While the euro was trading at around $1.18 a year ago, it is now at near parity with the US currency. To protect itself from this exchange rate risk, which devalues the savings of Europeans, the tokenisation platform RealT offers an innovative solution, while allowing to generate returns by exposing itself to the American real estate market.

The dollar’s dominance over the euro

Since 2021, the euro has been on a downward trend against the dollar.

The recent parity between the two currencies will not have escaped anyone’s attention and this has resulted in the euro falling by more than 18% since its last weekly high:

Figure 1: EUR/USD rate

The reasons for this devaluation are multiple and complex. The fact that many commodities are traded against the dollar and that their prices have risen sharply over the last few years is one reason. The different strategies of the US Federal Reserve and the European Central Bank with regard to key rates also play a role in the current outcome.

For European citizens, this creates a vicious circle. The cost of living is rising with soaring inflation and, to make matters worse, it is becoming increasingly expensive for industries to exchange dollars for foreign supplies. As a result, savers are seeing the value of their savings dwindle.

This raises the question of diversifying into other currencies. Just as with various financial assets, the possible decline in one or another thus reduces one’s exposure to risk.

In the world of cryptocurrencies, stablecoins are a possible solution to get through such periods. But there is an even more versatile alternative: RealT.

Indeed, the way the platform works allows exposure to the dollar, but also to the US real estate market. This offers protection in the event of a fall in the euro, while generating a more than decent return thanks to the dollar rents that investors can collect.

Protect yourself from a falling Euro with RealT

RealT is a platform mixing blockchain and real estate founded in 2019 by Rémy and Jean-Marc Jacobson. After many years of investing in real estate, they used their expertise to create a tool that makes investing in real estate simple, starting at $50.

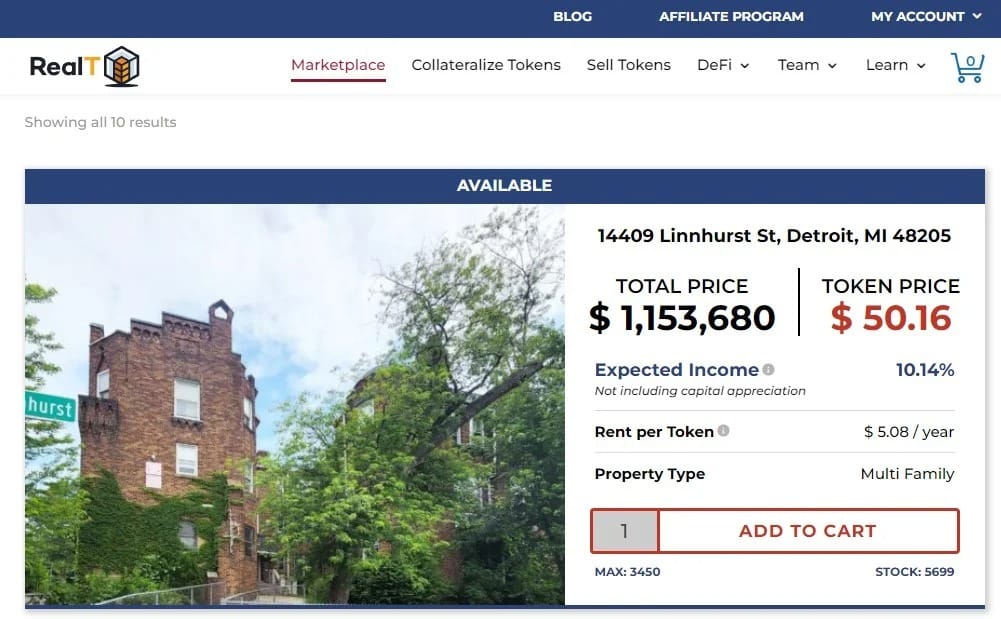

Figure 2: Overview of a property for sale on RealT

RealT buys properties through specially created companies. Users of the platform then purchase tokenised shares in these companies which own the properties in such a way that: one company equals one specific property. Thus, by holding a company share in the form of a security token, an investor actually holds a share in the associated property.

As the property is put up for rent, a user of the RealT platform receives a share of the income. He can expect a return of 10% per year on average. The advantage of this is that these real estate investments are made on the American market and therefore, by extension, in dollars. Thus, someone who started investing in January 2021 with a euro equivalent to about 1.2 dollars would realise a 20% gain if he or she were to switch back to the euro. This additional gain is then added to the average 10% base return.

