In its latest quarterly report produced by BDO Italia, Tether reports a net profit of $850 million for the period April to June. In doing so, the American giant brings its excess reserves to over $3.3 billion, although this has yet to be verified through a financial audit.

Tether publishes its latest results

Tether, the issuer of USDT, the most highly capitalized stablecoin on the cryptocurrency market, has just published its latest quarterly statement (April to June). Carried out by BDO Italia, the report shows that the American giant made $850 million in net profits.

As a result, Tether’s excess reserves are now valued at $3.3 billion:

“As a reminder, excess reserves are the company’s own profits – not distributed to shareholders and which the company has decided to retain in addition to the 100% reserves that Tether maintains to support all tokens in circulation. “

Remember that attestations, like the one published here by Tether, are to be dissociated from financial audits. In fact, financial audits are much more complete and strict, since they are based on all a company’s financial documents.

An attestation issued by an external firm can only verify the authenticity of documents transmitted by the company itself, which is a lower level of confidence than an audit. Tether has long been criticized for maintaining a certain opacity regarding its USDT reserves, but this does not seem to be hindering its growth.

Tether claims that its reserves “remain extremely liquid”, with 85% of its reserves held in cash or cash equivalents. In addition, the USDT issuer reveals that it holds the equivalent of $72.5 billion in U.S. Treasury bills.

The USDT is the big winner in the stablecoin race

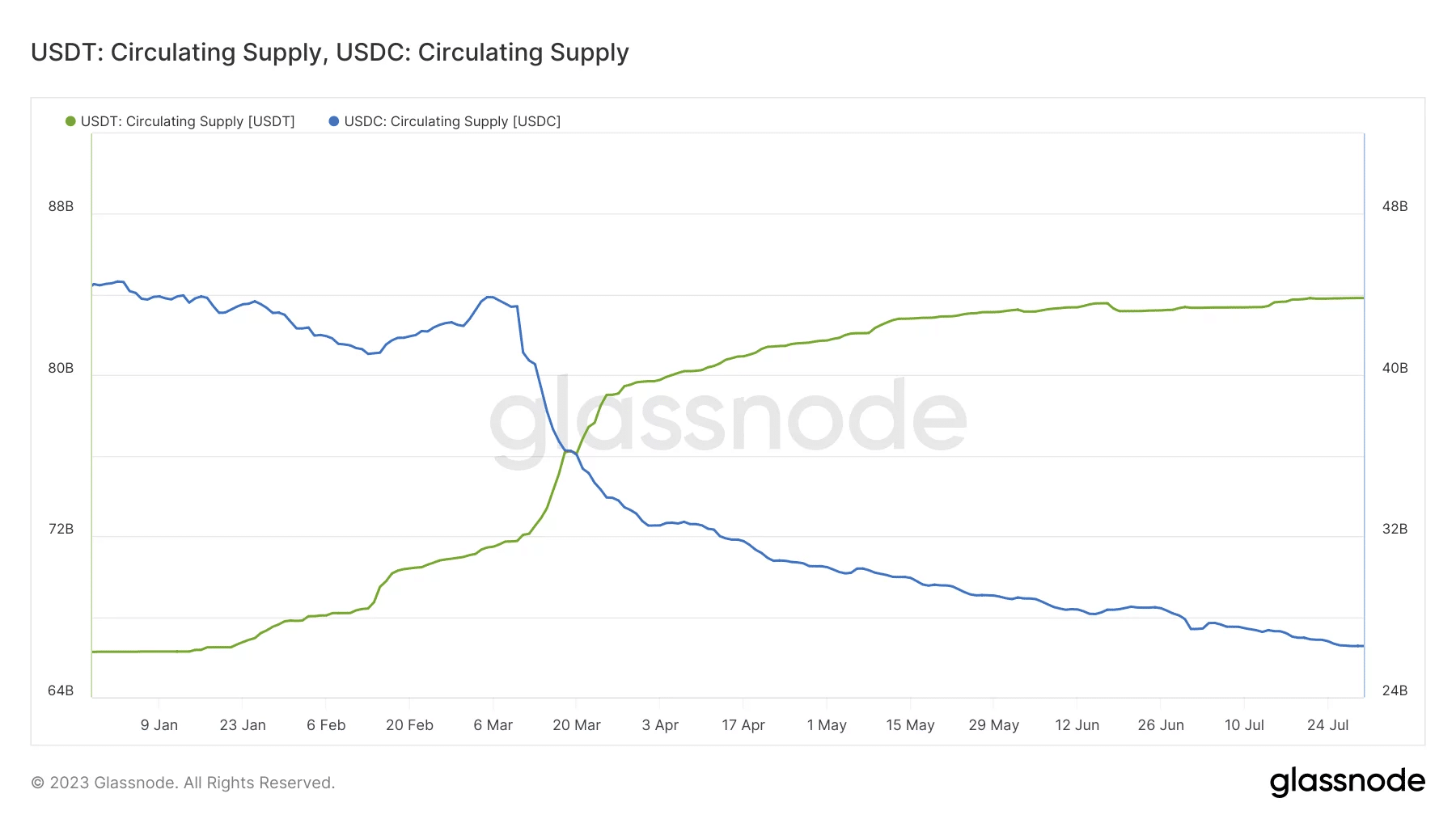

Since the loss of Circle’s USDC peg last March, Tether has been consolidating its dominance of the stablecoin market. At the time of writing, USDT alone accounts for 66.7% of stablecoins in circulation, with over $83.7 billion in market capitalization.

By way of comparison, the USDC now accounts for just $26.4 billion in market capitalization, far ahead of the DAI, with $4.1 billion.

As you can see below, the USDT has been moving upwards for almost 5 months now:

USDT (green) and USDC (blue) currently in circulation

According to Paolo Ardoino, CTO of Tether, the growing success of USDT is the result of a recipe combining “trust and innovation”:

“With a resolute focus on transparency, we want to shape a future where every participant in the global financial ecosystem can confidently navigate a domain built on trust and innovation. That’s why during this quarter, Tether’s USDT token in circulation surpassed its previous all-time high.”