Before investing in cryptocurrencies, it is essential to know how to decipher the Tokenomics of a project. This is essential to know everything that is behind a token and put all the chances on your side to make a wise investment.

What is Tokenomics

The study of Tokenomics, a contraction of the words “token” and “economics”, is one of the disciplines of fundamental analysis of crypto-currencies.

Indeed, there are two main types of analysis that an investor needs to perform in order to maximise their chances of profit:

- technical analysis, which consists of observing the price dynamics on a chart to capture a trend;

- Fundamental analysis, which consists of estimating the current and potential intrinsic value of an asset.

While technical analysis is predominantly used for short-term trading, fundamental analysis is used for long-term investing.

In this article, you will discover how to analyse the tokenomics of a cryptocurrency. You will then know much more than the majority of investors and avoid investing in projects doomed to failure.

Tokenomics: the game of supply and demand

Generally speaking, the price of an asset is the result of a balance between supply and demand. If demand is higher than supply, the price goes up and vice versa.

From this point of view, cryptocurrencies are no exception to the rule. However, it is in the characteristics of supply and demand that they stand out. Indeed, they do not function like any other financial asset.

Hence the emergence of this new science, the economics of tokens, whose purpose is to determine the quantity and manner in which the supply will be distributed on the one hand, and on the other to imagine the use cases that will generate demand.

The main difficulty is to avoid too great an imbalance between supply and demand. This is all the more difficult as it is impossible to anticipate the speed of adoption of a project and its cryptocurrency. This partly explains the high volatility of this asset class, as the first projects have, as they say, “wiped the slate clean”.

But to fully understand the difficulty of this balance, let’s start by looking at what characterises supply.

Supply, or what is supply in tokenomics

As is often the case in the cryptocurrency world, the terms used are in the language of Shakespeare. This is why you will regularly come across the word supply when talking about a project’s token offering.

The most reliable information about the supply of a token is always found in the whitepaper or project documentation.

However, an easy way to get detailed information is to use a data aggregator such as CoinMarketCap or CoinGecko.

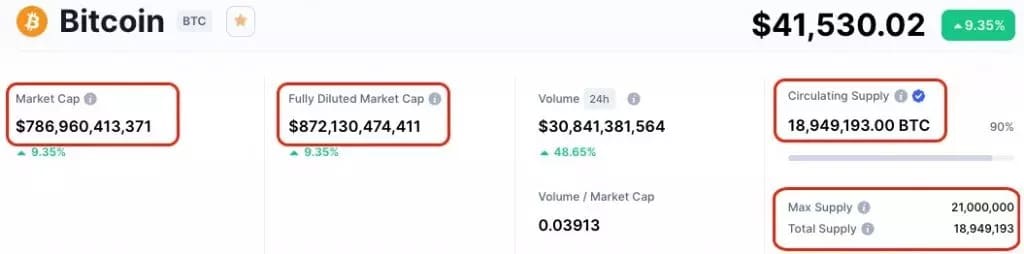

Figure 1: Display of Bitcoin tokenomics on CoinMarketCap

Let’s first review the metrics that measure the quantity of tokens.

The max supply is the maximum number of coins or tokens that will be put into circulation. The most famous example is Bitcoin and its 21 million units. But not all crypto-currencies have a maximum, in which case the Max supply is not filled in.

The total supply represents all the tokens that have already been created minus those that have been burnt – we will see this later – or withdrawn from circulation.

Finally, the circulating supply represents the fraction of the total supply that is freely circulating on the market at a given moment. It excludes “staked” tokens, as well as those held by the protocol itself or by the founders for example.

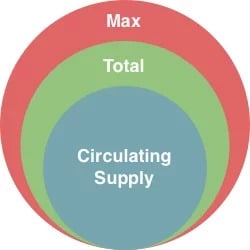

Figure 2: Diagram of token quantity metrics

Finally, the last two metrics that need to be understood are the market cap and the fully diluted market cap.

The market cap represents the market capitalization of a cryptocurrency. It is the equivalent of the usable money supply in an ecosystem at time T, as it is obtained by multiplying the circulating supply by the token price.

Market Cap = Circulating supply x token price.

Fully Diluted Market Cap is a view of the maximum money supply of an ecosystem, as it is calculated by multiplying the Max supply by the token price.

Fully diluted MC = Max supply x token price.

Now that you have a better view of the important metrics, we can look at what parameters will impact these metrics and how this will positively or negatively influence the token price.

The evolution of supply over time, a key aspect of tokenomics

It is important to understand that, in general, anything that will tend to increase supply will slow down the evolution of a cryptocurrency’s price.

Conversely, mechanisms that decrease supply are likely to support its price. Let’s look at this in more detail, by studying the parameters that vary the amount of token in circulation.

Inflation

In most cases, tokens are issued gradually over time until they reach the maximum supply when it is set.

To use the Bitcoin example, new coins are created with each block to reward miners. There is therefore inflation of the total supply, which at the time of writing is about 1.8% per year.

What makes bitcoin’s price in a long-term uptrend is that the demand for its adoption is far greater than its inflation. Not to mention that it is scheduled to be halved every four years according to halving cycles.

