In a survey released this week, the Bank of Canada shows the behaviour of Canadian investors towards Bitcoin (BTC). The study found that 89% of Canadians have heard of Bitcoin, while 13% have Bitcoin in their wallets

13% of Canadians own Bitcoin, survey finds

The Bank of Canada conducted a survey to understand the adoption of cryptocurrencies in the country. As a result, the results released this week show that 13% of Canadians owned Bitcoin (BTC) in 2021.

The data was collected through various surveys, totalling nearly 2,000 respondents. The report also shows the evolution of the behaviour of the country’s citizens, according to the years and the social and demographic classes.

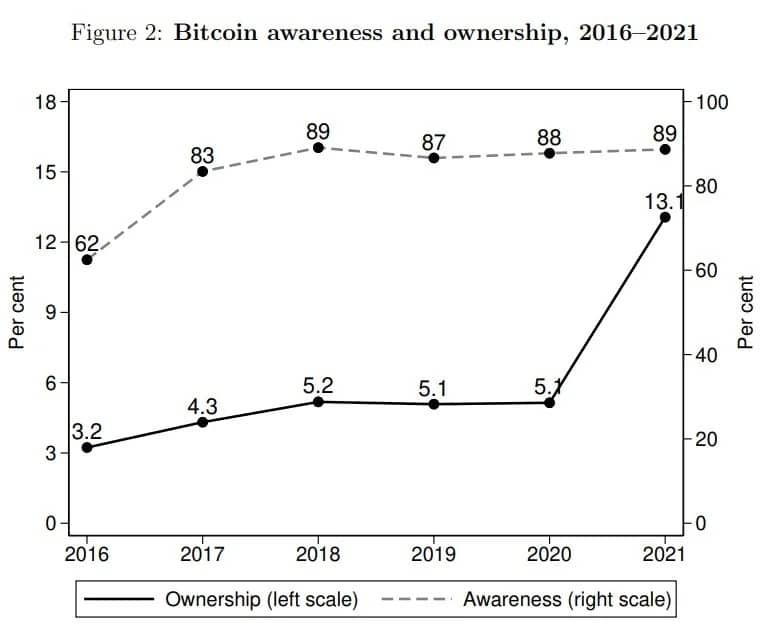

The first graph shows that between 2016 and 2021, we have gone from 62% to 89% of Canadians having heard of Bitcoin, and from 3.2% to 13.1% owning it:

Figure 1: Evolution of people who own and have heard of Bitcoin in Canada

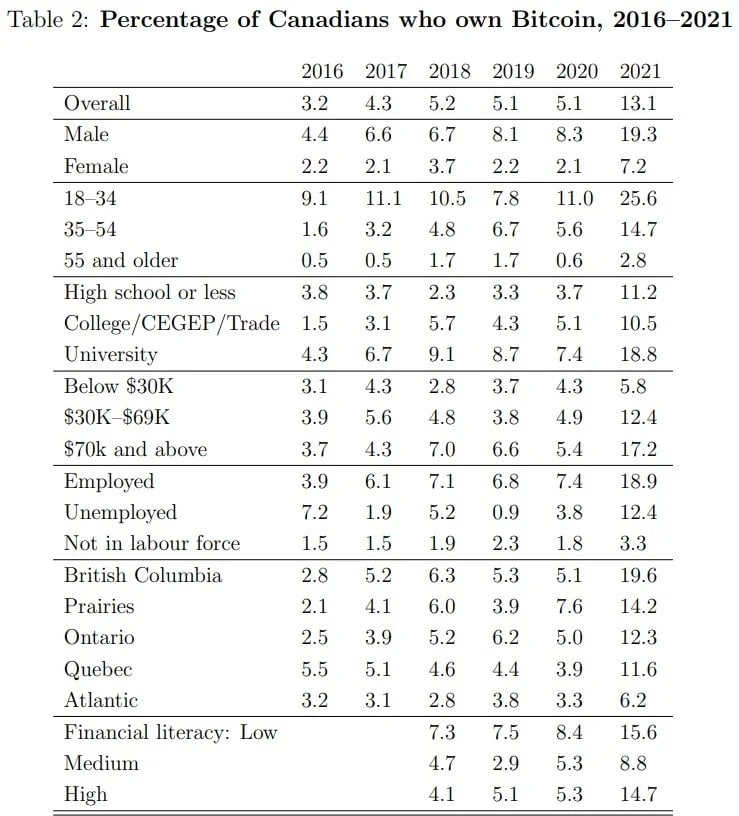

These figures are actually averages. However, the country’s central bank also shows this change in Bitcoin holders in terms of more specific factors:

Figure 2: Bitcoin ownership by social demographics

The survey then shows strong disparities. In particular, we can highlight differences according to geographical areas. For example, the Atlantic Provinces had 6.2% of TCB owners in 2021, while British Columbia had 19.6%.