The right choice for US real estate

Of course, there is no guarantee that after such a fall the euro will continue to fall against the dollar, the trend could just as easily be reversed.

Nevertheless, it is important not to underestimate the currency risk and the impact it can have on the economy on a daily basis. In this respect, it is wise to diversify your capital into foreign currencies.

The value of this approach will depend on one’s expectations regarding the need for liquidity. This strategy will obviously not be suitable for someone who wants to be able to switch back to the euro within the hour to recover funds. But it will be quite relevant for an investor expecting an attractive return, combined with the low volatility of the property market.

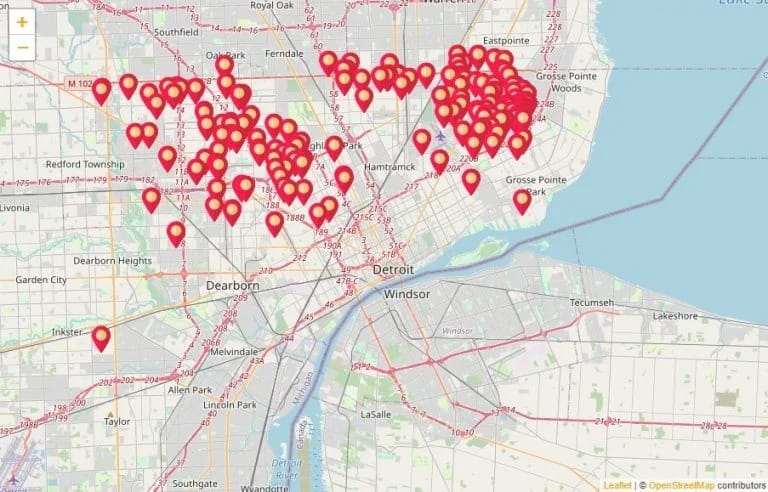

In this respect, the US market is an interesting choice. Especially since RealT does not select the geographical areas of its investments randomly. A large proportion of its properties are indeed concentrated in Detroit, Michigan:

Figure 3: RealT properties in the city of Detroit

This is an industrial region that suffered greatly after the subprime crisis in 2008. This led to a significant drop in real estate purchase prices. The subtlety in this state is that rental prices have not been as impacted, which has led to significant returns on investment.

Rémy and Jean-Marc Jacobson and the RealT team have been able to capitalise on these opportunities. As the region becomes more attractive, property prices are trending upwards again. In general, RealT will always look to make investments with similar strategies, in properties with long-term promise.

The platform has its properties revalued every year. Thus, although there is no guarantee, it is not surprising that the value of the tokens held by an investor will rise after each revaluation.

Beyond protection on the euro/dollar pair, RealT therefore also allows investors to aim for the long term by gaining exposure to US real estate. All this while staying on the blockchain, which allows cryptocurrency holders to diversify their portfolio very simply.

A more comprehensive strategy than stablecoins

Those familiar with decentralized finance protocols (DeFi) will certainly find the returns more attractive than those offered by RealT. However, this translates into increased risks such as hacks, smart contract bugs or possible stablecoin anchoring losses (as with Terra’s UST).

RealT’s tokens, on the other hand, have legal recognition. A contract must be signed when they are purchased in order to record the sale of the portion of the real estate in question. While this does not eliminate all risks, it is at least a good compromise between return and security.

On the other hand, RealT can generate an additional return through its RMM platform. Built in partnership with the Aave protocol, it allows you to deposit your fractions of real estate as collateral to be able to borrow liquidity, while continuing to receive the rents.

Thus, it is a capital optimisation that has nothing to envy to other strategies with stablecoins. This financial arrangement is then added to the three variables we mentioned earlier, on which RealT allows you to make your capital grow:

- Protection against the fall of the EUR/USD ;

- Value of the property price;

- Long-term rental returns.

Of course, as with any investment, an asset can move in both directions. In this respect, it will be necessary to manage your risk according to the criteria of your investment plan. Nevertheless, the RealT platform offers a real opportunity for anyone who wants to hold a store of value capable of generating returns, without being as volatile as the cryptocurrency market.