The monthly closes for Bitcoin (BTC) and Ether (ETH) are worth watching. Despite the low volatility of the past week, the market will have to take a clear direction in the week.

Technical analysis of Bitcoin (BTC)

Last week I told you about the importance of the monthly close on Bitcoin (BTC). Today is the 31st of January, and the close will be tonight at 1am. I’m going to go back to my analysis to give you the 2 potential scenarios.

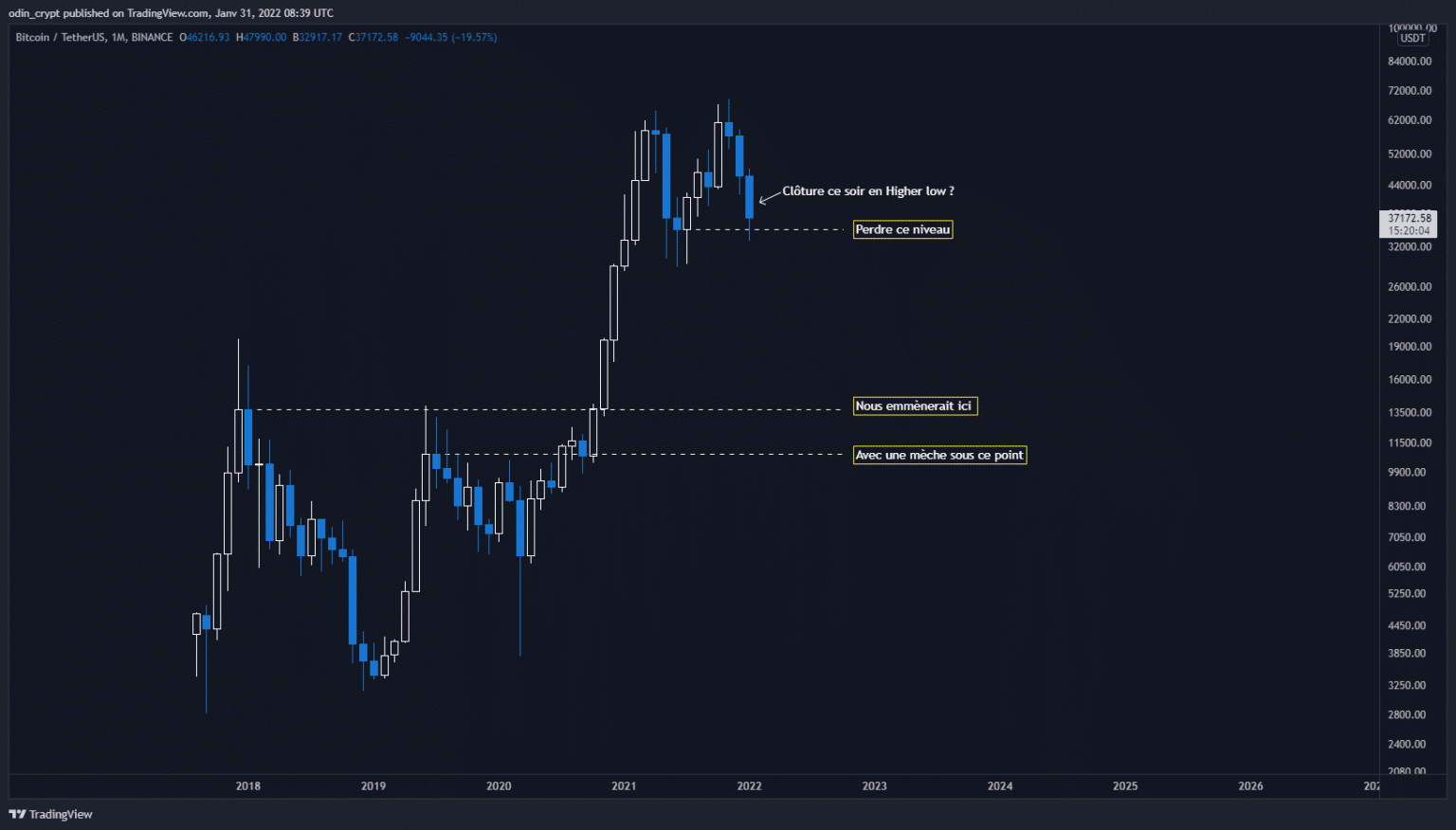

The important level to watch is at $35,000. The two scenarios that will play out are:

