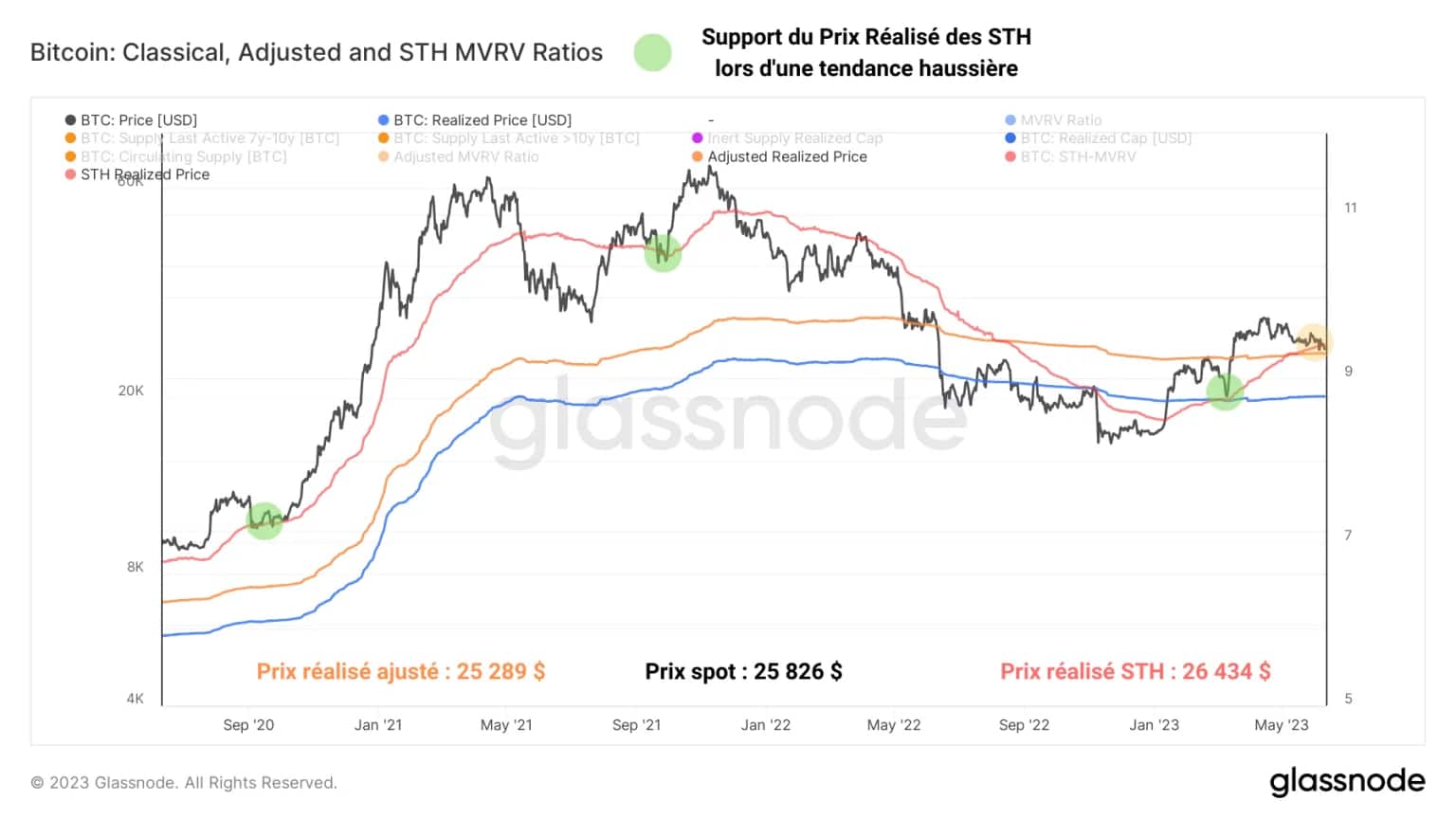

BTC has bounced back just below the short-term realised price (around $26,400), which is an ideal support level for BTC’s uptrend. If previous cycles are anything to go by, this type of test is likely to encourage a resumption of the uptrend.

