The trial of Sam Bankman-Fried, the former CEO of FTX, begins today. FTX, once a thriving cryptocurrency exchange platform, suffered a spectacular collapse in 2022 following terrible revelations about its inner workings. Sam Bankman-Fried faces numerous charges, and his fate will be decided at the trial which runs until November 9, 2023, potentially risking a sentence of over 110 years in prison.

Today sees the start of the trial of Sam Bankman-Fried (SBF), the former CEO of crypto platform FTX. On this occasion, here’s a brief look back at the FTX affair and what led SBF’s empire to its collapse as FTX had established itself as one of the world’s leading crypto exchange platforms.

As one of the biggest financial scandals of our time, here’s what you need to know as Sam Bankman-Fried’s trial gets underway.

FTX, what was it?

In 2017, Sam Bankman-Fried, after spending a few years in the professional financial world at Jane Street, took the initiative to launch Alameda Research, a company dedicated entirely to cryptocurrency trading. With a staff of around 20, SBF took advantage of the crypto craze to generate $20 million in profits just 3 weeks after the launch of Alameda.

Sam Bankman-Fried’s strategy was well-honed: in order to achieve such profits, Alameda Research took advantage of arbitrage opportunities by buying Bitcoin on Asian markets before selling it at a higher price.

Faced with this success, Sam Bankman-Fried decided to launch FTX (Future Exchange) in May 2019 to expand his business. At the time, FTX presented itself as a platform for experienced and sophisticated investors.

Photograph of the FTX Arena, renamed as such following the partnership established between FTX and the Miami Heat (NBA)

FTX quickly became a resounding success: by 2021, the company was valued at over $30 billion. Some of the world’s biggest stars have been quick to associate their image with the exchange, and FTX has enjoyed a string of sponsorship deals, notably with Riot Games (League of Legends), the Mercedes AMG-Petronas F1 team, the Golden State Warriors (NBA) and Major League Baseball (MLB), to name but a few.

How FTX got into trouble

Like many companies in the cryptocurrency world, 2022 was a particularly complicated year. Indeed, the latter suffered the successive collapses of Terra (LUNA), Celsius and then hedge fund Three Arrows Capital (3AC), events which took the Bitcoin price below the symbolic threshold of $20,000, whereas it had started the year at almost $50,000.

On November 2, the crypto specialist CoinDesk revealed that Alameda Research’s structure was actually held together by FTT, the FTX platform’s native token. In other words, overnight we learn that billions of dollars are actually backed by an extremely volatile token, and not by real money.

Panic quickly set in. As a reminder, at the time of the incident, FTX was the world’s 2nd largest cryptocurrency platform in terms of volume traded, the only one capable of rivalling the titan Binance. And it was Binance CEO Changpeng Zhao who would drag FTX into the abyss: 2 days later, he announced that he would sell all the FTTs obtained by Binance during a strategic investment in the platform.

Bitcoin price evolution over the year 2022

The market quickly caught fire. The price of FTT continued to fall, and CoinDesk’s revelations proved true: Sam Bankman-Fried’s empire was in fact only sustained by his own token, FTT.

Just over a week later, the final blow fell: FTX declared bankruptcy, and its hundred or so subsidiaries around the world followed suit in the process.

How does Sam Bankman-Fried position himself?

Since FTX collapsed, one revelation after another has come to light: embezzlement, the purchase of luxury goods at the expense of the platform’s customers, obscure financing of political campaigns, internal malfeasance, money laundering, corruption and total amateurism.

But Sam Bankman-Fried is not denying it: he continues to proclaim his innocence against all odds, despite the overwhelming evidence. In all, the former crypto prodigy faces half a dozen different charges.

Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), didn’t mince his words about FTX’s situation:

“[Sam] Bankman-Fried built a house of cards on a foundation of deception while telling investors it was one of the most secure buildings in the crypto business. “

The ex-CEO of FTX thus denied embezzling his customers’ funds or committing any wilful misconduct. He even tried to shift the blame onto Caroline Ellison, his former partner and ex-CEO of Alameda Research, by leaking personal information about her to the New York Times.

But it backfired: the court ruled that this was an attempt on his part to intimidate Caroline Ellison, who had already agreed to testify against him, in addition to admitting the charges against him.

Caroline Ellison is not the only high-ranking person to have agreed to testify against SBF. Other of his former lieutenants, including Nishad Singh, Gary Wang and Ryan Salame, have also pleaded guilty and agreed to help the American justice system in the FTX case.

Moreover, it appears that Sam Bankman-Fried is also trying to shift the blame onto his lawyers. The former FTX CEO has claimed that most of the positions he was accused of taking following the crypto exchange’s collapse were the result of advice from his legal team.

What can we expect from Sam Bankman-Fried’s trial?

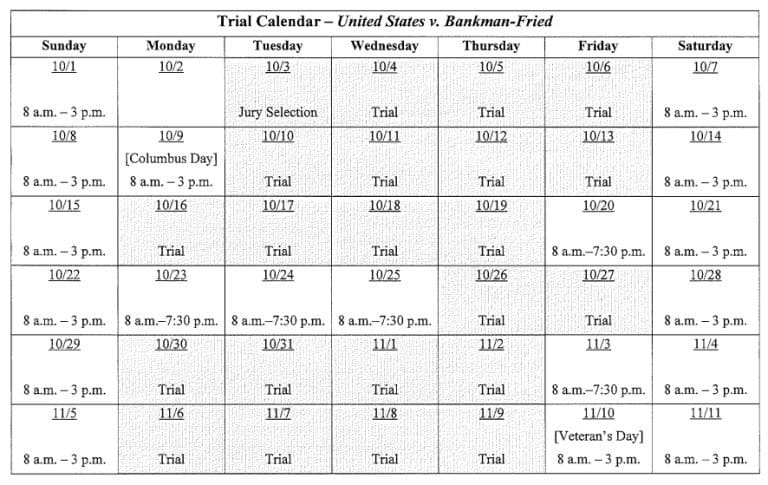

The trial of Sam Bankman-Fried begins today, Tuesday October 3, and is expected to run until Thursday November 9. Throughout the trial, the government will have to prove that Sam Bankman-Fried is objectively and undoubtedly guilty of the charges against him. If not, the former FTX CEO could be found not guilty.

At the end of the trial, Judge Lewis Kaplan will instruct the jury to consider each count of the indictment properly. The jury will be asked to determine whether or not Sam Bankman-Fried had the voluntary intent to commit the various acts of which he is accused.

Sam Bankman-Fried trial timeline

A Harvard Law School graduate, Judge Kaplan had previously addressed Sam Bankman-Fried directly at a hearing, telling him to “take the proceedings seriously”. At that same hearing, during which the judge had revoked Bankman-Fried’s bail, he had added that “the prison was not on anyone’s list of 5-star facilities”.

If convicted of all charges, Sam Bankman-Fried faces more than 100 years in prison. His former lieutenants, Gary Wang, Nishad Singh and Caroline Ellison, also face decades in prison. However, the fact that they have admitted their guilt and agreed to testify against SBF could lead to a possible reduction in their sentences.

In parallel with this trial, Sam Bankman-Fried will face 5 other charges in a second trial scheduled for March 2024.