MicroStrategy has informed that it has repaid its $205 million Bitcoin collateralized loan from Silvergate Bank. In addition, the company has also acquired new BTC.

MicroStrategy repays Silvergate Bank

Almost a year ago today, MicroStrategy announced that it had taken out a $205 million loan secured by Bitcoin (BTC) from Silvergate Bank through its subsidiary MacroStrategy.

While this loan was unheard of in traditional finance, it has been the talk of the town on several occasions in recent months. And for good reason, as the price of BTC kept falling throughout 2022, rumors of margin calls appeared, raising fears of a liquidation of the loan. While these rumors were quickly denied, the recent bankruptcy of Silvergate has caused new concerns about the safety of the collateral used for the debt.

Once again, MicroStrategy has reassured the market, and announced earlier this week that it had prepaid the entire loan, which was due on March 23, 2025:

MicroStrategy repaid its $205M Silvergate loan at a 22% discount. As of 3/23/23, $MSTR acquired an additional ~6,455 bitcoins for ~$150M at an average of ~$23,238 per bitcoin & held ~138,955 BTC acquired for ~$4.14B at an average of ~$29,817 per bitcoin. https://t.co/ALp9VLkTpt

– Michael Saylor⚡️ (@saylor) March 27, 2023

Moreover, the company was even profitable on this deal, as this early repayment and Silvergate’s current situation allowed it to close the deal for $161 million, as reported in the Form 8-K filed with the Securities and Exchange Commission (SEC).

This represents more than a 21 percent discount on the $205 million originally due. In addition, MicroStrategy subsidiary Macrostrategy held a $5 million account at Silvergate, and 34,619 BTC served as collateral for the loan as of March 24.

The acquisition of new BTC

In addition to the early repayment, MicroStrategy acquired 6,455 new BTC. These investments were made over a period from February 16 to March 23, at a total cost of $150 million and an average price of about $23,238 per unit.

This brings MicroStrategy’s Bitcoin holdings to 138,955 BTC, worth $3.75 billion at the time of this writing. The average unit cost of each BTC is now increased to $29,817.

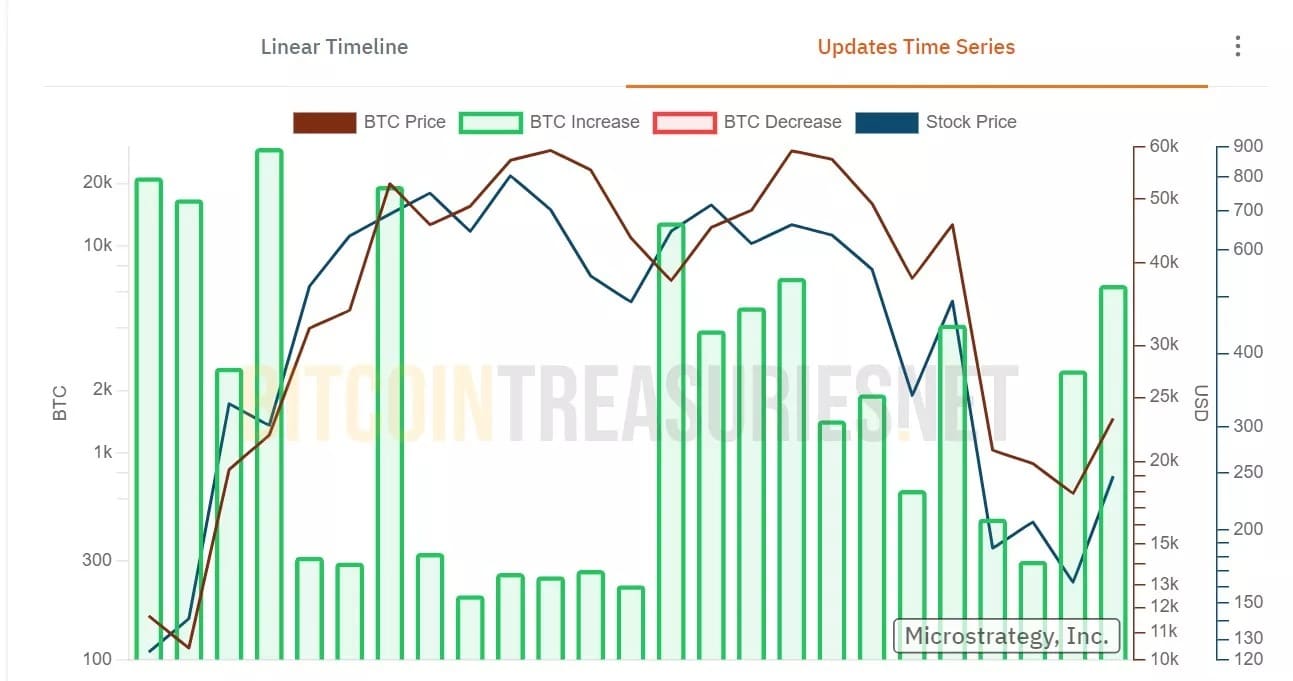

The graph below from the Bitcoin Treasuries website even shows a correlation between the price of Bitcoin in brown, and MicroStrategy’s share price shown in blue. New acquisitions are symbolized by green bars:

Comparison between BTC and MicroStrategy stock price

While it’s always interesting to see such a player backing the most important cryptocurrency at any cost, each new purchase raises the question of decentralization a bit more. Indeed, these holdings alone account for nearly 0.72% of the total amount of BTC.