For several months, many observers have been warning about the suspicious activities and unsustainable performance strategies of Celsius Network. In order to understand the steps that led Celsius to the current debacle, Cryptoast offers an analysis of the traces left by Celsius Network on the Ethereum chain.

Celsius is reaping the rewards of its recklessness

For several months, many observers have been warning about Celsius Network’s suspicious activities and unsustainable return strategies, but also about the fact that the company could end up defaulting on payments to its users, whose funds have also been frozen.

To further explore the ins and outs of this affair, Cryptoast published a dossier last week explaining how and why the platform is collapsing.

In order to provide a non-exhaustive list of the steps that led Celsius to the current situation, we analyse here the traces left by Celsius Network on the Ethereum blockchain by dissecting various financial operations undertaken by the platform.

Note that the wash trading strategies deployed via Wintermute and Uniswap, as well as the performance mechanisms of Celsius’ DeFi strategies are elided here.

How did the platform get to this point

The Stakehound case

One of the transactions recently documented by Dirty Bubble Media reveals that Celsius Network lost at least 35,000 ETH in the Stakehound key loss case.

On 22 June 2021, staking solution company Stakehound announced that it had lost access to a wallet holding more than 38,000 ETH, deposited on behalf of its clients. The depositors were left with the only consolation of Stakehound’s collateral token, STHETH, whose value plummeted to $34.

