The bitcoin price is doing its utmost to try and hold above the lows of last June, the $24,800 / $25,000 mark, the starting point at the time of a bullish impulse linked to the first applications for authorisation of bitcoin spot ETFs. Is this bitcoin’s swan song? The final answer will come from the Federal Reserve on Wednesday 20 September

U.S. Federal Reserve, let’s not put the cart before the horse

An expression that has been in vogue in France since the 18th century among scholars is the swan song. The swan, when it sees death coming, would then begin to sing in the most beautiful way before breathing its last.

So is the attempt to preserve the $25,000 support one last time the swan song for the price of Bitcoin?

One thing is certain: since last November, Bitcoin has demonstrated its ability to stand up to the many coalitions that have repeatedly called for its downfall. We’re talking about its fall on the stock market, but also its fall as a project, as a philosophy.

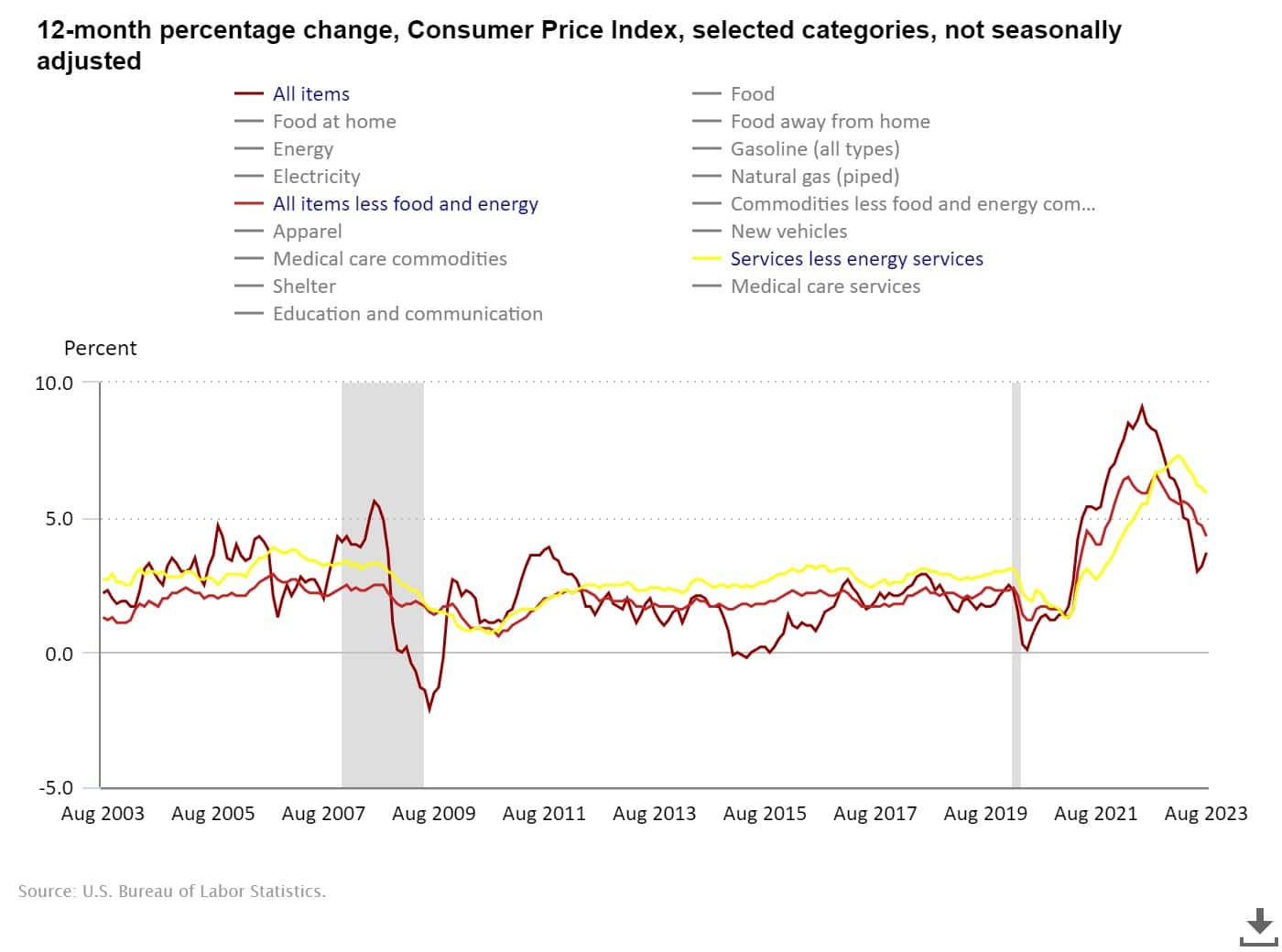

Once again this week, it was the US inflation figures that posed a direct threat to the BTC. The data published on Wednesday confirmed the rebound in US nominal inflation, while the fall in core inflation (which excludes the most volatile elements, such as the rebound in the price of oil) reassured the financial markets.

The good news is that market interest rates have not risen above their annual highs, which would mean a stall for the price of BTC on the stock market. On the other hand, let’s be clear: this is only one fundamental battle that has been won; total fundamental victory is a long, long way off.

What happens next? It is the US Federal Reserve (FED) that should allow bitcoin to make its final choice on support, breaking it with a bang or bouncing back for good and setting off again to attack the annual highs with all guns blazing.

The Fed could indeed pause next Wednesday in its rate hike cycle, but the market will be paying close attention to its updated macroeconomic projections for inflation and employment.

So, “tempus narrabo”, as the Romans used to say. In other words, “qui vivra verra!”, for the less bilingual among you.

Graph from the US Department of Labor showing nominal inflation, core inflation and services inflation for the US and the CPI price index at annual rates

On the technical front, bitcoin clings with both hands to the rock face

Now back to the technical analysis of the bitcoin price. Bitcoin sometimes reminds me of a high-level sportsman, a mountaineer hanging off a rock face with both hands still firmly clinging to the top.

This metaphor will serve as a technical analysis of the bitcoin price this week, as we need to break through resistance to get to safety. I think that breaching resistance at $27,000 on a daily closing basis would already be a good safe-haven chart signal, but in the meantime, caution is still the order of the day.

Chart created with the TradingView website, which displays the weekly and daily Japanese candlesticks for the BTC future contract on the Chicago Stock Exchange (CME)