- A close above $35,000 drawing a higher high than the previous one, and keeping the bullish structure;

- A close below $35,000 breaking this momentum and opening up deeper retests below $20,000.

At this time, we can’t say where this close will occur. But let us clarify our analysis in order to understand the trend.

Bitcoin (BTC) analysis in 1M

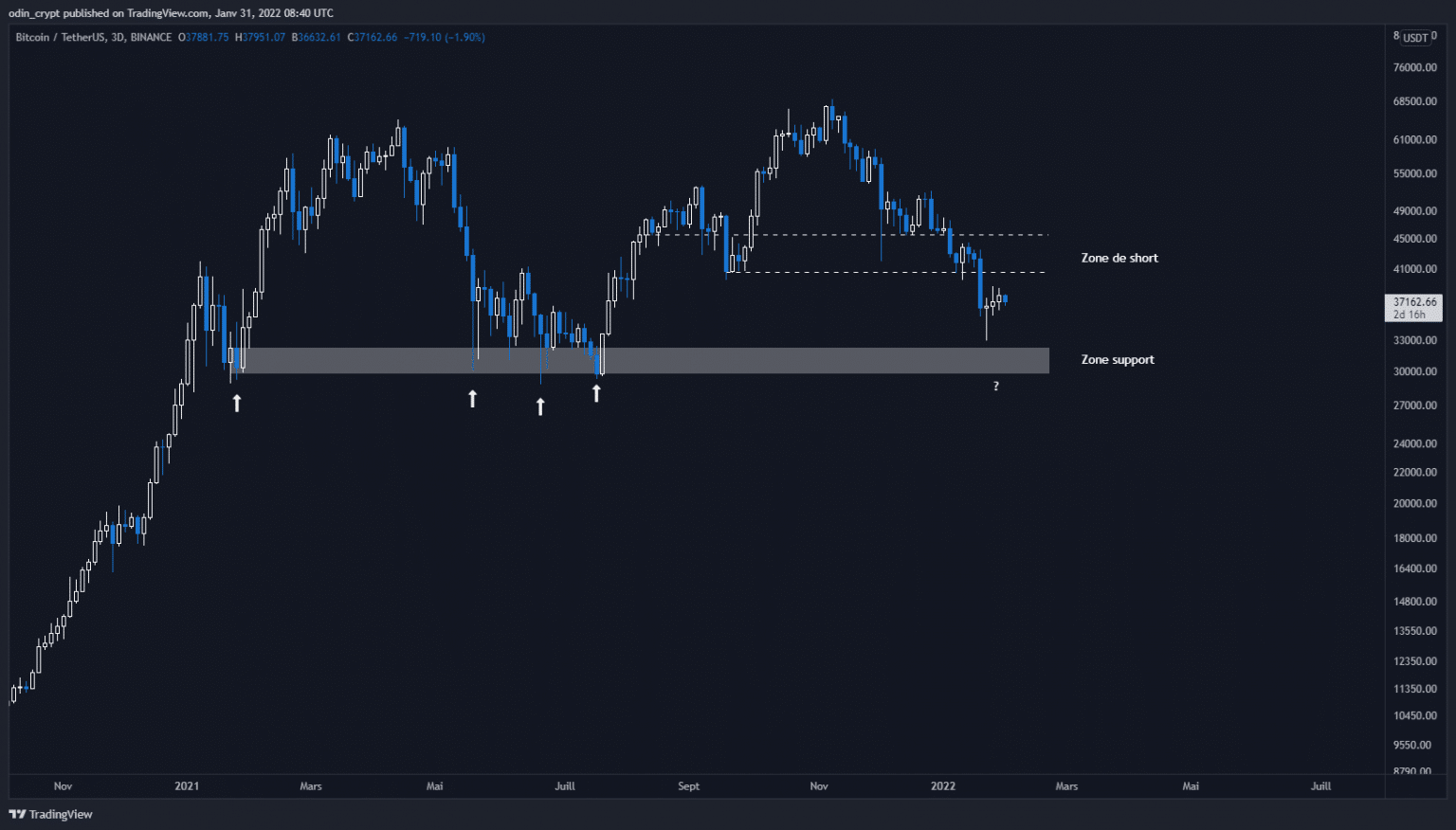

The daily view tells us that the bearish setup remains valid. The $30,000 – $32,000 support area has not been revisited, and the short area is still untested. It is highly likely that the price will come to the $41,000 – $45,000 area before resuming the downward path. Again, it’s too early to tell if this decline will be temporary or not, but what is certain is that it will offer an interesting profit point.

