This is a major operation for the ArchEthic blockchain and its UCO token. Indeed, the French startup behind the project has just burned 90% of UCO tokens while thoroughly reviewing tokenomics. What are the effects of this initiative

ArchEthic burns 90% of total UCO token supply

The ArchEthic transaction chain, led by French startup Uniris, is a blockchain that aims to create a new decentralised internet. Its scalable, scalable and energy-efficient infrastructure is based on the implementation of a new consensus, called “ARCH”.

In order to meet the current standards of the cryptocurrency market and to take advantage of this to review its tokenomics, ArchEthic’s native token, the UCO, has just undergone a profound change. Indeed, ArchEthic has just burned 9 billion UCO tokens, or 90% of all tokens.

According to the team, this massive operation is aimed at ensuring the long-term sustainability of the project, in line with the analysis of simulations comparing the outstanding supply of the UCO token to the fully diluted future supply.

In a statement, the ArchEthic team explains that after the listing of the UCO token on various platforms without public sale, the outstanding UCO token offering compared to the fully diluted offering was divergent from market norms, which compromised investor confidence.

The startup says that this move is not a marketing ploy, but is justified by the thoughtful work done to make the project economically self-sustainable.

Our commitment, above all, is to the self-sufficiency of our network without compromising trust,” said Sebastien Dupont, CEO of ArchEthic. “We have big goals to see this blockchain being used in the real world, and we will not take any risks that could compromise that.

With an initial offering of 10 billion UCO tokens, the ArchEthic network therefore retains 1 billion UCO tokens after this colossal burn, which have been redistributed to ensure a disinflationary model.

New tokenomics for UCO

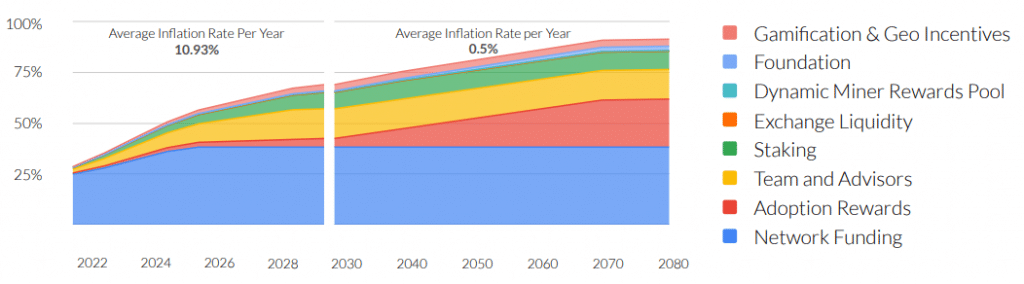

Annual average inflation rate for UCO

In parallel to the UCO burn, the ArchEthic blockchain token gets new tokenomics. These new tokenomics guarantee a controlled average annual inflation rate of 10.93% until 2030.

From 2030 onwards, inflation will be reduced to only 0.5% per year until 2080. At this point, no more new UCO tokens will be issued.

Average annual inflation rate of outstanding UCOs until 2080

The new distribution of UCO tokens

ArchEthic’s teams take advantage of this burn to review in depth the distribution of UCO tokens

Network funding (38.2%)

These funds will be used by the ArchEthic Foundation to finance the development of the network. This includes the 216 million UCOs already in circulation and the remainder will be used to fund future versions of the mainnet, leading to a self-sustaining economy.

Rewards for adoption (23.6%)

Governed by a decentralised autonomous organisation (DAO), this portfolio is dedicated to promoting the use of the ArchEthic blockchain via incentives for developers, subsidies for new services and rewards for end-users of services.

Teams and advisors (14.5%)

All the people who have been involved in the development of the blockchain through this portfolio.

Staking rewards (9%)

9 million UCOs will be distributed annually to users who stage their tokens.

Liquidities on exchanges (5.57%)

These funds are used to manage liquidity on centralized and decentralized exchange platforms (CEX and DEX).

Decentralisation incentives (3.44%)

To maximise the decentralisation of the network, this portfolio is intended to support nodes that appear in parts of the world that are not yet connected to the network. Participants in the network will also be rewarded for their time connected to it.

Rewards for miners (3.34%)

Once the total transaction fees exceed the incentives needed to compensate all miners, the UCO will enter a disinflationary phrase. Excess transaction fees will be burned, reducing the number of UCOs in circulation.

Foundation (2.13%)

ArchEthic Foundation’s operations will be supported by this portfolio, which will be controlled by the DAO, i.e. the UCO token holders.

Next step, the mainnet

Besides this massive burn of UCO tokens and its new tokenomics, the next big step for the ArchEthic blockchain is expected in Q2 2022.

This is when ArchEthic’s mainnet 1.0 will be deployed and its entire ecosystem will be running autonomously.