Ordinals registration madness has struck again: average fees for a Bitcoin transaction recently approached $40, and hundreds of thousands of transactions are waiting to be processed due to mempool congestion. An opportunity to test the scalability of the Bitcoin network should it become massively adopted…

Bitcoin fees return to levels of a year and a half ago

According to data from BitInfoCharts, average transaction fees on the Bitcoin blockchain have approached $40, something that hasn’t happened since April 2021.

Evolution of average transaction fees on Bitcoin over the past 3 years

As has been the case for some time now, the increase in fees on Bitcoin is due to the craze surrounding Ordinals registrations, misunderstoodly compared to non-fungible tokens (NFT). Immutable digital artefacts, registrations have often been in the news since they found mainstream appeal last May, when the BRC-20 standard appeared.

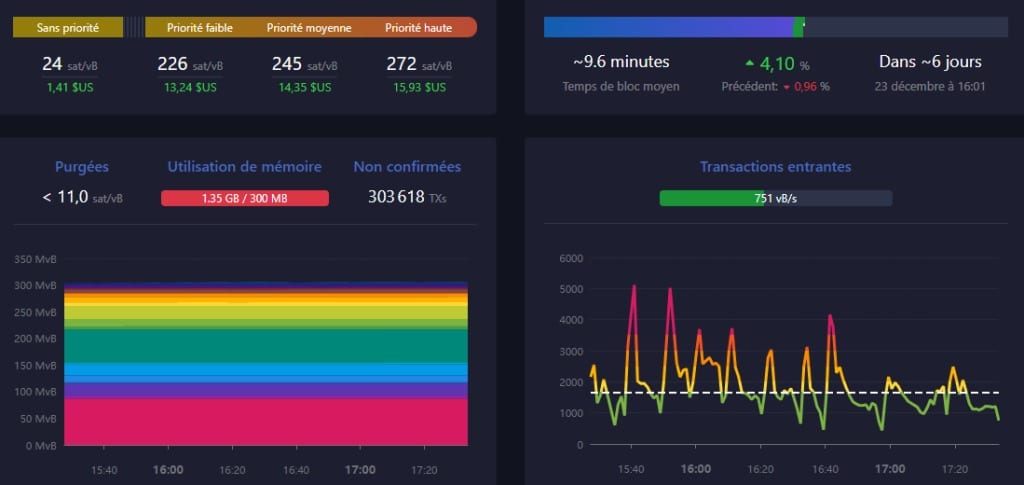

According to data from mempool, just over 300,000 transactions are currently waiting to be processed on Bitcoin. As a result, many network users are being forced to pay higher fees to have their transactions processed by miners.

Overview of pending transactions on Bitcoin

This data directly fuels the already heated debate surrounding Ordinals registrations, with some believing this innovation to be contrary to Bitcoin’s original purpose, while others defend it as nothing more than an ingenious use of the Taproot and SegWit updates, which had notably enabled Bitcoin’s block size to be enlarged.

A debate that created a real split in the community, to the point where Luke Dashjr, one of Bitcoin’s main developers, called the registrations a “loophole” and blocked the possibility of creating them from Bitcoin Knots, a Bitcoin Core competitor software that he himself developed.

