Binance has decided to set up a $500 million fund to allow struggling miners to take out a loan from the platform for 5-10% interest. Indeed, 2022 is a particularly difficult year for Bitcoin (BTC) miners, who are sometimes forced to sell their BTC stock to survive.

Binance releases $500 million for miners

Binance, the world’s largest cryptocurrency exchange, has launched a $500 million fund to support struggling Bitcoin (BTC) miners.

Bitcoin (BTC) mining is the process of finalising blocks on the Bitcoin blockchain. It is an extremely complex calculation method that allows miners to be rewarded for their activity directly in the form of BTC. To learn more, we invite you to watch our video explaining Bitcoin mining.

Also, Binance will allow miners who are currently experiencing financial difficulties to receive a loan from the platform, for an interest rate ranging from 5 to 10% under conditions not yet detailed. According to the press release, these loans can be spread over a period of 18 to 24 months.

This financial boost will be available to private companies, but also to public companies, it says:

“This project, the first of its kind for Binance Pool, is designed to provide secure debt financing services to leading public and private companies in the bitcoin (BTC) mining and digital asset infrastructure space worldwide. “

In order to qualify for any of these loans provided by Binance, however, miners will need to provide collateral with the platform in the form of mining equipment or directly in the form of cryptocurrencies.

Bitcoin miners’ earnings at an all-time low

This initiative was put in place as a result of the severe difficulties faced by Bitcoin miners, who are seeing their incomes directly impacted by the decline in the price of the king of cryptocurrencies, which has been steadily falling since its high (ATH) price of $69,044 reached on November 10. It is now hovering between $18,000 and $24,000, and this is expected to continue for some time.

As a result, miners have seen a significant drop in income, forcing some to sell their assets, to the point where the amount of Bitcoins held by miners has not been this low since 2010.

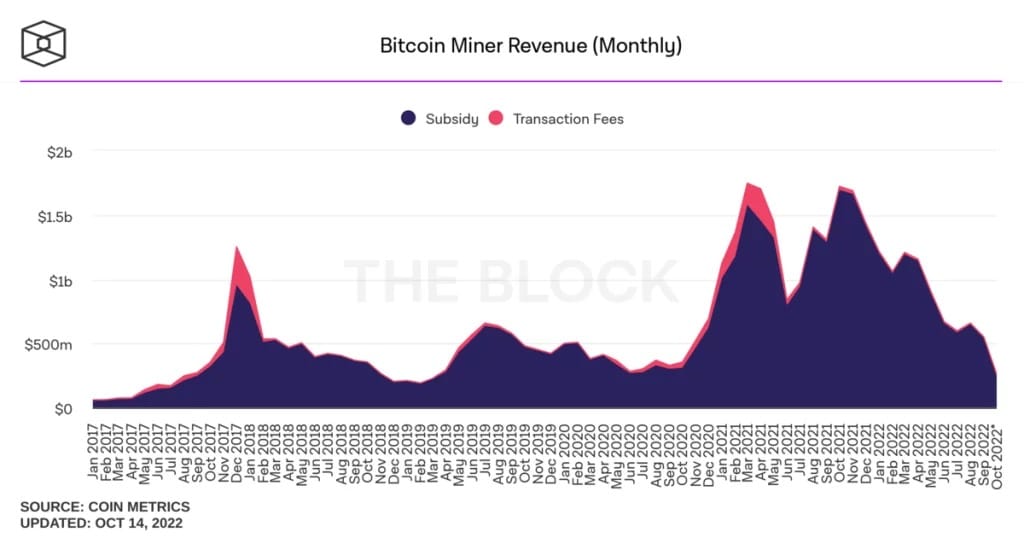

Bitcoin miners’ monthly earnings from January 2017 to today

These difficulties, coupled with the rising cost of energy, have led giants such as Computh North to declare bankruptcy. In this case, the firm filed for Chapter 11 bankruptcy protection in the United States to pay off its $500 million in loans.

In the same vein, Poolin, one of the largest Bitcoin mining pools, had to refuse some of the withdrawals requested in BTC and Ethers (ETH) by its customers due to a major liquidity problem caused by too many simultaneous withdrawals.

Marathon Digital and Riot Blockchain, which are among the world’s largest publicly traded mining companies, sold more Bitcoin than they produced last month. This is in stark contrast to their results in the first 4 months of the year, when they only sold about 30% of their production.