Bitcoin (BTC) 3D analysis

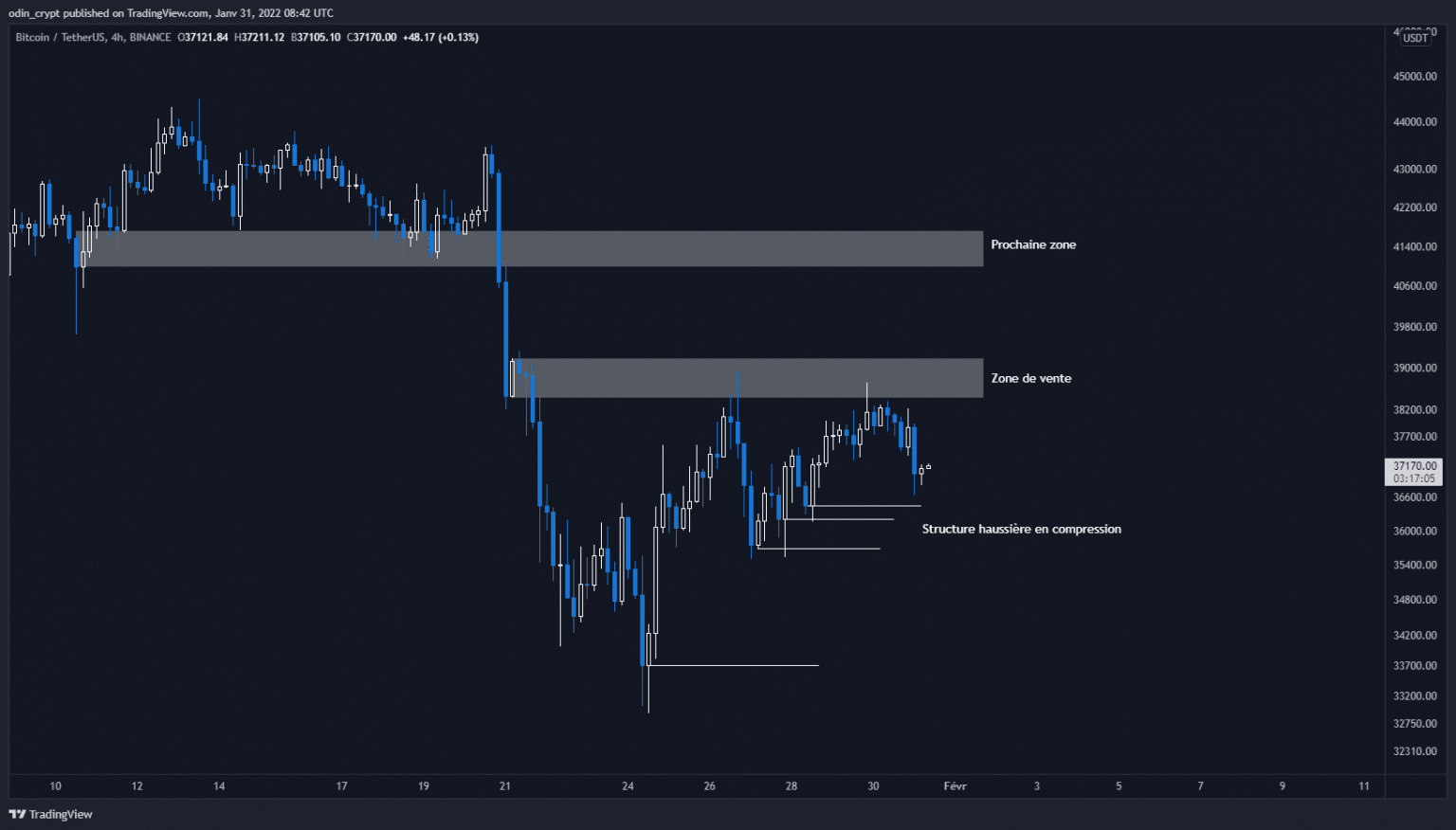

The 4h view confirms this trend, with the added bonus of a localized rise towards these outlets. There is very clearly a compression of this trend on the resistance, which tends to think that it is becoming increasingly fragile. This will probably give a boost towards $41,000.