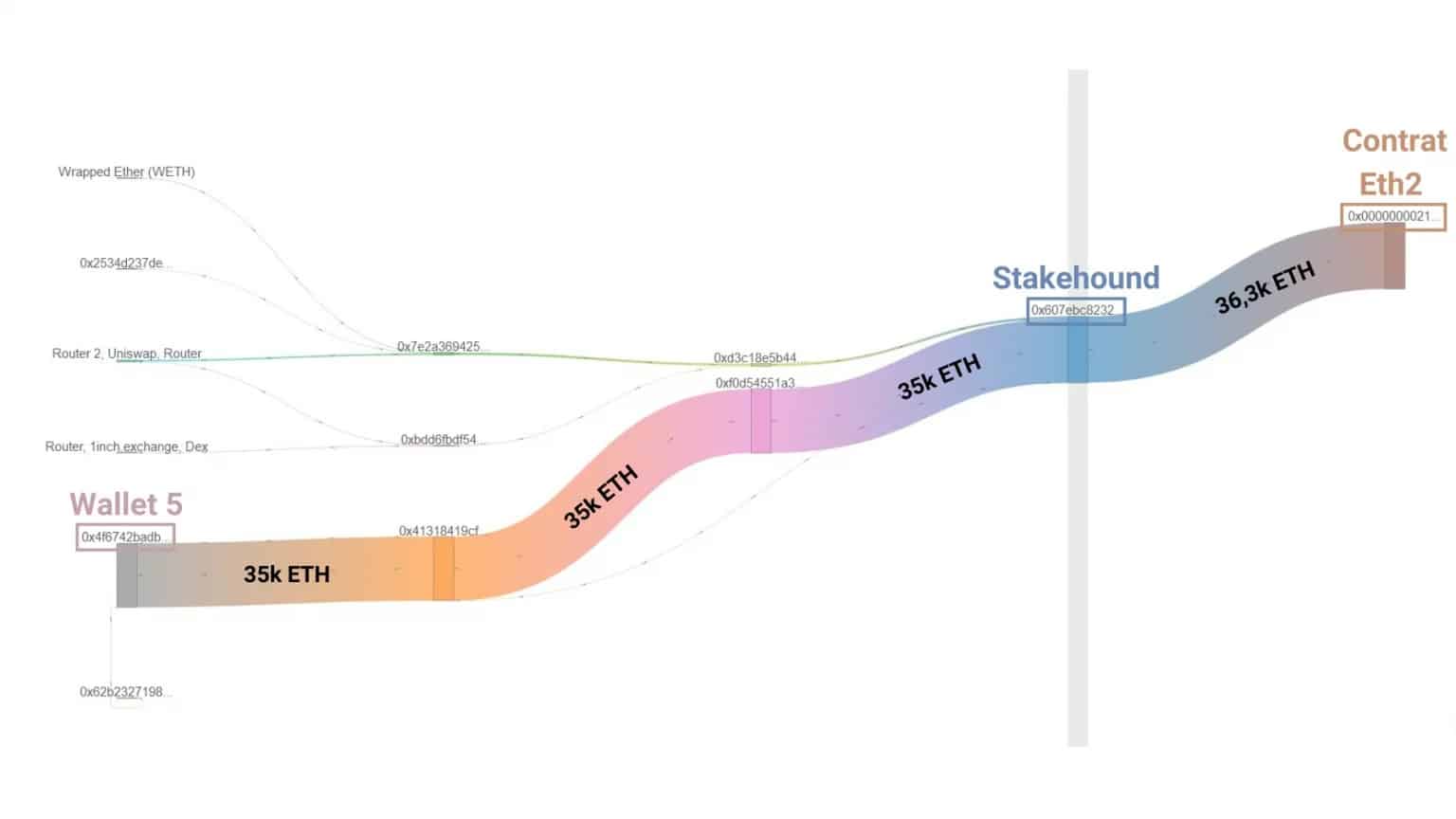

What matters to us in this case is that Celsius Network sent 35,000 Ether to Stakehound in a single transaction on 2 February 2021, as illustrated by this visualization:

Figure 1: Capital transfers from Celsius to Stakehound

Celsius’ identified portfolios currently hold a total of at least 42,306 STETH, making it the largest owner of a useless token. At the current ether price (1 ETH = $1100), this represents a loss of approximately $38.5 million.

Safe deposit box number 25977

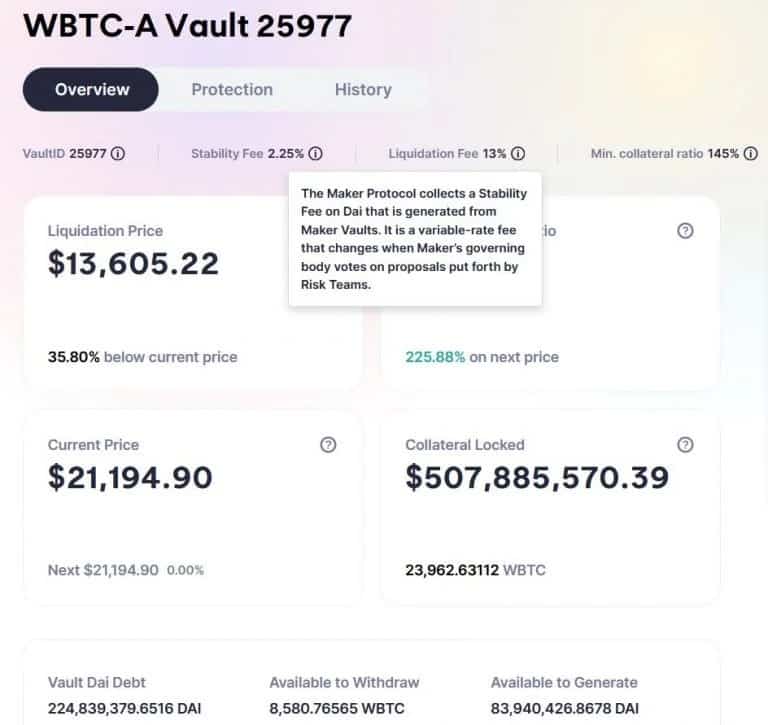

On October 7, 2021, Celsius opens a wallet with the Maker DAO protocol that it uses to fund a variety of DeFi transactions via the borrowing of DAIs, backed by wBTC.

Initially depositing 999.3 wBTC as collateral in the wallet, Celsius generates and withdraws 20 million DAI from the smart contract, repeating the operation many times until the first repayment of 50 million DAI on 4 December 2021.

This wallet has recently been in the spotlight as its liquidation risk was high, given the downward volatility of the BTC price. In response to the market downturn, Celsius has deposited more than 6,000 wBTC in collateral since June 12 and redeemed nearly 42 million DAI in order to maintain a sustainable collateralization ratio.

Figure 2: The Maker DAO vault 25977, combined with Celsius

With $224 million in debt today, this portfolio has a liquidation price of $13,603, making it a target for potential vulture funds betting on BTC to destabilise Celsius.

