The giant Grayscale is releasing a new diversified fund aimed at institutional investors. This basket of assets will offer exposure to several networks other than Ethereum (ETH), but on which the deployment of smart-contracts is also possible. Which blockchains are involved

New Grayscale fund focuses on Ethereum competitors

Grayscale, the cryptocurrency asset manager, is launching a new fund: the Grayscale Smart Contract Platform Ex-Ethereum Fund, or simply GSCPxE. Behind these somewhat nebulous terms is actually a basket of gas tokens from different blockchains competing with Ethereum (ETH).

A deal’s a deal. Meet GSCPxE (Grayscale Smart Contract Platform Ex-Ethereum Fund), our newest investment product. https://t. co/sm7VJzOJcV GSCPxE $SOL $ADA $DOT $AVAX $ALGO $MATIC $XLM

– Grayscale (@Grayscale) March 22, 2022

This is a new diversified exposure solution for investors, meeting a specific need of the company’s clients. The Ethereum network is still dominant, but its competitors have made their mark in recent months by offering alternatives. Grayscale’s clients are therefore now expressing the need to bet on other smart-contract ecosystems, should they continue to grow.

This is a logic confirmed by Michael Sonnenshein, Grayscale’s CEO, on the subject of this new hedge fund:

Smart-contract technology is critical to the growth of the digital economy, but it’s still too early to tell which network will win […]. The beauty of GSCPxE is that investors don’t have to pick a single winner and can instead access the development of the ecosystem […] via a single investment vehicle. “

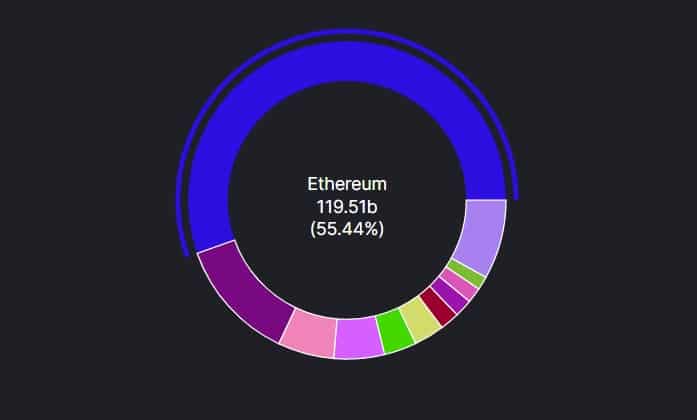

Ethereum remains the largest DeFi platform by total locked value, but its dominance has eroded over the past year. The (Source: DeFi Lama)

The composition of GSCPxE

The product is designed to replicate the performance of CoinDesk’s SCPXX index. Note that CoinDesk, like Grayscale, is part of the Digital Currency Group investment fund. The composition of this index is as follows, at the time of writing:

- Cardano (ADA): 24.82%;

- Solana (SOL): 23.41%;

- Avalanche (AVAX): 19.11%;

- Polkadot (DOT): 15.19%;

- Polygon (MATIC): 9.23%;

- Algorand (ALGO): 4.26%;

- Stellar (XLM): 3.98%.

However, this fund is not intended for retail investors, but rather for institutional investors, in the sense that you will need to be accredited by Grayscale in order to trade the securities. The base fee is 2.5% per annum and the minimum entry ticket is $50,000.

This remains interesting news for the crypto ecosystem in general. Like any new fund addition by Grayscale, it tends to suggest a trend from institutional investors, and thus a potential influx of capital. Now, it’s a broader diversification that is taking shape, accompanying, this idea of a multi-channel future.