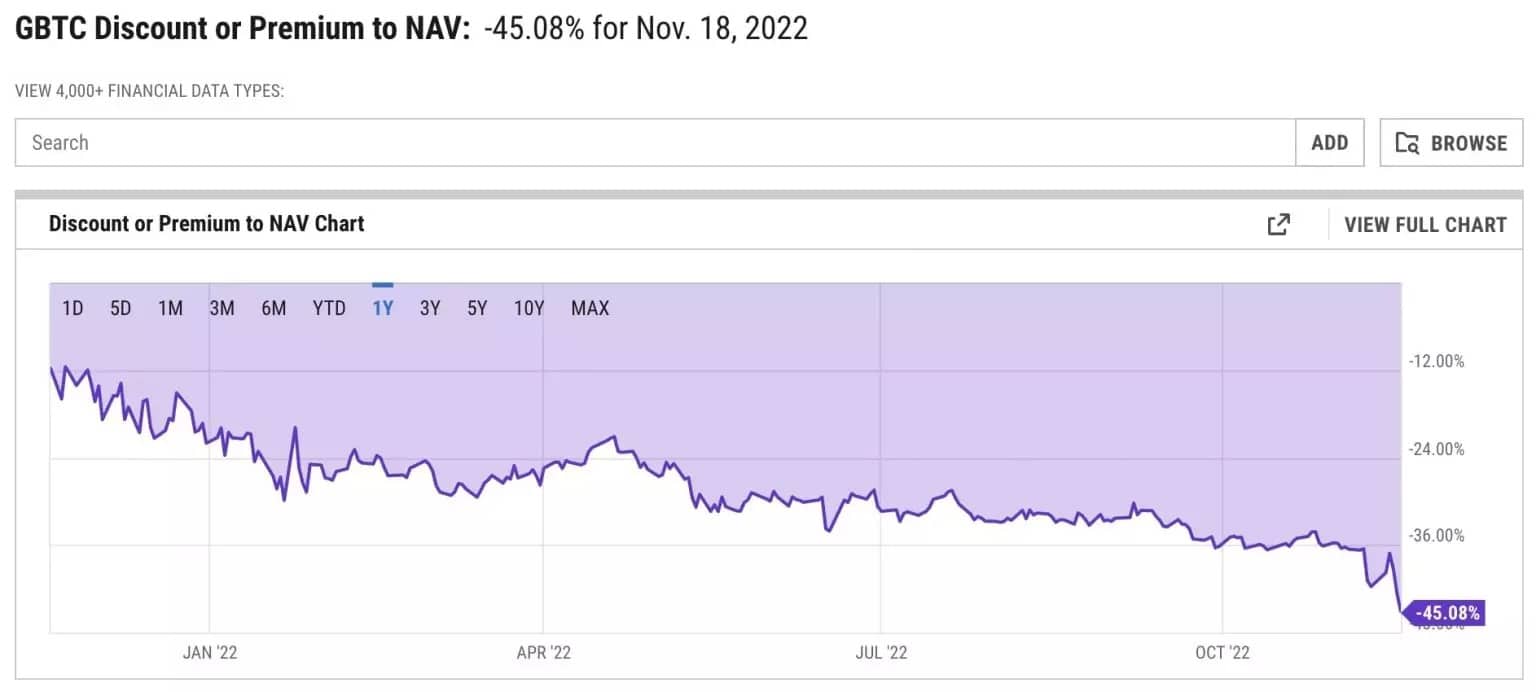

Institutional investment vehicles in cryptocurrencies are not as popular as they once were. The Grayscale Bitcoin Trust (GBTC) is at a record discount of -45% to Bitcoin (BTC), to which it is supposed to be correlated. Besides the bear market, what are the reasons for this fall? What risks are weighing on the crypto market? We explain.

Grayscale’s GTBC discounted 45%

There is a threat to the crypto market right now. The Grayscale Bitcoin Trust (GBTC), considered the largest cryptocurrency investment vehicle dedicated to institutional players, seems to be in a very bad shape and could collapse.

While it is supposed to be correlated to Bitcoin (BTC), GBTC is currently discounted by 45% and even passed the 50% mark this Monday morning. It has been printing lows for several weeks. In practical terms, an asset is considered discounted when its price is lower than the NAV (net asset value, in this case Bitcoin) and premium when it is higher.

