More than 50 countries are restricting the use of crypto-assets within their borders, according to a US congressional report. A figure that is rising in part because of the illegal activities that cryptocurrencies could enable, according to the document.

A rising figure

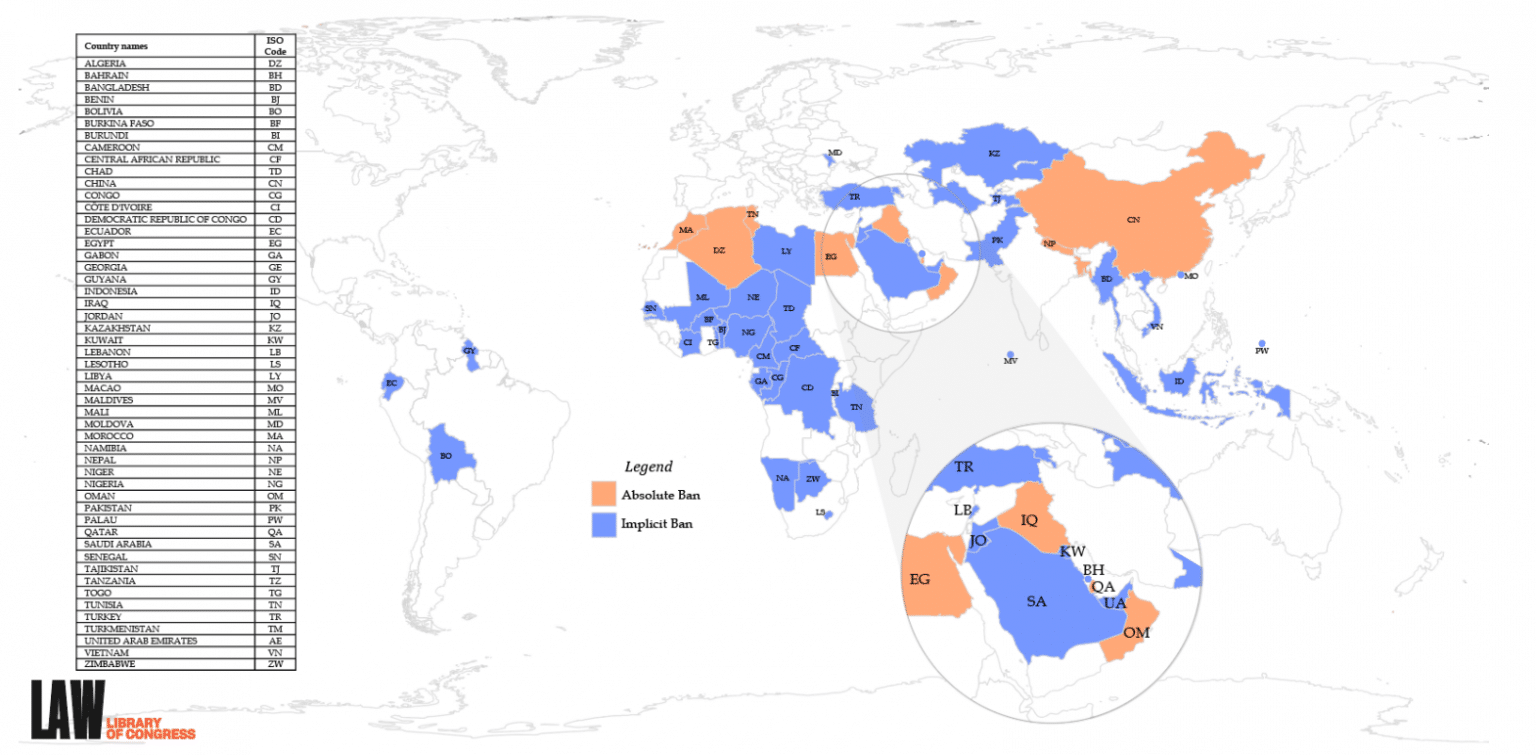

According to a report by the Global Legal Research Directorate (GLRD), a branch of the US Library of Congress, 51 countries currently restrict the flow of cryptocurrencies.

The report is an update of its first version compiled in 2018. In particular, it shows that the number of countries that completely ban the circulation of crypto-assets has increased from 8 to 9, while those partially restricting their use has increased from 15 to 42.

The 9 countries totally banning the use of crypto-currencies are: Algeria, Bangladesh, Egypt, Iraq, Morocco, Nepal, Qatar, Tunisia and of course China, which is constantly tightening the measures against them.

In this regard, we recall the impact that the Chinese government’s measures against miners in its country had on the hashrate of Bitcoin.

Various reasons

In a number of jurisdictions, the authorities wanted to emphasise that crypto-assets, unlike global currencies, are not issued or controlled by central banks and are subject to high volatility.

It is also pointed out that the anonymity provided by trading in crypto-currencies creates opportunities for the development of illegal markets or activities such as money laundering or terrorism.

Indeed, in 2013, more than $1 billion was seized in bitcoin following the closure of the Silk Road website, one of the largest illegal online markets, selling weapons and drugs, among other things.

However, at present it is extremely difficult to prove how much Bitcoin is really used for illegal activities, as we explained here.

Finally, there is the question of taxation. Knowing which countries tax cryptocurrencies is not complicated, but the difficulty is how to categorise the income that comes from them (salary, secondary income…) and this is still a question that is widely debated between the different countries of the world.

Legal status of cryptocurrencies around the world (Source: US Congressional Report)

The case of France

In France, the law is quite clear about the benefits of cryptocurrencies. Also, we can read on the website of the Ministry of Economy:

When they are part of a usual practice, capital gains from the sale of digital assets, bitcoins or other cryptocurrencies, are taxed as industrial and commercial profits (BIC). On the other hand, gains made on an occasional basis by individuals when selling cryptocurrencies have benefited since the 2019 Finance Act (Article 41) from an adapted taxation […]. Thus, in accordance with Article 150 VH bis of the General Tax Code, the overall capital gain realised in the year is taxable if the total of the disposals exceeds 305 euros. Gains are subject to a single flat-rate withholding tax: they are taxed at an overall rate of 30%, i.e. 12.8% for income tax and 17.2% for social security contributions.

In July, the International Monetary Fund (IMF) expressed reservations about the use of Bitcoin and cryptocurrencies in general. Indeed, it was concerned that countries might use crypto-assets as their national currency, as El Salvador has done.