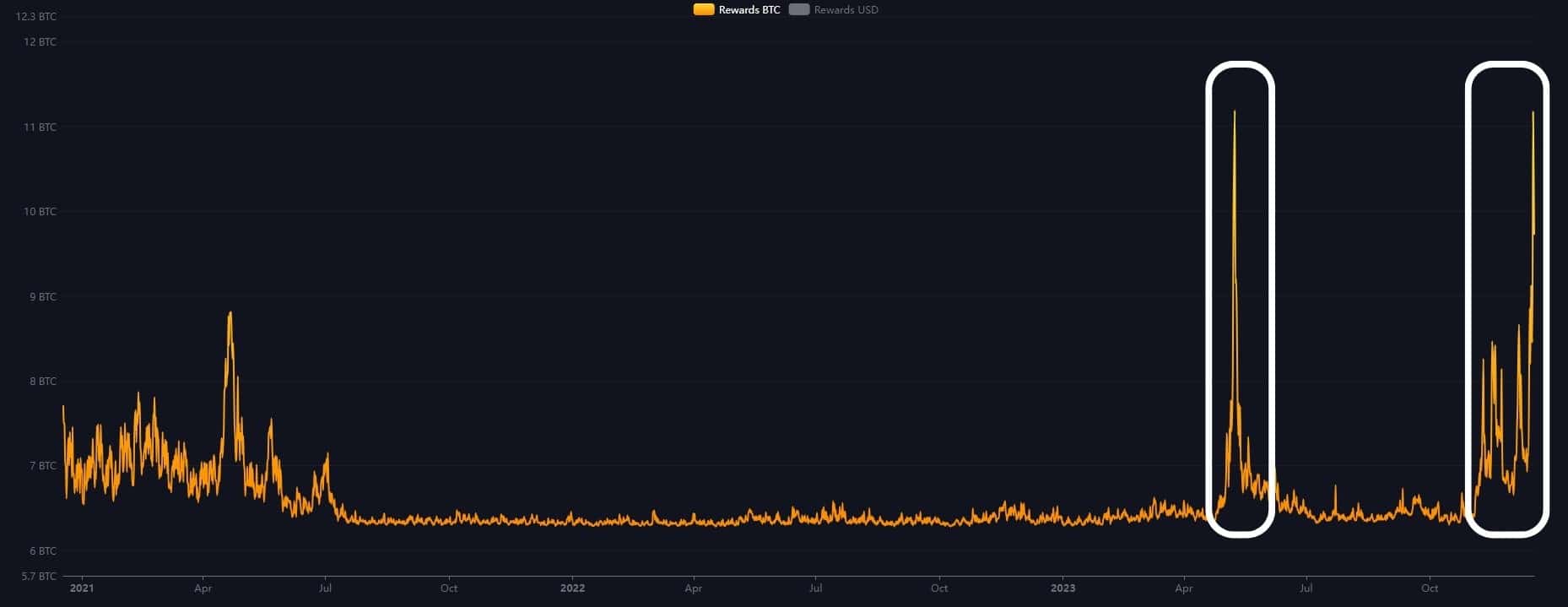

BTC miners first to rejoice at mempool congestion

While the increase in fees naturally impacts Bitcoin users wishing to carry out small-value transactions, BTC miners are the first to be delighted by mempool congestion. Indeed, the higher the number of satoshis per vByte (sat/vByte), the higher the rewards for each block mined in parallel :

Evolution of the reward per block mined for Bitcoin miners over 3 years (in BTC)

If we bear in mind that Bitcoin miners are the lifeblood of the network, it’s quite understandable that they would be in favor of processing Ordinals registrations from a pure profitability point of view.

With this in mind, the current mempool congestion could be a real-life test of what could happen if Bitcoin were to experience mass adoption.

Adam Back, CEO and founder of Blockstream, noted that no matter what happens, there’s no stopping “JPEGs on Bitcoin” and that this should be seen instead as an opportunity “to drive layer 2 adoption” and “force innovation”.

you can’t stop JPEGs on bitcoin. complaining will only make them do it more. trying to stop them and they’ll do it in worse ways. the high fees drive adoption of layer2 and force innovation. so relax and build things.

– Adam Back (@adam3us) December 16, 2023

Hodlonaut, a well-known figure in the Bitcoin ecosystem, supported this view of things (also characterizing Ordinals registrations as absurd in passing), adding that all this was just a glimpse of the future, and that it should be understood here that “scaling doesn’t happen on layer 1s”.

Whether you’re for or against registrations, one thing’s for sure: they at least have the merit of putting many blockchains to the test, as was also recently seen on the side of Arbitrum, which saw its sequencer fail for 1h30 2 days ago.