GBTC’s discount continues to deepen

Launched in September 2013, GBTC is a security that offers investors a way to gain exposure to Bitcoin without actually buying it. Money from institutional players is gathered and used to buy Bitcoins, which are then held in a fund owned by Grayscale.

In other words, it is not the investors who hold the bitcoins, but Grayscale. With the recent fall in the GBT, many people have begun to question Grayscale’s stewardship, insinuating that the company is not actually holding the bitcoins.

Does Grayscale really hold BTC?

This is the question on everyone’s mind right now: does Grayscale really hold bitcoins? For information, the company is supposed to keep 634,000 BTC, or 10.2 billion dollars at the current price. If this were not the case, it would obviously be catastrophic as the risk of contagion on the market is enormous.

In response, the company issued a statement on Friday 18 November entitled “Safety, security and transparency”, which was also published on Twitter in the form of a thread. The company was keen to reassure its investors:

“Grayscale’s digital asset product holdings are safe and secure. The balances are reflected in historical public filings and have been evaluated by our third party auditors. “

However, these words did not convince, quite the opposite. Indeed, Grayscale does not want to publicly reveal the addresses holding the bitcoins for “security reasons” that seem difficult to justify. This soon set the world on fire

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

– Grayscale (@Grayscale) November 18, 2022

Despite the insistence of investors over the past few days, Grayscale confirmed this Monday morning that it would not publish the addresses of its wallets. A few hours later, Coinbase Custody explained that it regularly verifies the assets held by Grayscale via on-chain validations. Not sure if this safeguard is enough to calm the storm

Coinbase performs regular “on-chain validation” to confirm existence and security of exact amount of Bitcoin pic.twitter.com/7rbiPq43yZ

– Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 21, 2022

Genesis, CoinDesk, Grayscale: dangerous liaisons

This complicated situation for Grayscale is more globally part of the major crisis that Genesis Trading is currently going through. The company, which had already found itself in trouble following the Three Arrows Capital (3AC) debacle, recently suspended its withdrawals because of its own exposure to FTX (to the tune of $175 million).

Except that Genesis Trading, along with Grayscale (and incidentally Coindesk), is part of the Digital Currency Group managed by Barry Silbert. According to some rumours, the two entities would have potentially carried out some operations in order to save Genesis, placing Grayscale in an uncomfortable situation.

But it would go even further. As explained earlier, institutional clients have been reducing their exposure to cryptocurrencies by selling their GBTC (at a percentage loss, since it has a discount) for several months.

This phenomenon is even more marked by the fall of some major entities, such as 3AC or BlockFi which had to sell 100% of their positions on Grayscale.

However, it seems that the Digital Currency Group has taken the decision to buy back GBTCs themselves, thus taking advantage of the discount, without however modifying the supply of Bitcoin held behind. A manipulation that makes DCG the largest holder of its own investment product.

Table of top investors in Grayscale Bitcoin Trust (GBTC) product

However, despite these various transactions, the GBTC price has not held up. On the contrary, it continues to fall, dragging down the DCG group’s positions. However, in the face of Genesis’ turmoil, the group must find 1 billion dollars.

Given the current situation, it is difficult to imagine that investors would be inclined to lend DCG this amount. In other words, they will certainly have to sell their GBTC, incurring huge losses in the process. This would of course cause the Bitcoin price to fall drastically below $10,000.

Grayscale blames SEC

Earlier this year, Grayscale tried to convert the GTBC into an Exchange Traded Fund (ETF), a similar investment vehicle that can be traded on an exchange and tracks the price of a basket of one or more assets.

In particular, offering a Grayscale Bitcoin ETF would allow institutional players to redeem their shares, which would have had an impact on the quantity of shares in circulation and would have slowly narrowed the price gap between GBTC and BTC.

But all of Grayscale’s attempts have been blocked by the US Securities and Exchange Commission (SEC), which has so far eliminated all “spot” ETFs (linked to the Bitcoin market price). Instead, the US financial regulator only allows forward ETFs (linked to derivative contracts on the future price of bitcoin).