Tether, the issuer of the stablecoin USDT, recently announced its intention to invest up to 15% of its profits in Bitcoin (BTC) in order to strengthen and diversify its reserves. By making such investments, Tether hopes not only to increase its reserves, but also to provide a clearer view of its performance and capital allocation strategy.

Tether focuses on Bitcoin

Shortly after publishing its first quarterly report for the year 2023 with net profits of $1.5 billion, Tether, the issuer of the stablecoin USDT, has announced that it will now invest up to 15% of its profits in Bitcoin (BTC) in order to “strengthen and diversify” its reserves.

At the time of its last report, Tether indicated that 1.5% of its reserves were in Bitcoin ($1.5 billion) and 4% in gold ($3.4 billion). The remainder is made up of cash or cash equivalents and short-term deposits such as Treasury bills.

The company has also announced that it will be the sole holder of its future Bitcoins, in reference to the maxim “Not your keys, not your Bitcoins”. The move also aims to strengthen, increase and diversify the USDT issuer’s reserves, while providing a “clearer view of the company’s performance and capital allocation strategy”, as Paolo Ardoino, Tether’s CTO, elaborated:

“The decision to invest in Bitcoin, the world’s first and largest cryptocurrency, is underpinned by its strength and potential as an investment asset. Bitcoin has continually proven its resilience and has established itself as a long-term store of value with substantial growth potential. Its limited supply, decentralised nature and widespread adoption have made Bitcoin a preferred choice for institutional and retail investors. “

A massive first investment?

According to Tether’s latest report, the company is expected to invest around $222 million in Bitcoin very soon.

Given the phenomenal growth that Tether has seen, particularly since the recent depeg of its main rival, Circle’s USDC, the company should quickly find its place among the largest holders of BTC such as Galaxy Digital Holdings, MicroStrategy, Voyager Digital, Marathon Digital and Tesla.

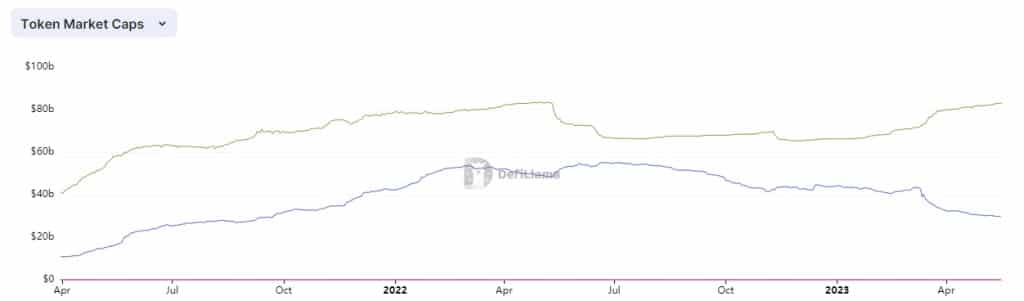

As we can see below, Tether’s USDT has now surpassed Circle’s USDC, and is poised to hit $83 billion in market capitalisation. Since its temporary depeg, the USDC’s capitalisation has fallen from $43.2 billion to $29.4 billion, a loss of around $13.8 billion.

Evolution of the market capitalisation of the USDT (in green) and the USDT (in blue)

In a bid to increase transparency and reassure some investors about its sometimes-critical past, the company decided to reduce its holdings of commercial paper to zero last February, and also opted for less risky methods such as Treasury bills. However, some continue to criticise the lack of an audit, which the company promised some time ago.