DeFi operations in deficit

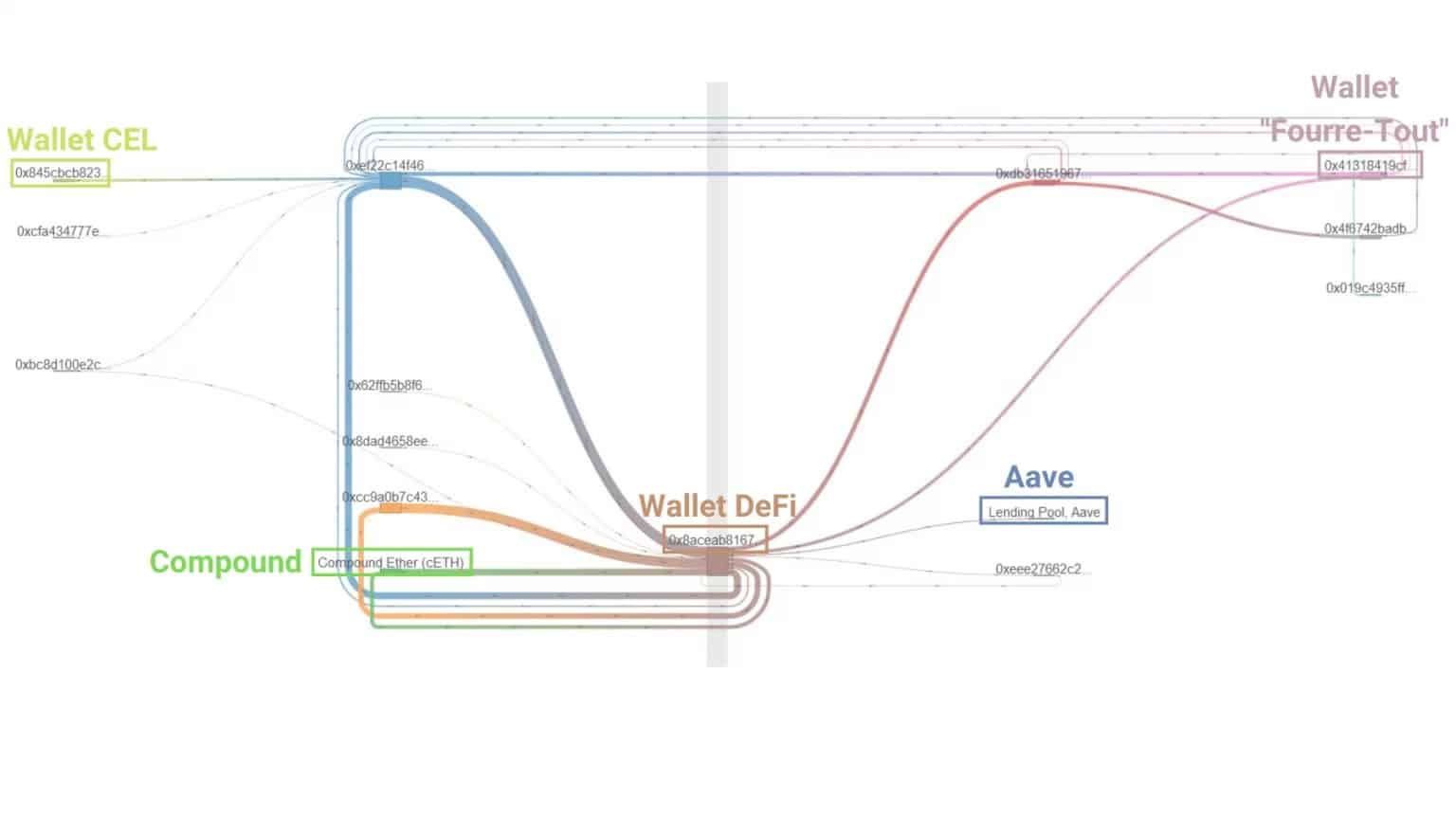

To date, Celsius has $651 million in deposits on the Compound and Aave protocols. Notably, the company has $229 million in wBTC on Compound and $422 million in stETH on Aave, frequently interacting with Celsius’ 0x8aceab8167… wallet, known as the company’s premier DeFi wallet.

Figure 3: Celsius’ 0x8aceab8167… wallet activity

These deposits, made since the year 2021, are supposed to generate interest. However, the average annual return on these deposits is quite low, even lower than many bank savings accounts – from around 0.005% APY for wETH deposited on Aave to 0.031% APY for wBTC deposited on Compound.

There is therefore a significant gap between what Celsius pays for its loans and what it receives as interest on its deposits. Based on a conservative estimate of the average annual return Celsius offers its customers, DirtyBubbleMedia’s data suggests that the platform would have faced an annual deficit of $86 million over the year 2021.