Figure 2: Classic, adjusted and short-term realised price

However, if prices were to fall significantly below this level, it could invalidate the short-term trend in BTC and cause a more severe correction, as well as a considerable loss-taking.

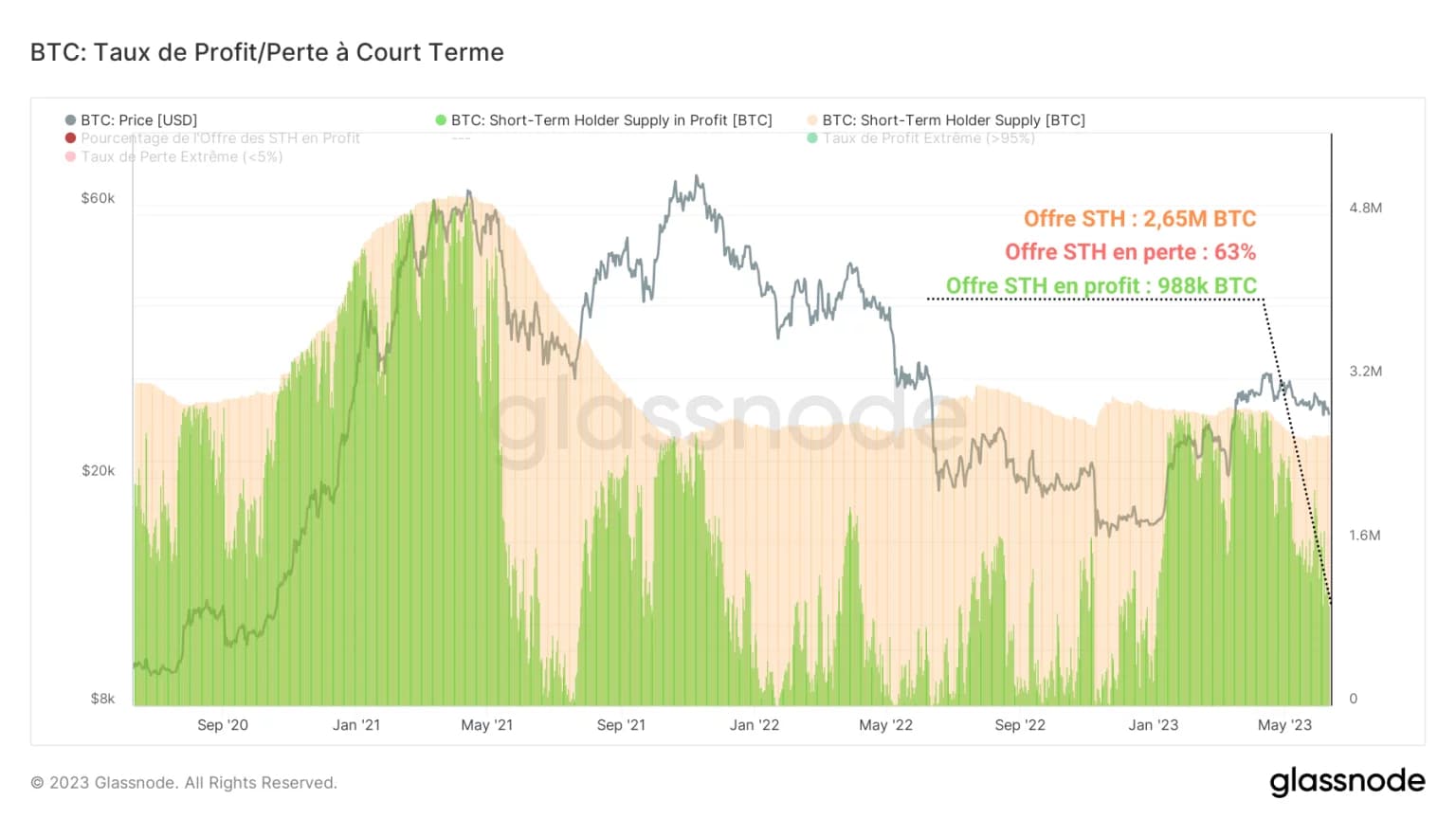

Looking at the latent profitability of short-term investors (STH), we can see that the majority of BTC supply by this group is now in an advanced loss-making state.