In short, demand is growing much faster than supply, which creates upward pressure on the price.

Conversely, many cryptocurrencies have inflation rates that are too high, especially to offer impressive returns via staking or decentralised finance protocols (DeFi). But this can be counterproductive.

Let’s take the example of PancakeSwap’s CAKE to illustrate our point.

It is possible to get more than 60% return per year via staking. This seems interesting at first sight, but it is without counting on a 66% inflation of the number of tokens.

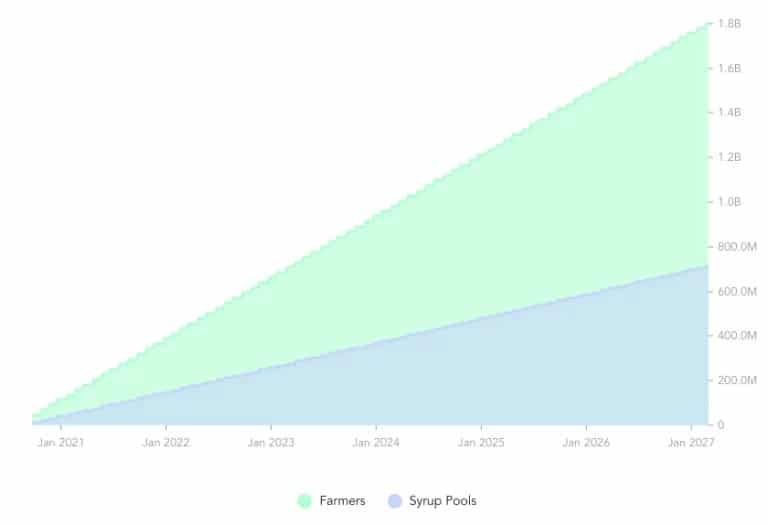

Figure 3: Evolution of the number of CAKE tokens in circulation over time

This leads to a dilution phenomenon quite similar to what can be observed during a capital increase on the stock market. The capitalisation remains stable, but the number of tokens being more important, its price is mechanically reduced.

This is one of the reasons why the CAKE is down by more than 85% since its historical record. Yet it is one of the most widely used decentralised applications (dApp) in the entire crypto ecosystem. This shows the decorrelation that can exist between the success of an application and the valuation of its token.

Figure 4: CAKE token price evolution since your ATH

Deflation

Unlike inflation, there are mechanisms to reduce the quantity of tokens, which is then rather favourable in the long run to the increase of the price.

The main techniques to achieve this are burn or buy-back. In simple terms, this involves removing tokens from the circulating supply.

In detail, these techniques can be used to limit inflation, in which case we talk about disinflation, or to reduce the total supply. In this case, it is called a deflationary token.

In all cases, the aim is to control or reduce supply so that demand exceeds supply and create this famous tension on the price.

A very good example is BNB, the cryptocurrency used on the BNB Chain and the Binance platform.

Indeed, Binance has several burn mechanisms depending on the fees paid by the users, both on the exchange and via the BNB Chain. In total, more than 36 million BNB have been burned since the beginning. At the current price (February 2022), this represents almost 15 billion dollars. And another 64 million are expected to be withdrawn over the next few years.

Since all the tokens have already been issued, the aim is not to limit inflation, but to reduce the total amount of tokens in circulation. The BNB is therefore a deflationary token, which should favour its long-term evolution.

Vesting

Finally, there is one last parameter that can influence, temporarily, the quantity of tokens in circulation. This is called vesting.

Tokens acquired during pre-mining by members of the founding team and advisors, or by private or institutional investors during fund-raising for example, are often subject to a lock-in period.

This is done to prevent these early investors, who have benefited from very advantageous prices in return for taking the risk, from being tempted to sell the assets immediately when the tokens are listed on the exchanges. A massive sale would then cause the price to fall immediately.

This is why there is usually a release schedule to control this potential influx of new tokens.

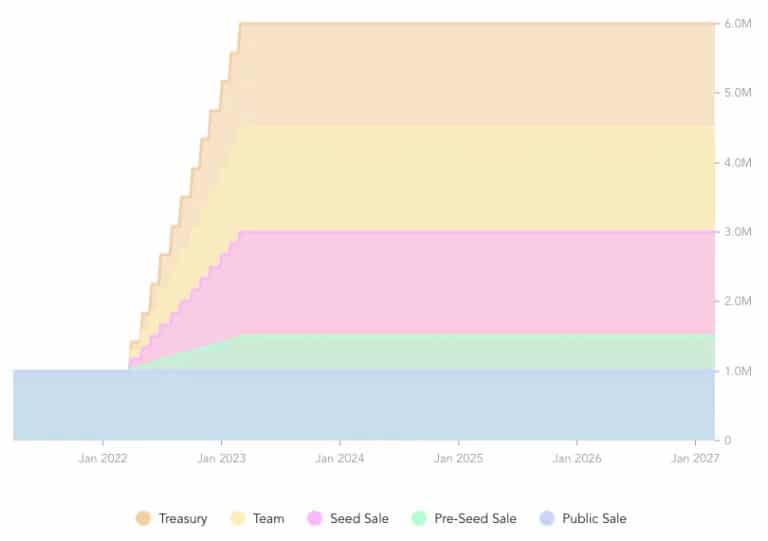

If we take the example of ILV, the token of the highly anticipated Play to Earn Illuvium, we can see a number of things on the token release schedule available on the Messari platform.