Overexposure to stETH and Staking Eth2

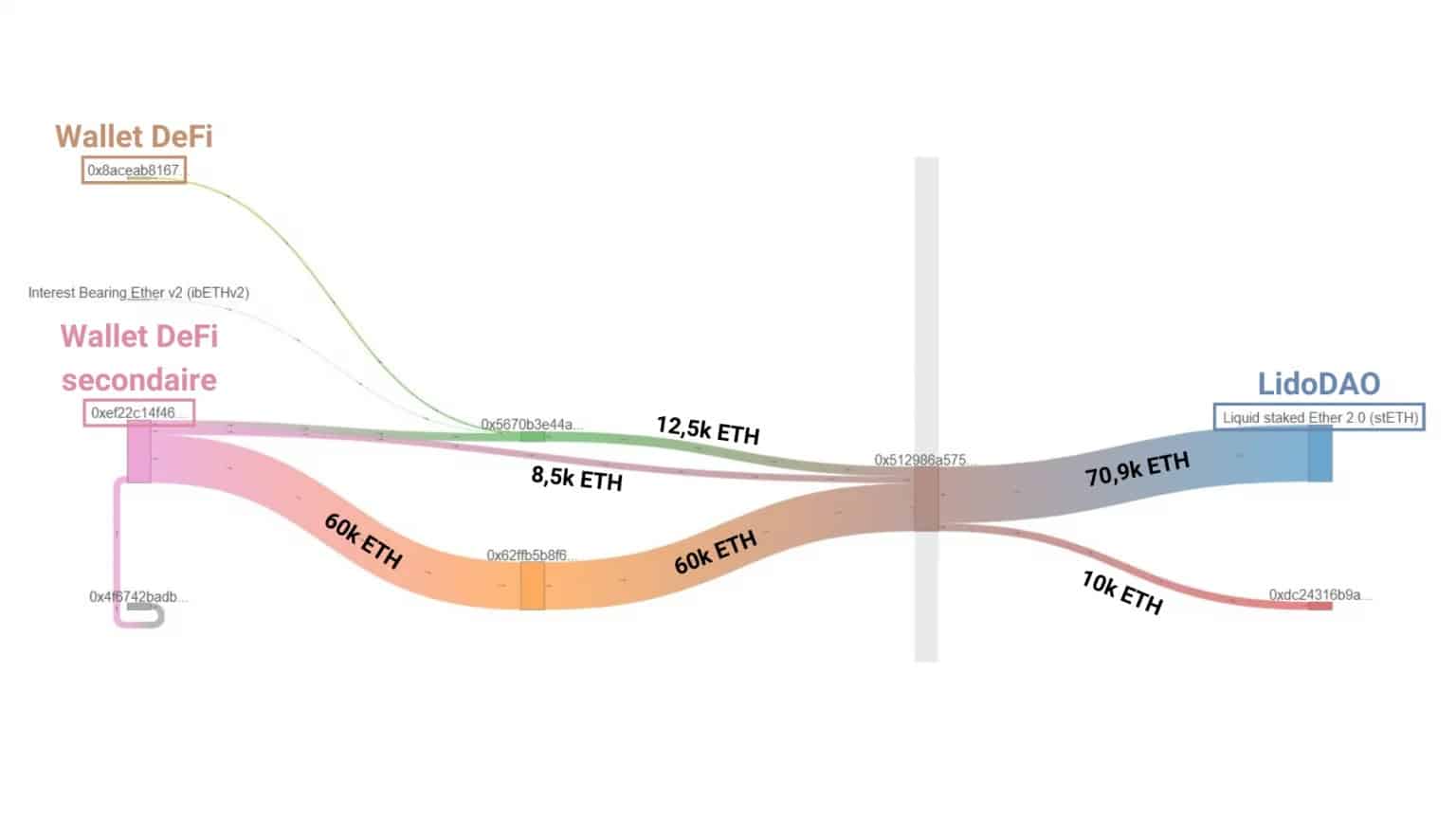

During 2022, Celsius Network has once again taken the gamble of gaining exposure to stETH but also of staking a majority of the Ethers deposited on the platform, directly to the Eth2 deposit contract.

