The ORDI token, based on the Bitcoin Ordinals protocol, sets a new record by reaching a market capitalization of $1 billion, testifying to the growing interest in Bitcoin-based non-fungible tokens (NFTs). We take stock of this remarkable achievement.

A new record for ORDI

The price of the ORDI token, based on the Bitcoin Ordinals protocol, recently passed a historic milestone, reaching almost $65 and a market capitalization of $1 billion. This milestone testifies to the growing interest in such an NFT protocol on Bitcoin.

Launched in December 2022 by Casey Rodarmor, Bitcoin Ordinals are a form of digital artifact inscribed directly on the Bitcoin blockchain. This technology exploits satoshis (a fraction of Bitcoin) as media for the inscription of various content.

Binance’s announcement of ORDI’s listing on their platform played a decisive role in raising the profile of the protocol and its assets. Last August, Binance had also launched an Ordinals Listing service that enabled platform users to integrate data on the Bitcoin blockchain through the Ordinals protocol more easily.

The introduction of these innovations triggered a significant valuation of the protocol’s assets and the ORDI token. Whereas at the beginning of November last year, ORDI was trading at around $6, it then recorded a spectacular 850% increase in one month.

This growth has propelled ORDI to the forefront of BRC-20 tokens, positioning it as the first to achieve such a remarkable valuation on the market.

The impact of the Ordinals protocol on Bitcoin

Despite its innovative nature, the Ordinals protocol is creating a sharp division in the Bitcoin community. Virulent criticism comes from a section of the community, who perceive these digital artifacts as a transgression of the original essence of the Bitcoin network, as conceptualized by Satoshi Nakamoto.

In their view, Bitcoin was intended exclusively for financial use, and not to host digital artifacts. They point out that entries on Ordinals compromise the fungibility of satoshis and contribute to block overload, resulting in higher transaction fees.

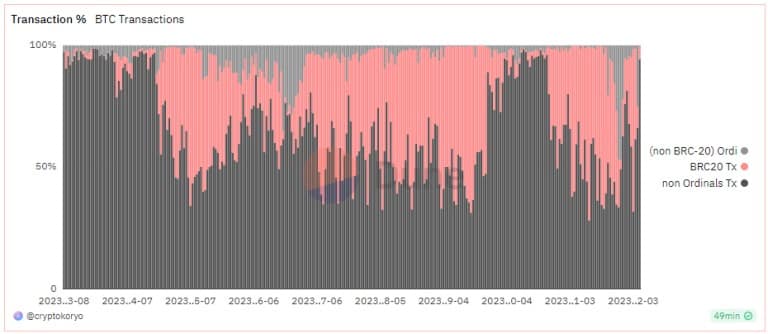

Transaction breakdowns by utility

According to the data presented in the graph, at certain periods, transactions linked to the Ordinals protocol represent more than 50% of the total volume of transactions on the Bitcoin network.

This situation leads to significant congestion in the mempool, resulting in a significant increase in transaction fees. Currently, minimum fees on Bitcoin stand at around 200 sats per vB, equivalent to almost 10 euros for a standard transaction.

However, these concerns coexist with a favorable perception of this innovation among other members of the community. The latter argue that the increase in transaction fees, induced by the Ordinals protocol, increases miners’ revenues, making their activity more profitable and thus reinforcing the decentralization of Bitcoin mining.