Figure 5: ILV Token Release Schedule

ILV tokens allocated to the team and investors will be released progressively over 12 months from March 2022. The outstanding supply will be multiplied by 6, from 1 to 6 million tokens.

For information, pre-seed and seed investors bought their tokens at $1 and $3 respectively, while it is currently worth over $600. It seems obvious that as soon as they get the chance, they will want to cash in all or part of their colossal capital gain.

This is why vesting is often detrimental to the price of a token, as it introduces massive inflation over a short period of time, combined with profit taking by early investors.

Only a strong demand could compensate for this. Perhaps the launch of the Beta version of the game scheduled for Q1 2022 could be a trigger, but nothing is less certain.

As a result, always look for a release schedule on Messari or in the project’s whitepaper before investing.

The utility of a cryptocurrency as a key component of demand

After supply, demand is the other element that needs to be understood when reading the tokenomics of a cryptocurrency.

Past the speculative demand that can drive up the price of a cryptocurrency in the short term, it is the demand related to its utility that will bring its long-term success.

That’s why you need to look for the different use cases of the coin or token. What is it used for? How can I use it?

We will review different use cases, knowing that a token can accumulate several.

Blockchain coins

Coins are a particular type of token. They are the native tokens that are essential to the operation of blockchains. It is impossible to perform a transaction or execute a smart contract on Ethereum without using ETH for example.

From this perspective, infrastructure blockchain corners are likely to have a steadily growing real demand as they are adopted.

The utility token of a platform or protocol

Utility tokens, as you might guess without knowing English at your fingertips, serve a specific purpose in an ecosystem. They are needed to access or use a service for example.

One example is the CHSB, the utility token of the SwissBorg platform. The number of CHSBs held allows different VIP levels to be obtained, with associated benefits such as increased staking yields or reduced transaction fees.

A utility token often has use cases limited to the ecosystem it depends on, and its value must be compared to the value of the service it enables.

The payment of network transaction fees

Tokens can be used to pay fees for services. The best example, but not the only one, is the exchange platforms like Binance, FTX, KuCoin and others.

All of them have their own token. More often than not, there is an incentive, such as a fee reduction, to pay with the in-house token.

Use as a currency

Of course, cryptocurrencies are also exchange currencies, the most famous being bitcoin. Being able to use a cryptocurrency as a means of payment is a powerful demand factor, but there are actually quite few that can take on this role.

Staking

Another use case is staking. Whether it is to participate in the consensus of a blockchain in Proof of Stake, or to obtain staking rewards, it is necessary to own and immobilize tokens.

Decentralised Autonomous Organisations (DAOs)

Finally, in order to participate in the governance of a decentralised autonomous organisation (DAO), one must own the organisation’s tokens. In order to participate in decisions, vote or receive rewards, you will have to buy tokens.

Logically, a token with multiple use cases is more likely to have a sustained demand. The stronger the demand for utility, the more likely the price will rise in a healthy and steady manner over the long term.

The case of the Binance BNB, a token with multiple uses

To illustrate all that you have discovered above, let’s take the example of the BNB from the Binance ecosystem, which has many use cases.

First of all, as the BNB token can be used within the Binance exchange, it is one of the most popular utility tokens in the ecosystem.

Users of the platform have an interest in buying and holding BNB to benefit from various advantages:

- 25% discount on trading fees if paid in BNB;

- Cryptocurrency used to acquire NFTs on their marketplace;

- Access to Launchpad, to invest in new projects;

- Access to Launchpool, to receive airdrops of tokens;

- Staking and farming to get returns on the DeFi;

- Etc.

For the record, Binance is by far the world’s leading cryptocurrency exchange, with 85 million customers at the end of 2021. All these users have an interest in buying and holding BNB to benefit from these many advantages, which creates a healthy and steady demand.

On the other hand, BNB also serves as the native corner of the ecosystem blockchain, the BNB Chain. This is a whole set of complementary use cases added to an already long list.

All this, coupled with an already 100% issued and deflationary supply probably explains why BNB is the 3rd largest cryptocurrency behind Bitcoin (BTC) and Ether (ETH).

Conclusion on tokenomics

To summarize, it is through tokenomics analysis that you will be able to estimate the long-term valuation potential of a cryptocurrency.

The goal is to determine if demand will be greater than supply, to drive the price up. Because no matter how good a blockchain or decentralised application is, if its tokenomics are poorly designed, the price of its token could be likely to fall in the long run.

That’s why you should make the effort to check out a cryptocurrency’s whitepaper before investing, especially if you’re planning to hold for the long term.

And generally speaking, prefer tokens with low inflation or deflation, and with multiple use cases that can sustain steady demand.