Out of a total of 2.65 million BTC, only one million is still held at a profit by STHs. Approximately 1.65 million BTC, the majority of which have a purchase price close to $25,800, are therefore in a state of latent loss.

Figure 3: Percentage of supply in profit of STH

This represents almost 63% of the total supply held by this group and indicates that short-term investors are now facing considerable financial stress. As a reminder, these individuals are associated with a highly sensitive psychological profile. Opposed to the conviction of long-term investors, the emotionality of short-term investors is one of the main ingredients of high short-term volatility movements (panic or FOMO).

Under these conditions, the likelihood of STHs panicking and engaging in coordinated loss-taking is non-negligible. Despite significant financial stress and uncertainty about the market’s short-term trend, STHs took moderate losses.

Figure 4: Realised profits and losses of STHs, as a percentage of total cohort supply

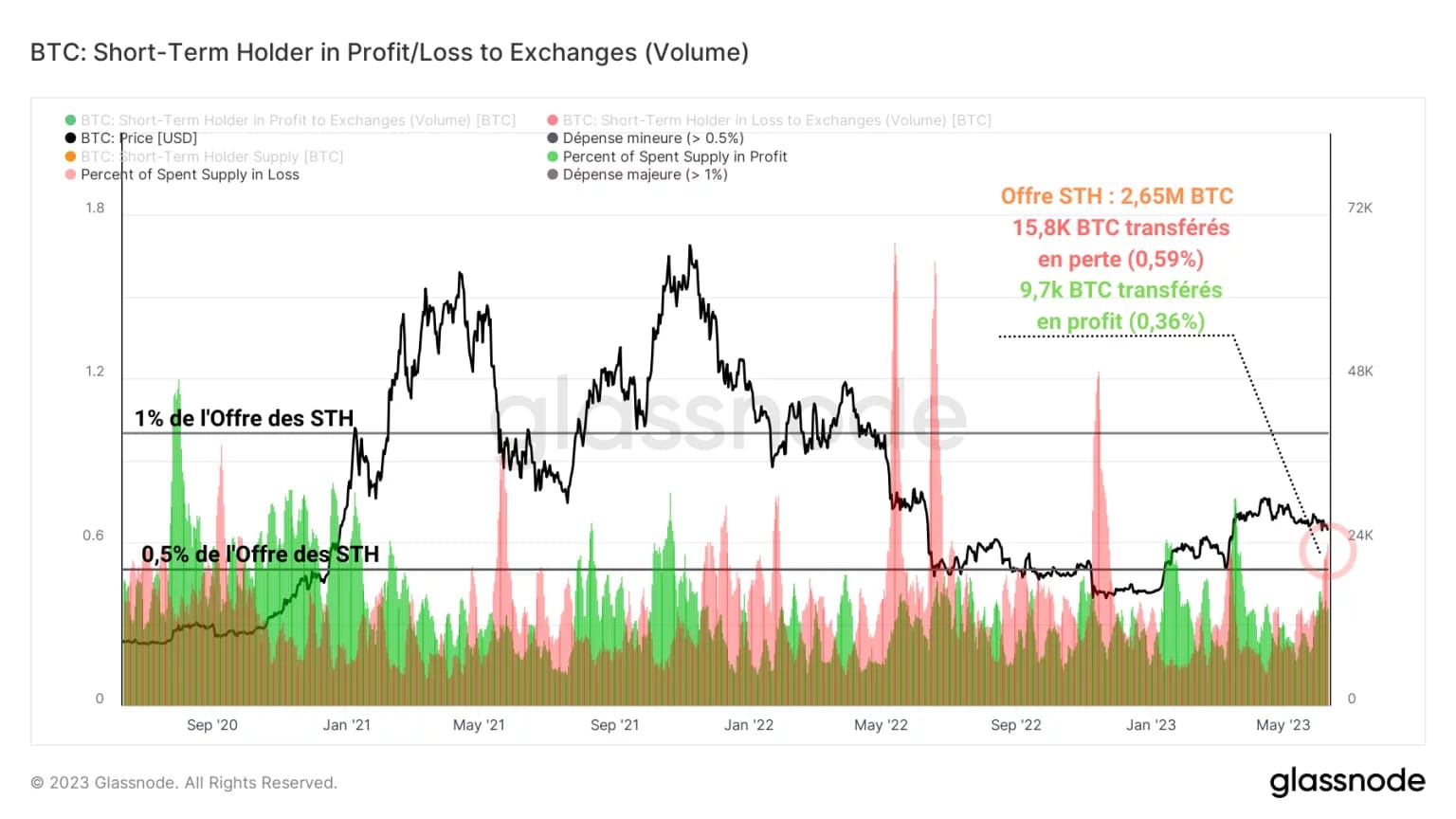

Analysing the volumes of BTC in profit/loss sent by this group to exchanges, we can observe two salient facts:

- Following successive waves of profits since the beginning of 2023, the May-June period saw the first consistent wave of losses. This wave was initiated by the rejection of the $30,000 level and is currently registering a notable peak;

- Over the last few days, this spike in loss taking has gone so far as to represent daily spending in excess of 0.5% of the total supply held by STHs. In terms of scale, this minor loss-taking coincides with that of early March.

This means that part of this group has already exhausted its potential selling pressure. But although some short-term investors have been selling at a loss for the past week, this has not been enough to cause the spot price of BTC to plunge.

Poolin liquidates its BTC

Let’s turn our attention to BTC miners. In our analysis of the condition of miners last April, we established that the financial situation of miners quickly recovered in early 2023, mining activity is profitable again.