Bitcoin (BTC) analysis in 4H

Ether (ETH) technical analysis

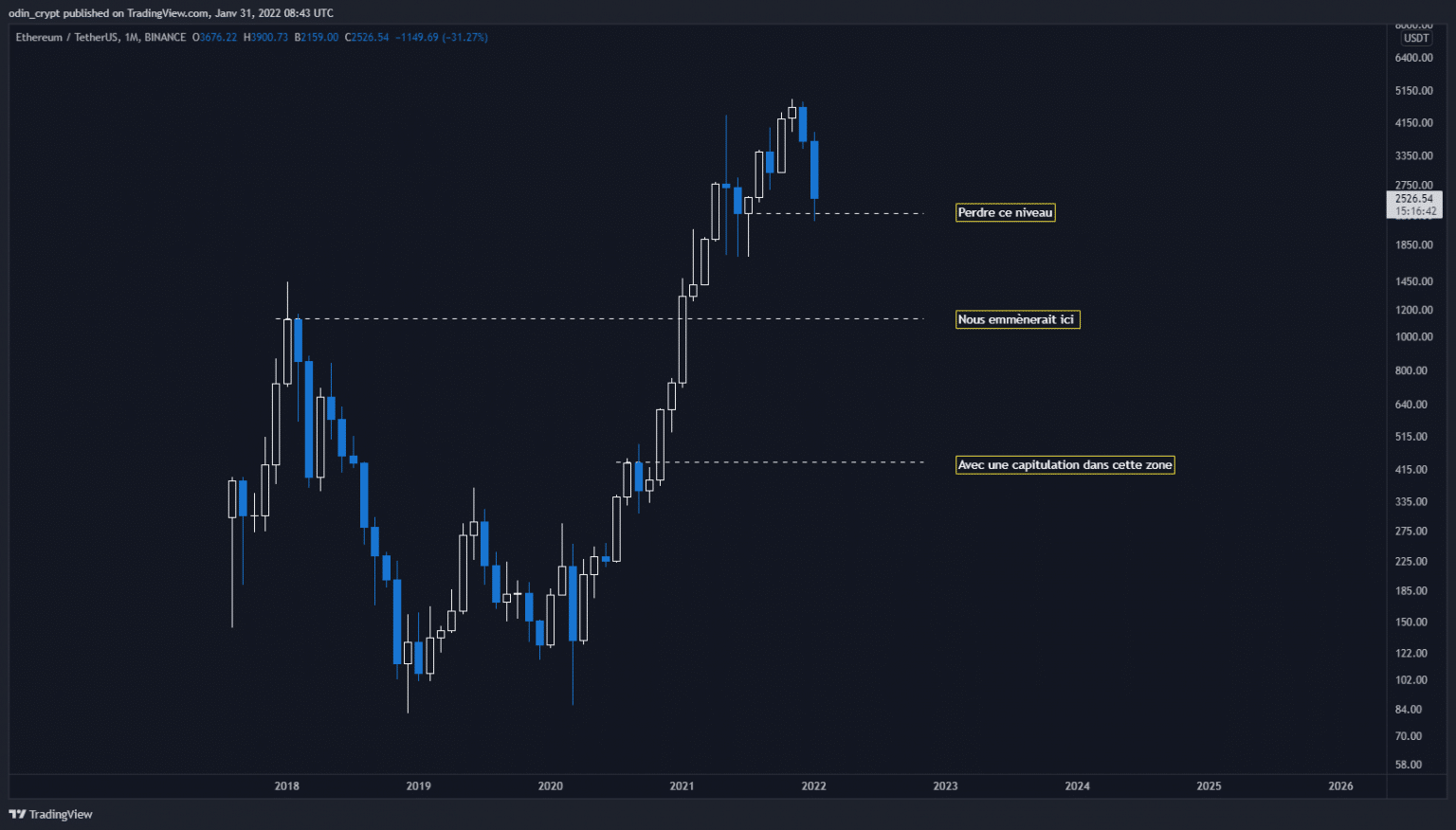

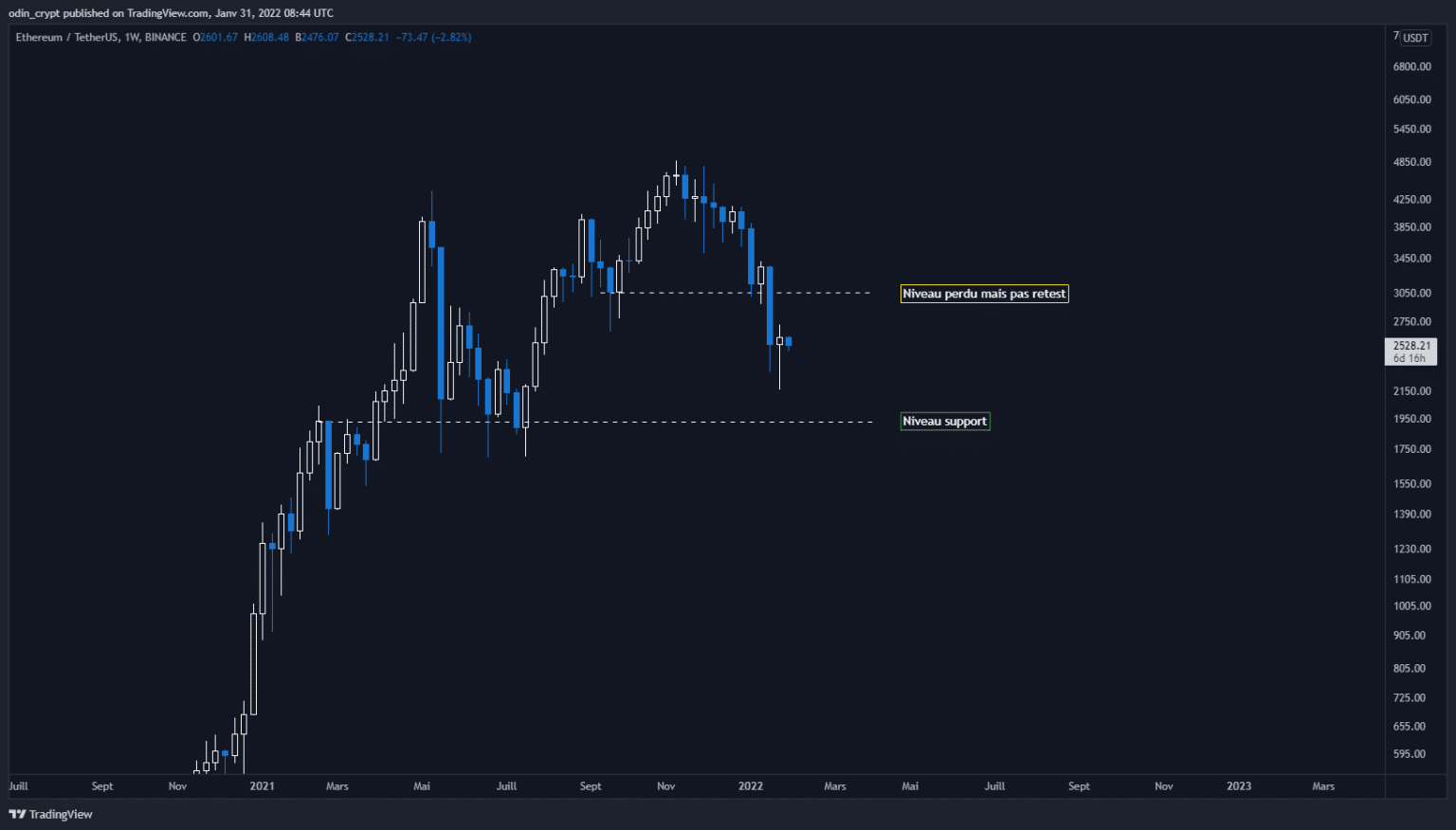

Ether (ETH) seems to be going the same way as Bitcoin, and tonight’s monthly close should give us more indication.

A close below $2,250 will be a bad sign for further bullishness. It would break this momentum, and open up tests of the last unvisited highs at $1,100.

It is therefore important to hold this pivot point, which will accentuate or not the market correction.

Ether (ETH) analysis in 1M

The weekly time frame gives us a very similar scenario to Bitcoin, with a bullish retracement on the last lost level. This level is currently at the $3,000 level, and will act as a sell/profit zone for market participants.

The next big support level is currently at $1,900, but there is no guarantee that this will be revisited.

For now, we will have to be patient to see more clearly. The big closes will set the tone for what happens next

