FTX has just received court approval to liquidate $3.4 billion of cryptocurrencies, and it’s expected to do so in successive tranches to avoid disrupting the crypto market too much. How FTX plans to liquidate its entire portfolio

FTX gets court approval to sell its cryptocurrencies

The Delaware court has just authorized FTX to liquidate its cryptocurrencies, amounting to approximately 3.4 billion dollars as of August 31, when the exchange had published the list of all its assets.

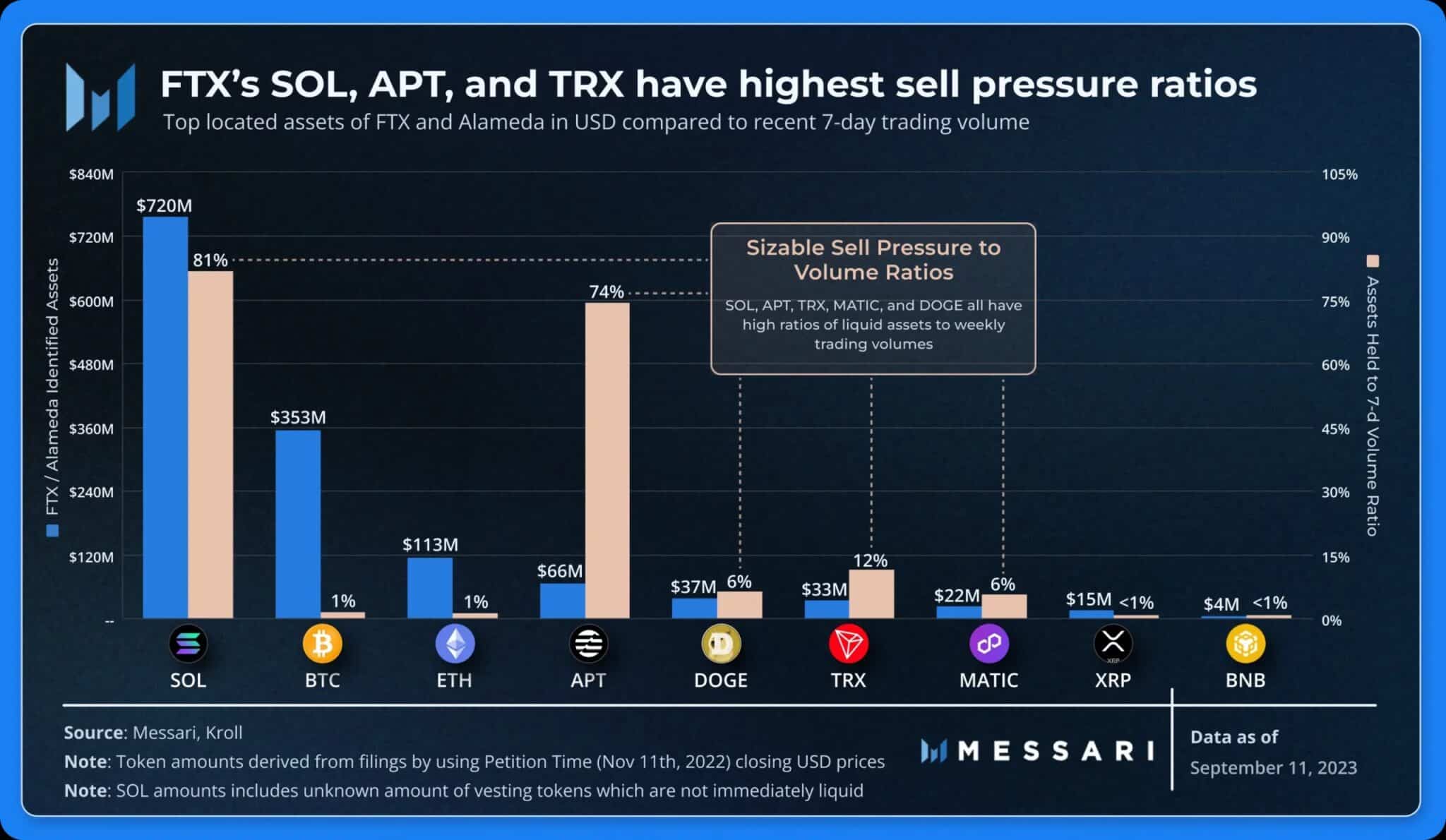

According to Messari’s latest calculations, however, these figures would have fallen given the unfavourable conditions in the crypto market. As of 11 August, FTX held $720 million in SOL, $353 million in BTC, $113 million in ETH and $66 million in APT.

Assets held by FTX (blue) and relative selling pressure compared to 7-day trading volume (beige)

Excluding the illiquid tokens held by FTX (FTT, MAPS, SRM, FIDA, MEDIA, etc.) and its stablecoins, the exchange would a priori hold around $1.3 billion in cryptocurrencies. Of course, this amount is subject to change depending on the day-to-day market.

Last month, FTX management requested that the sale and/or management of its cryptocurrencies be handled by Galaxy Digital. According to FTX’s request, it probably shouldn’t sell all of its cryptos, or at least not right away, as it mentioned the possibility of staking or swapping certain tokens as long as this helps to reimburse injured customers.

A smooth liquidation

In any case, if FTX were to sell its cryptocurrencies, the judge in charge of the case decided that it could only do so in increments of $100 million per week in order not to disrupt the market. However, this limit could be increased to $200 million over the same period, in which case only one cryptocurrency could be sold at a time.

SOL, Solana’s native token, will also be sold in such a way as not to disrupt its price too much. According to the latest estimates, FTX holds 16% of the total supply of SOL tokens, a revelation that has caused panic in the crypto community. However, the vesting period for SOL tokens owed to FTX will not end until 2027, so a large proportion of them are still completely impossible to sell.

Furthermore, in order to sell Bitcoin, Ether or certain tokens, FTX will be required to give 10 days’ notice to the court.

During the hearing, a lawyer for FTX explained that it was impossible to link each cryptocurrency to each customer, and that the amounts owed to each injured customer would therefore be calculated in dollars, before being distributed “in the form of cash”.

A lawyer on FTX’s ad hoc committee also said that “the sooner the better” to start selling the affected cryptocurrencies, with most parties ostensibly seeking to speed up the process. It was not specified whether the sale of cryptos would be conducted over-the-counter (OTC) or via the traditional market.