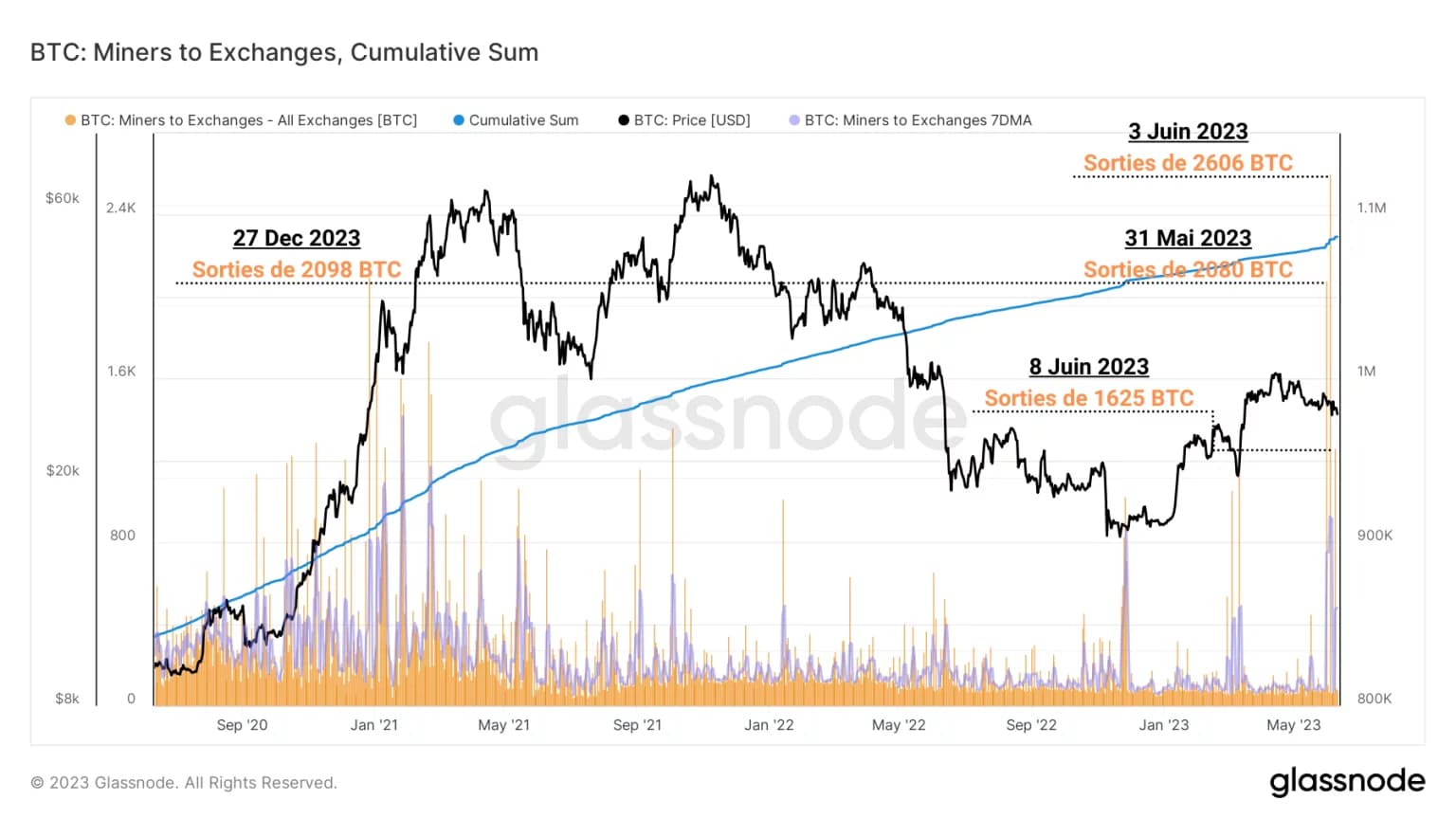

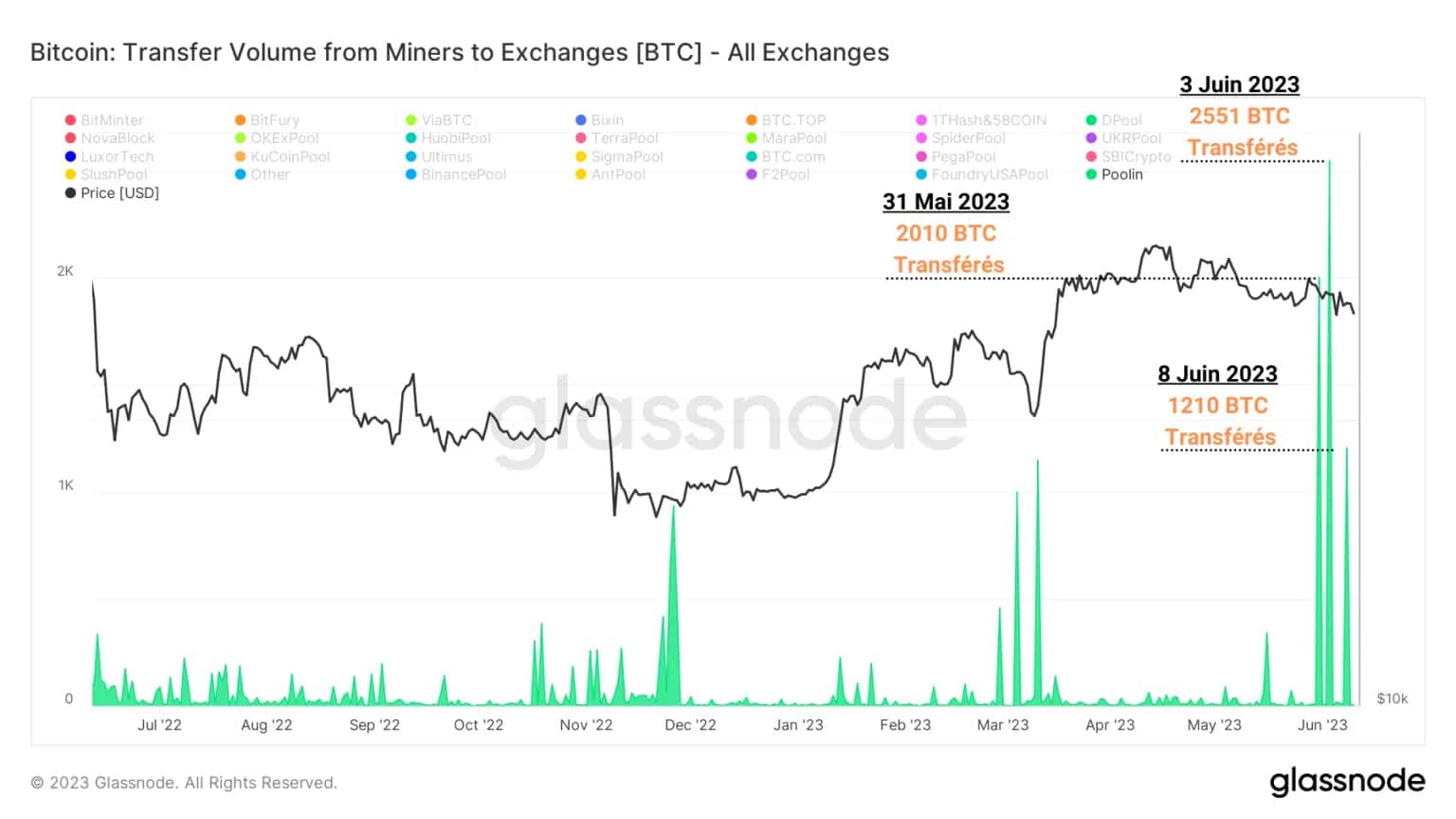

Overall, miners’ net flows were relatively neutral and we assumed that the price of BTC was not high enough to encourage them to sell. However, the data indicates that record outflows from wallets associated with BTC miners have taken place very recently:

- 31 May 2023: outflows of 2080 BTC ;

- 3 June 2023: 2,606 BTC released;

- 8 June 2023: outflows of 1625 BTC.

Figure 5: Flow from miners to exchanges (CEX)

If these flows attract our attention, it is because they represent very high volumes compared with recent years, even exceeding the profit-taking of 2098 BTC that occurred in December 2021, during the last bull market.

Before even assuming that some miners might be selling out of a lack of confidence in the BTC trend, let’s take a look at the main entity involved in this spending: the Poolin mining pool, based in Beijing.

Being involved in yield farming activities in the DeFi sector, this entity suffered large financial losses throughout the bear market of 2021 – 2022. Its exposure to DeFi, combined with falling profitability in the mining business, forced Poolin to suspend withdrawals from its wallet in September 2022, citing liquidity problems.

