The raising of the US debt ceiling is the fundamental concern of the moment with the June 1st deadline, highlighted by Treasury Secretary Janet Yellen, looming. What impact could this have on Bitcoin (BTC)?

A deal to raise the US debt ceiling would be good for Bitcoin

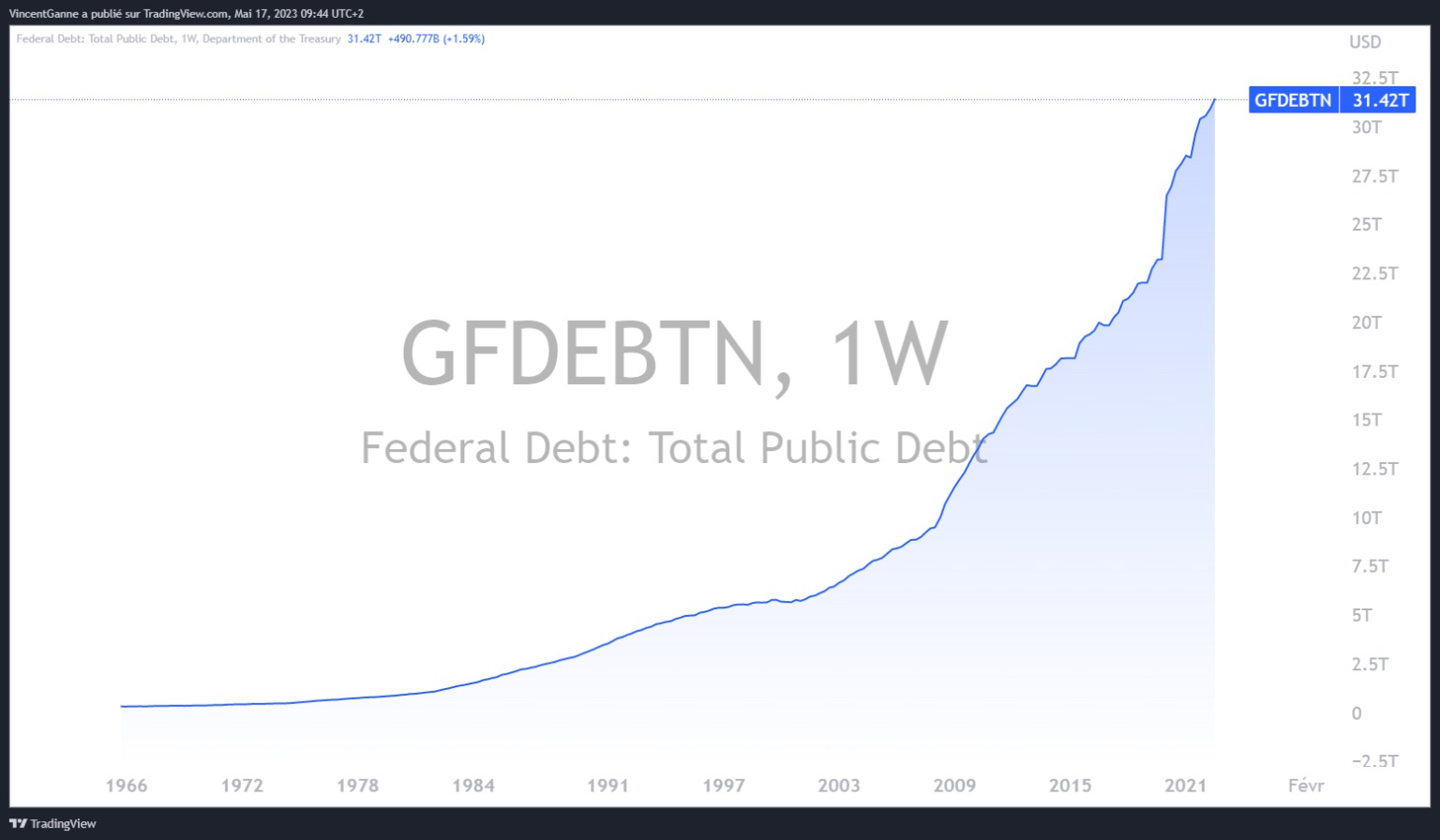

Remember that in the United States, there is a legal ceiling on the public debt which must not be exceeded and which is determined by the United States Congress, the House of Representatives and the United States Senate. This public debt represents the sum of the budget deficits of the US federal government and is necessary for the proper functioning of the US Administration and its many economic and administrative services.

The current issue is that a – necessary – negotiation is underway between the Democratic Administration of President Joe Biden and Speaker Kevin MacCarthy, the Republican leader of the US Representatives and the lower house of the US Parliament.

If no agreement is reached between the 2 parties by the end of the month, the US federal government will be in a shutdown situation, which will damage the US economy by suspending economic interaction between businesses and consumers on the one hand, and government services on the other.

In the past, there have already been shutdown episodes, 6 periods of closure to be precise, 2 of which lasted more than 2 weeks between 1995 and 2013. Since then, the general level of US public debt has exploded upwards, and a new shutdown period would jeopardise the solvency of the federal government, whose simple debt servicing (the payment of interest on outstanding debt) requires new budget deficits.

Having done some research, it appears that the economic and stock market impact of past shutdowns has been limited, but in the current fundamental context of the fight against inflation, the consequences could be more serious.

In any case, if the shutdown is avoided thanks to a bipartisan agreement, then this will have a bullish effect on the US equity market, and by correlation, a bullish effect on the price of Bitcoin. So this is the hot fundamental theme for the next few trading sessions

Graph showing the evolution of the amount of public debt in the United States

2 chart patterns are possible in the short term for BTC

The upcoming development of this US debt ceiling issue will allow the Bitcoin price to finally make a chartist choice. I believe that this choice must be made between 2 hypotheses:

- Breaking through resistance at $28,000 and resuming the uptrend towards $32,000 and then $35,000, the latter level being the major resistance for the medium/long term;

- Retrace towards $24,000/$25,000, to gain liquidity before heading back to attack the aforementioned resistances.

These 2 technical working hypotheses would be invalidated if support at $23,000 were broken, with the risk of the bullish gap on the BTC future contract closing below $21,200. Let’s let the market make its own choice

Chart showing the price of the bitcoin future contract in daily Japanese candlesticks