Indeed, although the most important deposits of the 0x8aceab8167… wallet seem to be on Compound and Aave, a number of other protocols interact with it. One of the most important appears to be Lido’s DAO, to which Celsius has sent some 70,900 Ether in exchange for Lido’s Liquid Staked Ether (stETH), largely from address 0xef22c14f46…

Figure 4: Capital transfers from Celsius to Lido

In addition, Celsius Network has also transferred significant amounts of Ether to the Eth2 deposit contract, locking in Ether for when Ethereum moves from proof of work (PoW) to proof of stake (PoS), via two wallets.

During March, Celsius used the Figment Eth2 Depositor contract to send funds, depositing a total of 112,352 Ethers from this wallet. A second wallet then transferred 90,368 Ethers directly to the Eth2 Depositor contract, followed by a further transfer of 28,325 Ethers.

Today, Celsius holds close to 324,756 ETH in the Eth2 deposit contract, locked up until the merge. Celsius is therefore unable to refund 100% of the ETH deposited by its customers, in addition to having exposed itself to the stETH depeg with Lido.

The recent liquidation by Tether

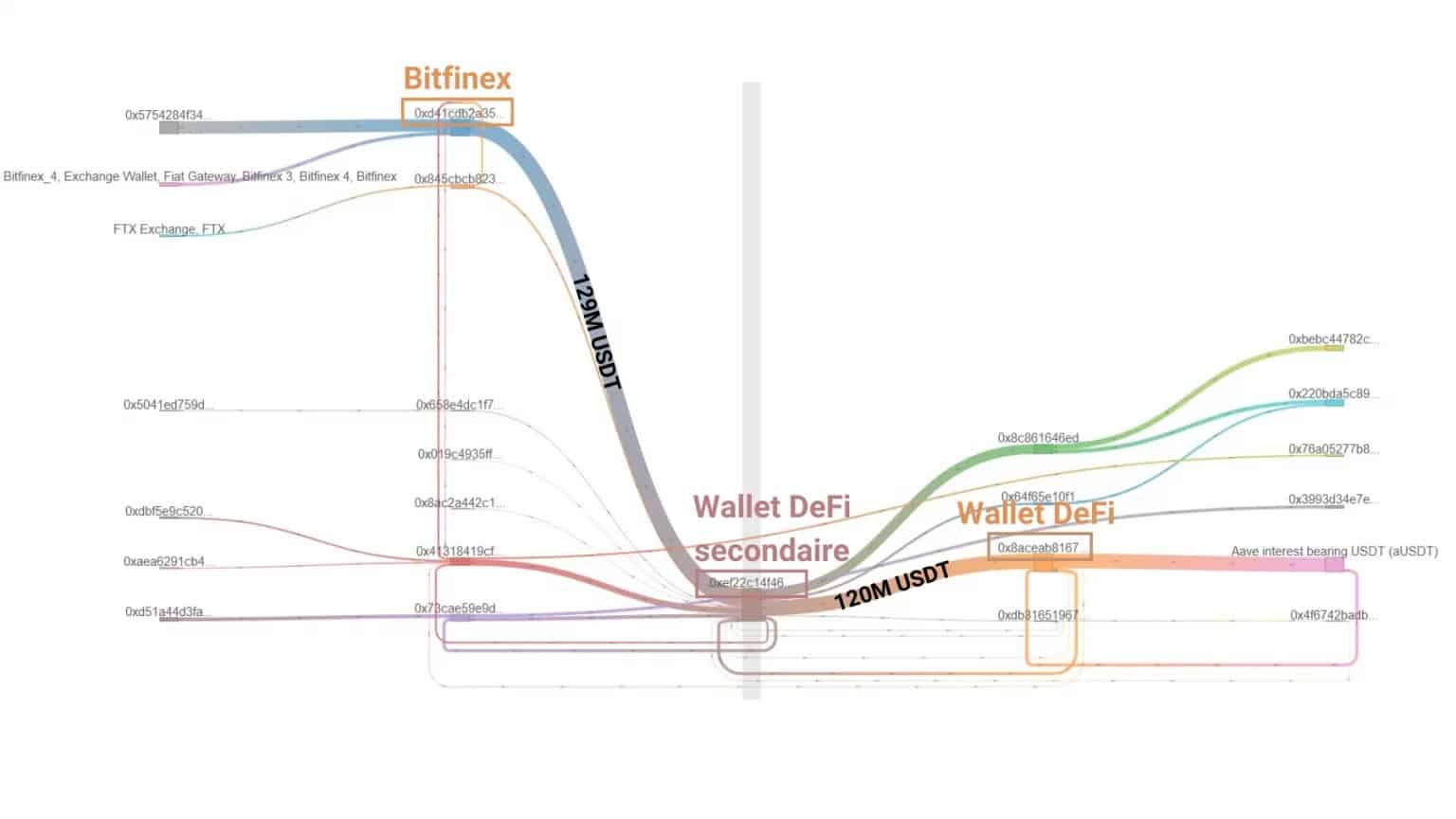

On June 15, Tether announced that it was liquidating the collateral that Celsius had contracted with it. Indeed, Celsius Network had a debt of nearly one billion dollars with Tether for several months. Following the announcement, a hundred million dollars were transferred from Tether to Celsius from this address.

Figure 5: Capital transfers from Bitfinex to Celsius

Tether said it had liquidated Celsius without incurring any losses, noting that the position was over-collateralised. The firm took the opportunity to state that it had no equity exposure to Celsius.