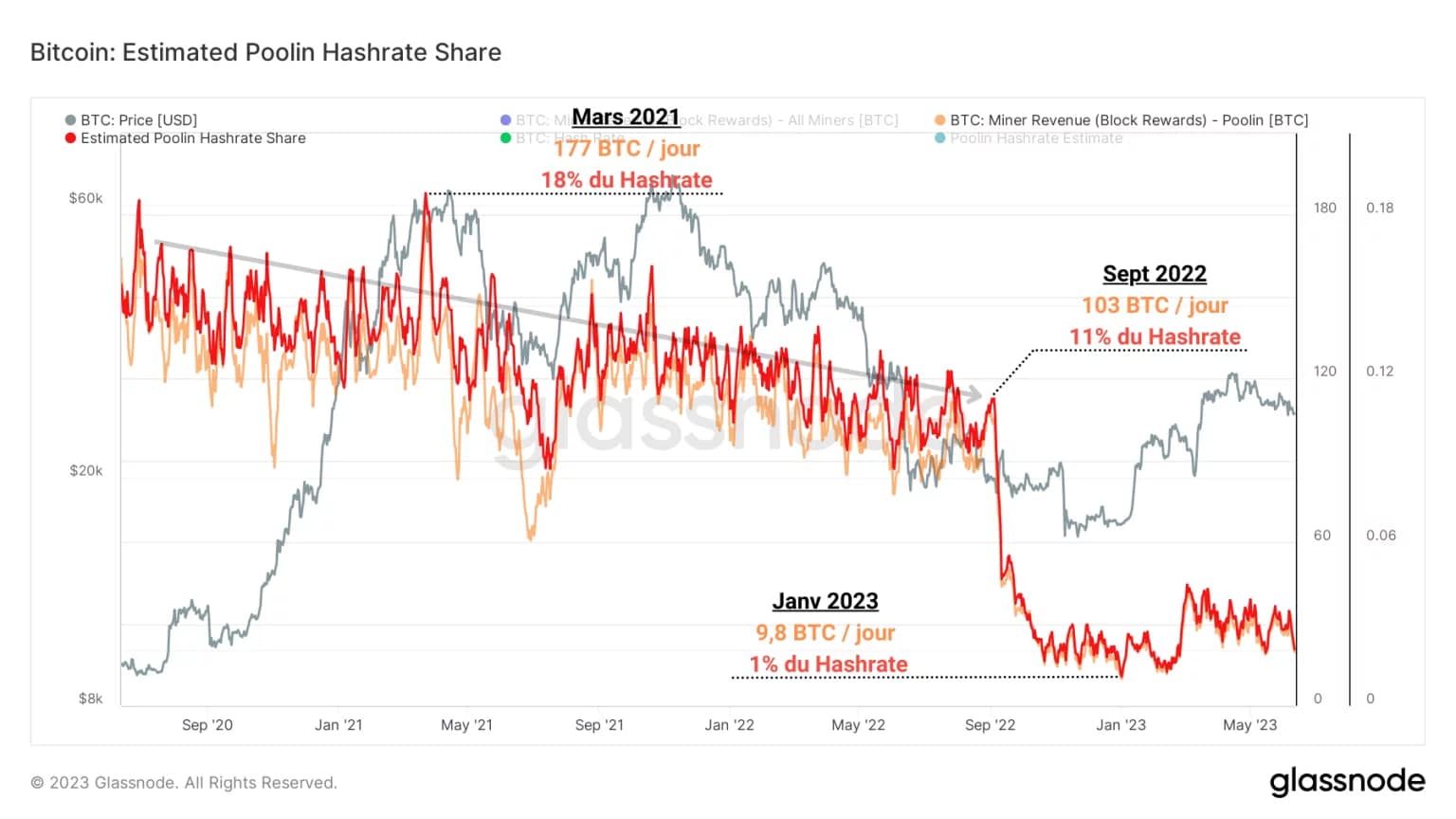

Figure 6: Poolin’s revenue (BTC) and relative share of hashrate (%)

More than 10% of the hashrate associated with it was redirected directly to other pools, causing a colossal drop in the firm’s revenues, leaving it broke at the beginning of 2023.

Today, Poolin accounts for just 1% of global hashrate and has seen its revenues plummet by more than 90% since its peak of 177 BTC per day in March 2021. It is against this backdrop that Poolin is currently seeking to liquidate part of its capital, giving rise to the outflow we identified above.

Figure 7: Poolin flows to exchanges (CEX)

A closer look at outflows from Poolin portfolios shows that they are directly linked to the record outflows measured above.

- 31 May 2023: transfer of 2010 BTC ;

- 3 June 2023: transfer of 2551 BTC;

- 8 June 2023: transfer of 1210 BTC.

During these transfers, the BTC mobilised by Poolin represented more than 95% of the total volume from miners to exchanges. The hypothesis that some miners were selling, due to a lack of confidence in the BTC trend, is therefore invalidated.

Summary of this on-chain analysis of BTC

This week’s data shows that the BTC market is currently testing a decisive pivot point, which will guide BTC’s short-term trend towards a continuation or invalidation of the uptrend underway since January 2023.

Unrealised losses by short-term investors represent almost 63% of the total supply by this group, indicating that they are now facing significant financial stress. Under these conditions, there is a non-negligible chance that STHs will panic and engage in coordinated loss-taking.

However, STHs have taken fairly moderate losses in recent days. While part of this group has already exhausted its potential selling pressure, this has not been enough to cause the spot price of BTC to plunge.

Finally, recent spending by miners is not associated with a lack of confidence in the BTC trend, but with the liquidation of part of the assets of the Poolin mining pool, which has been experiencing difficult times since September 2022.