The hashrate is a widely followed measure by blockchain professionals. The hashrate of Bitcoin in particular is subject to significant variations. What is the hashrate of a cryptocurrency like Bitcoin and what is its purpose? What is its importance and what information does it give about the blockchain to which it refers?

The hashrate, a key indicator of PoW blockchains

The hashrate is a data to watch closely for miners, but also for investors in cryptocurrencies.

It is often mentioned in the specialized media, especially since the ban on cryptocurrencies and mining in China in May 2021.

What exactly is hashrate, and how can this be interpreted?

Hashrate is a technical term in blockchain. It refers to the total computational power required to register a new block on a blockchain that uses a proof-of-work (PoW) system, such as Bitcoin (BTC) and Ethereum (before its new version 2.0).

The hashrate refers to the total computing power dedicated to creating blocks and verifying transactions on a blockchain.

How is the hashrate measured?

Hashrate is measured in hashes per second (h/s). The main units of measurement used are terahash and exahash. Here are some orders of magnitude:

- 1 megahash per second (MH/s) = 1 million h/s ;

- 1 gigahash per second (GH/s) = 1 billion h/s;

- 1 terahash per second (TH/s) = 1000 GH/s;

- 1 exahash per second (EX/s) = 1 million TH/s.

To compare hashrate levels, you can refer to Bytwork.com’s conversion tool.

What are the hashrate levels?

There is no precise measurement of hashrate for networks that use proof-of-work, only estimates, such as those provided by Blockchain.com (for Bitcoin) and Etherscan (for Ethereum).

The hashrate of the Bitcoin blockchain is estimated at 180 million terahash per second (TH/s) and that of Ethereum at 895 TH/s, at the time of writing. This rate can go up and down significantly from month to month, depending on many events outside the blockchain in particular.

Hashrate: meaning and interpretation

Hashrate, a competitive gauge for miners

Hashrate is first and foremost an essential data for mining professionals. To understand this, let’s go back to the definition of mining.

When a transaction is issued on the blockchain, it must be securely validated by creating a new block. Each individual transaction is temporarily recorded on a node, i.e. a computer on the network. It is then recorded on the blockchain, in packages of tens or hundreds of transactions, with the creation of a block.

To create a block, miners compete to perform a complex mathematical calculation as quickly as possible. The fastest one wins the right to create the block and is rewarded with crypto-currencies.

For miners, it is therefore crucial to be the fastest and therefore to have a good hashrate, i.e. a high calculation capacity. This is THE measure that allows them to evaluate their level of competitiveness, the costs of their activity and their profitability.

For investors, the hashrate can serve as an indicator of a blockchain’s reliability

Although difficult to measure precisely and especially to interpret, the hashrate also gives the pulse of a blockchain.

The speed of calculations depends on the power of the miners’ machines, and therefore on the quantity of resources dedicated to the mining of a blockchain. It is an indicator of the motivation and confidence of miners in this blockchain and in its cryptocurrency, by which they are paid.

Secondly, the hashrate is an indicator of the level of complexity of the mining. It is therefore a measure of the security of a blockchain. The higher the hashrate, the less vulnerable the network will be to an attack.

Indeed, the fact that a blockchain has a high hashrate protects it against entities that would try to take a monopoly on mining on its network. If an entity obtains more than 51% of the hashrate of a network, then there is a risk of taking control of the network and of embezzlement. This is known as the “51% risk” or “majority attack”.

It would currently take about 90 million terahashs per second to hold more than 50% of the Bitcoin network hashrate, which is clearly not within anyone’s reach.

We can thus compare the security of the different blockchains using the proof-of-word by comparing their respective hashrates. We can see, for example, that the hashrate of the Bitcoin network is much higher than that of the Ethereum blockchain.