Ether (ETH) analysis in 1W

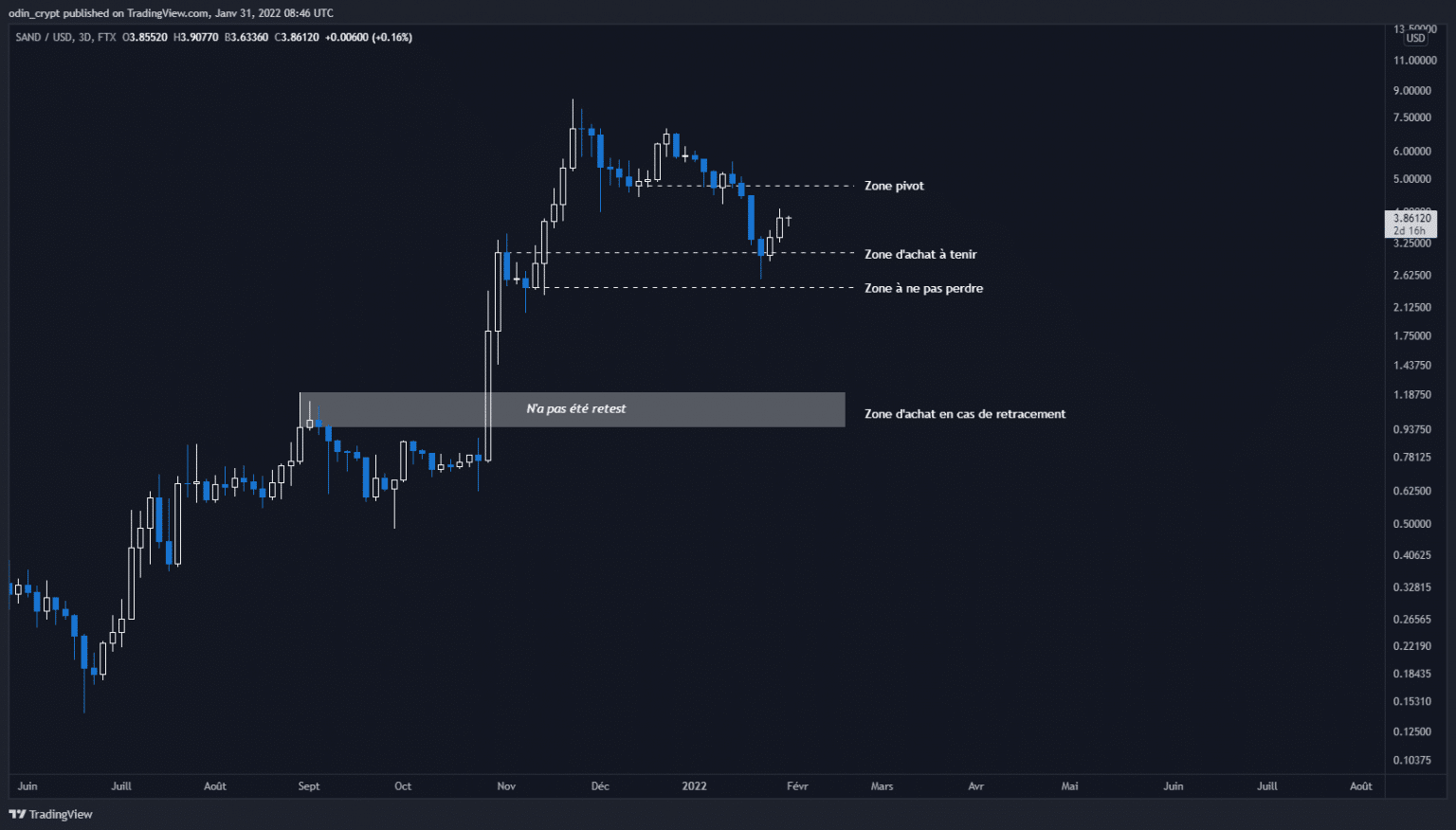

Sandbox technical analysis (SAND)

In my very first analysis at Cryptoast, I did a Sandbox (SAND) view. I was talking about a retracement on the $3 area. This test went well, and the price held this area.

Now, the SAND will retrace its last downward movement to visit the $4.7 area. This area corresponds to the pivot zone that led to the retracement to $3.

In terms of strategy, it is interesting to take some profits at $4.7 and watch the price reaction in this area. A recovery in the latter would indicate a return to the ATH at $8.5 and probably a price discovery phase. In any case, you can secure a nice 56% on the December 13, 2021 analysis.

3D Sandbox (SAND) analysis

Conclusion

Tonight’s monthly close will play a key role in Bitcoin (BTC) and Ether (ETH). This will give a clearer indication of a macro trend reversal, or a possible bullish continuation on the majors. The $35,000 area for Bitcoin and the $2,200 area for Ether should be watched closely.

Sandbox (SAND) is showing more encouraging signs. The macro bullish structure is still in place, and the $3 area has been revisited as we had planned. From now on, the price needs to recover the $4.7 area to see a real bullish continuation towards the former ATH. The ideal scenario would be a break of the latter in a price discovery continuation.

In any case, patience will still be required. Indeed, the upcoming important closes combined with the low volatility of the last few days have a great influence on the market. Stay alert, and protect your capital in this kind of phase!