Where are the remaining funds?

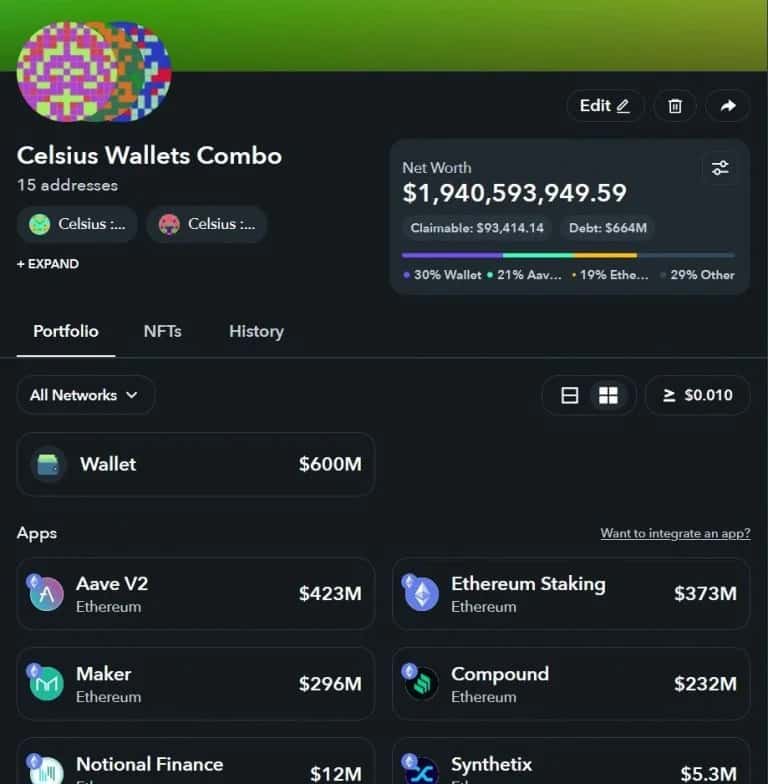

As a result of these transactions and events, the total on-chain wallets identified as held by Celsius total almost $2 billion in value, spread across the firm’s own wallets and decentralised applications such as Coumpond, Aave, Maker, Synthetix or Notional Finance.

These funds are mostly composed of debt, wBTC, ETH and stETH, partly blocked as collateral or staked. In itself, the amount of liquidity available to date is estimated at USD 930,000, while the total debt incurred by these portfolios is over USD 650 million.

However, this represents only a minor part of the funds owned by Celsius, the rest being held on centralized exchanges or in portfolios not yet identified.

You can view and navigate them via this Zapper dashboard.

Figure 6: Cumulative on-chain portfolios of Celsius

Summary and conclusions

In the end, this sequence of deleterious financial transactions has only exposed Celsius Network’s lack of risk management, despite all the communication efforts made to maintain the community’s trust.

Today, Celsius finds itself tied hand and foot, crippled by the immobilisation of part of its funds, significant losses and exposure to unstable financial products.

All eyes are now on the liquidation threshold of the 25977 vault and the possible future restructuring of the Celsius Network. Since the tweet announcing the freezing of users’ funds, the platform has not issued an official statement on its Twitter account, leaving its custodians in a state of uncertainty.

Other newsworthy transactions have been elided here and will be published shortly on our Discord Channel, to go further, join the Pain Grille made up of experts to take you through the world of cryptocurrencies!