In a catastrophic context for Terra’s ecosystem (LUNA), a proposal has been put to the vote to lower the Anchor protocol interest rate to 4%. The idea was submitted directly by one of the former developers of the original Anchor contract and a current Terra collaborator.

Probable change of direction for the Anchor protocol

The Anchor Protocol, known for its 19.5% APY on Terra’s UST (LUNA), has not been spared from the latest unfortunate events.

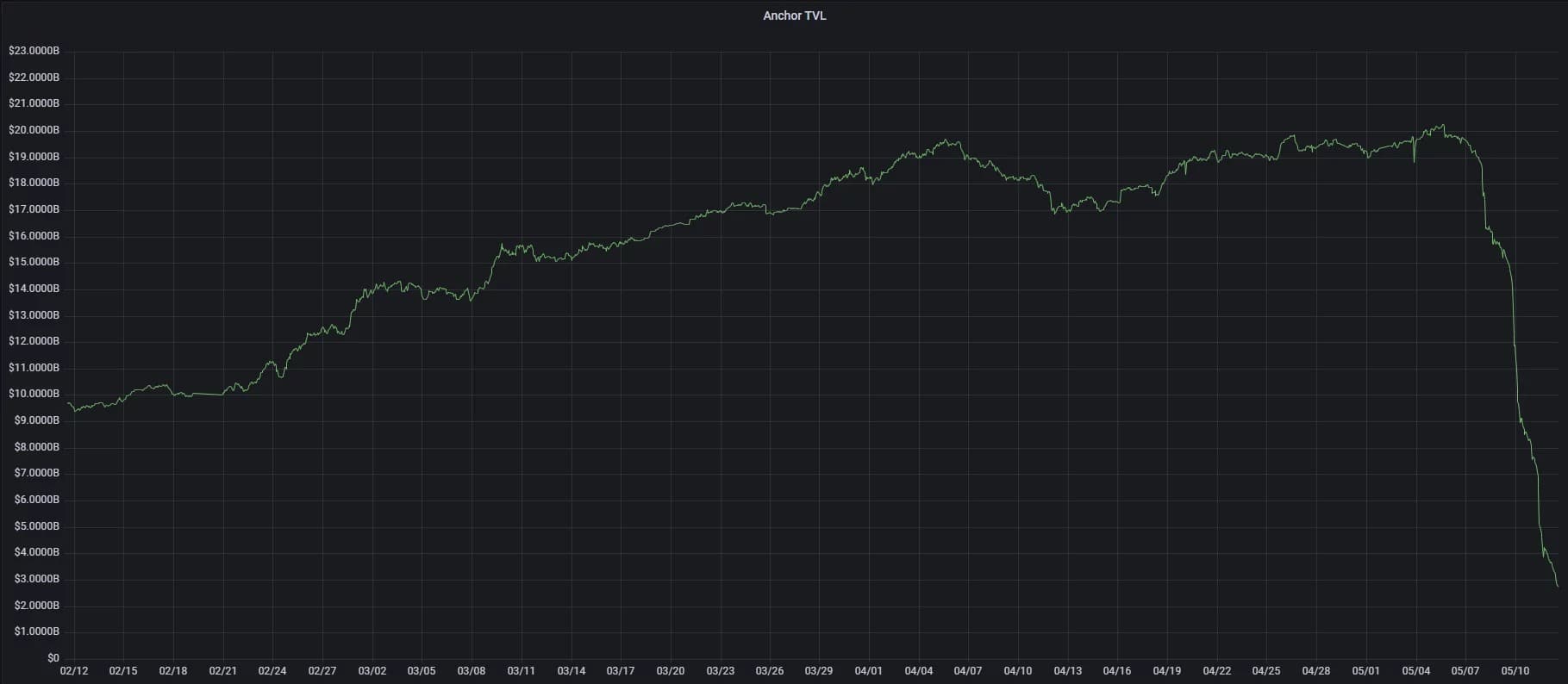

Indeed, most of the cash that had been deposited in the pool has been withdrawn by its users, bringing the total locked-in value (TVL) from around $19 billion to $2.7 billion at the time of writing.

Fig. 1 – Anchor protocol TVL from February to present

The reason for this impressive drop is due to the UST price, which first struggled away from its $1 benchmark on the evening of May 9, before starting a downward spiral that saw it drop to $0.22 on May 11, the lowest ever for a stablecoin of this size.

Since then, it has been fluctuating up and down, but still significantly away from its peak value of $1. This has caused a major stir in the market as a whole, which was already weakened by a downward trend and a Bitcoin that is now below the symbolic threshold of $30,000.

Fig. 2 – UST price from May 8 to today

Also, in order to have more control over the USTs in circulation and to limit the possibilities of attack on the Anchor protocol, a proposal has been put to the vote on the platform to sharply reduce the yields proposed so far from 19.5% to 4%.

The proposal in detail

This proposal, issued directly on Anchor under the name “Emergency measures for restoring Terra peg” was posted yesterday by a former developer of the original Anchor contract and will be put to a community vote until 18 May.

In broad terms, the idea is to aim for a 4% interest rate instead of the current 18% (previously 19.5%, but recently readjusted by 1.5%), with a minimum interest rate of 3.5%.

” A UST outside its $1 peg can no longer sustain an 18% annual interest rate. The temporary drop in Anchor interest rates should prevent the depletion of the Anchor reserve, thus preventing new USTs from entering circulation. Interest rates could be recalculated when the depeg is resolved. “

The proposal includes other, more technical measures, such as increasing the virtual liquidity of the Terra Luna virtual swap pool by a factor of 1,000 or changing its reset rate at each block to reduce the chance of slippage.

For Daniel Hong, who submitted the proposal to the vote, this is a measure to limit the damage, and which a priori will not change anything as to the attractiveness or not of the investors :

“While some may argue that higher interest rates help reduce the supply of USTs in circulation, when stablecoin has already lost public confidence due to a two-day depeg, people would try to get out anyway. “

At the time of writing, 267,000 ANCs (tokens needed to vote on Anchor) have been used to vote “Yes” to the proposal, and only 3,462 for a “No”. The majority of votes are therefore in favour, but still far from the necessary 10% quorum.