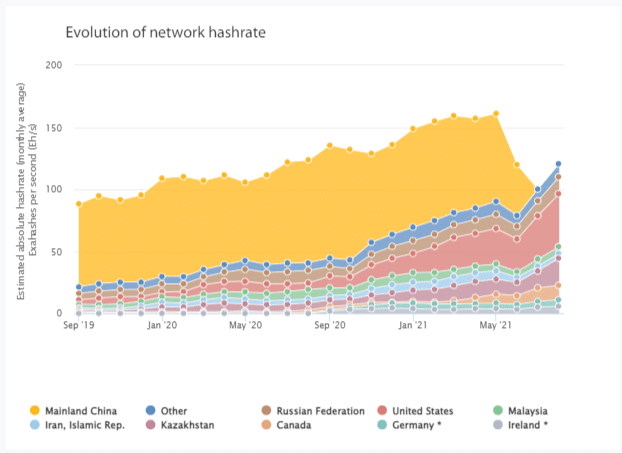

Finally, the hashrate in the global sense allows us to measure the resources dedicated to mining a blockchain by geographical region. For example, in 2019, it was known that China accounted for more than 75% of the global Bitcoin hashrate, according to data from the Cambridge Center for Alternative Finance.

This changed in May 2021 with the ban on mining in China. It is now the US that leads with 35% of the hashrate, followed by Kazakhstan with 18%, Russia and Canada.

Hashrate evolution from September 2019 to August 2021 (Source: Cambridge Center of Alternative Finance)

This means that mining is becoming more widely distributed around the world, and that’s good. Indeed, the geographical distribution of miners is a guarantee of security and real decentralisation of a blockchain.

This geographical decentralisation limits the impact that a climatic event or a sudden fiscal or political decision can have on the computing power of a blockchain.

What factors influence hash rates?

The level of hashrate varies depending on the amount of computer resources dedicated to mining.

It depends on the amount of transactions which varies daily, and the difficulty of the problems to be solved.

It also depends on the age and size of the blockchain. The more complex the blockchain, the more difficult the mining. It is a bit like a diamond mine: the more you dig, the harder it is to dig.

It also depends on the price of Bitcoin and Ether. The higher the prices, the more profitable and attractive mining is. Thus, the activity is attracting more and more miners since 2019.

An important fluctuation factor is the cost of electricity. Indeed, the activity of mining is very energy-intensive and costly in electricity. Thus, the hashrate can be impacted unpredictably and randomly by climatic elements, such as the increase in electricity prices due to heavy rains in the Sichuan region of China in August 2020.

It is also easy to deduce that new, greener and cheaper sources of energy (such as volcanic energy in El Salvador) can increase the profitability of mining, thus attracting new miners, and pushing hashrate upwards.

Finally, the main disruptive element remains the policies of the countries where miners are based. A policy of subsidies or, on the contrary, a new taxation of mining activities can encourage or dissuade miners.

The case in point will of course be the ban on mining and cryptocurrencies in China in May 2021, which caused a temporary drop in the Bitcoin hashrate of more than 50%.

It is therefore understandable that in the long term the hashrate can be linked to the prices of the crypto-currencies Bitcoin (BTC) and Ether (ETH), but that it is very difficult to interpret a trend in the hashrate in relation to the price of the crypto-currency underlying the blockchain concerned.

What are the trends in hashrates?

Bitcoin and Ethereum hashrates fluctuate on a daily basis. They have seen their levels fall sharply at times since 2019, but overall they have been trending upwards since 2009, when the Bitcoin network was created, and especially since the acceleration of blockchains since 2018.

Historically, the main drops in Bitcoin hashrate levels have been linked to China’s policy measures, most notably in November 2020, due to an increase in electricity due to rains in Sichuan, then in June 2020, following electricity restrictions for Chinese mining farms, and especially between May and July 2021, with the gradual banning of mining and cryptocurrencies.

Conclusion

To summarise, the hashrate measures the power of all the machines dedicated to ensuring the security of a blockchain. It provides us with many elements of analysis allowing us to judge the level of reliability and decentralisation of a blockchain.

It remains an indicator to be taken with caution, as it depends above all on the profitability of the mining activity, and can be dependent on various and variable factors, such as the cost of electricity, the tax system linked to the profits from mining or the policy of a country.

While the hashrate can be read as an indicator of the health of a blockchain, it remains primarily a comparison tool and does not necessarily predict the good or bad health of the crypto-asset price.