In addition, the gender gap is also very large. For example, while the figure for men was 19.3%, it was almost three times lower for women at 7.2%. Age is also a factor of disparity, showing a high concentration among 18-34 year olds, regardless of the year studied.

Differences in investor behaviour

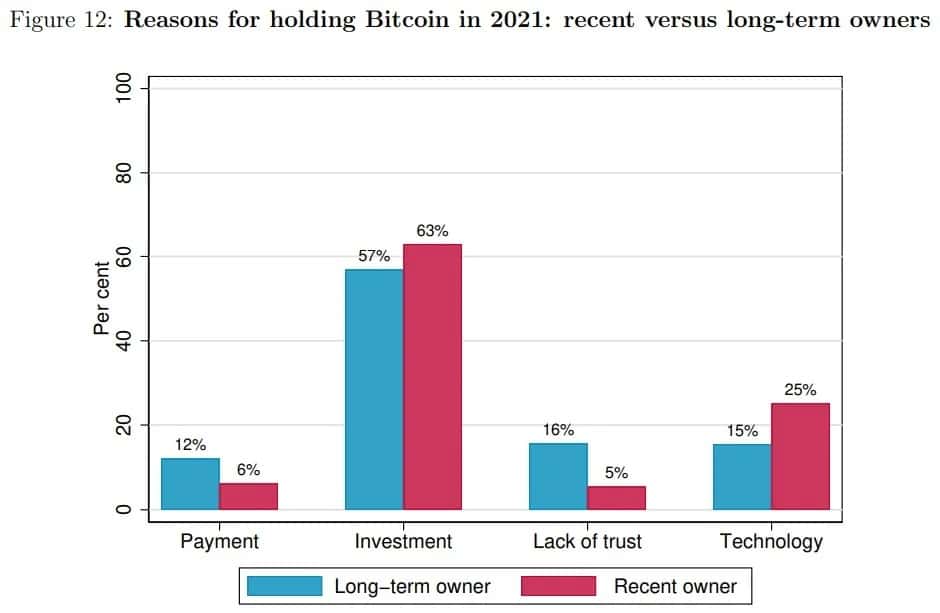

Among Canadians who own Bitcoin, there are also notable differences in the reasons for investing. For example, while investment is the number one reason for both short and long term holders, the “secondary” reasons are more disparate.

Among the notable differences, lack of trust in the traditional system is therefore more important for long-term investors:

Figure 3: Canadians’ reasons for buying Bitcoin

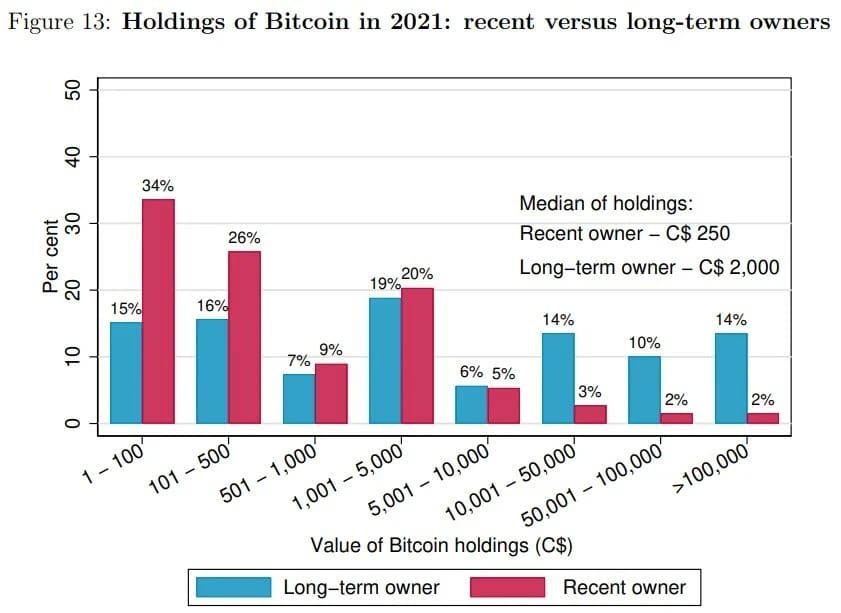

In terms of BTC capital, the chart below shows that qualified long-term investors have a median investment of C$2,000, compared to C$250 for new entrants. Moreover, we can note that 60% of the latter had less than $500 at the time of the survey:

Figure 4: capital invested in BTC

Logically, the larger the capital invested, the more long-term investors we will find in the population studied.

Of course, the data in this study should be updated, given that it is dated December 2021. And for good reason, as the bear market has since taken its toll, it is likely that the values of these results are much lower. Nevertheless, this report has the merit of offering a lot of interesting information, which can be compared with data from other countries around the world.