The landscape of decentralised finance (DeFi) has changed dramatically in the space of a year. After a meteoric rise last spring, the Binance Smart Chain has recently been overtaken by the Terra ecosystem (LUNA) in terms of total value locked in.

Ecosystems shaking up the hierarchy

In January 2021, decentralised finance (DeFi) was mostly concentrated on a single blockchain: Ethereum (ETH). In fact, the ecosystem alone captured nearly 97% of the total on-chain locked-in value (TVL), or about $10.5 billion at the time.

In the space of a year, the DeFi landscape has completely evolved. New blockchains have become popular with users, at the expense of Ethereum. Faced with its exorbitant costs, users have naturally turned to cheaper options such as Binance Smart Chain (BSC), Avalanche (AVAX), Solana (SOL) or second layer solutions such as Polygon (MATIC).

In 2021, BSC was probably the most popular solution. Still very little used at the beginning of the year, the ecosystem quickly spread to reach 20% of the total value locked on-chain. This represented 31 billion dollars locked, compared to only 140 million on 1 January.

In fact, the PancakeSwap protocol even surpassed Uniswap, its competitor on Ethereum, at times in terms of daily trading volumes. As for Binance’s token, BNB, it has gone from $43 to over $680 in the space of a few weeks.

Terra ecosystem outperforms Binance Smart Chain

As expressed above, the DeFi landscape is changing at a rapid pace. On 20 December 2021, the Binance Smart Chain was overtaken by the Terra blockchain (LUNA) in terms of total value locked on-chain.

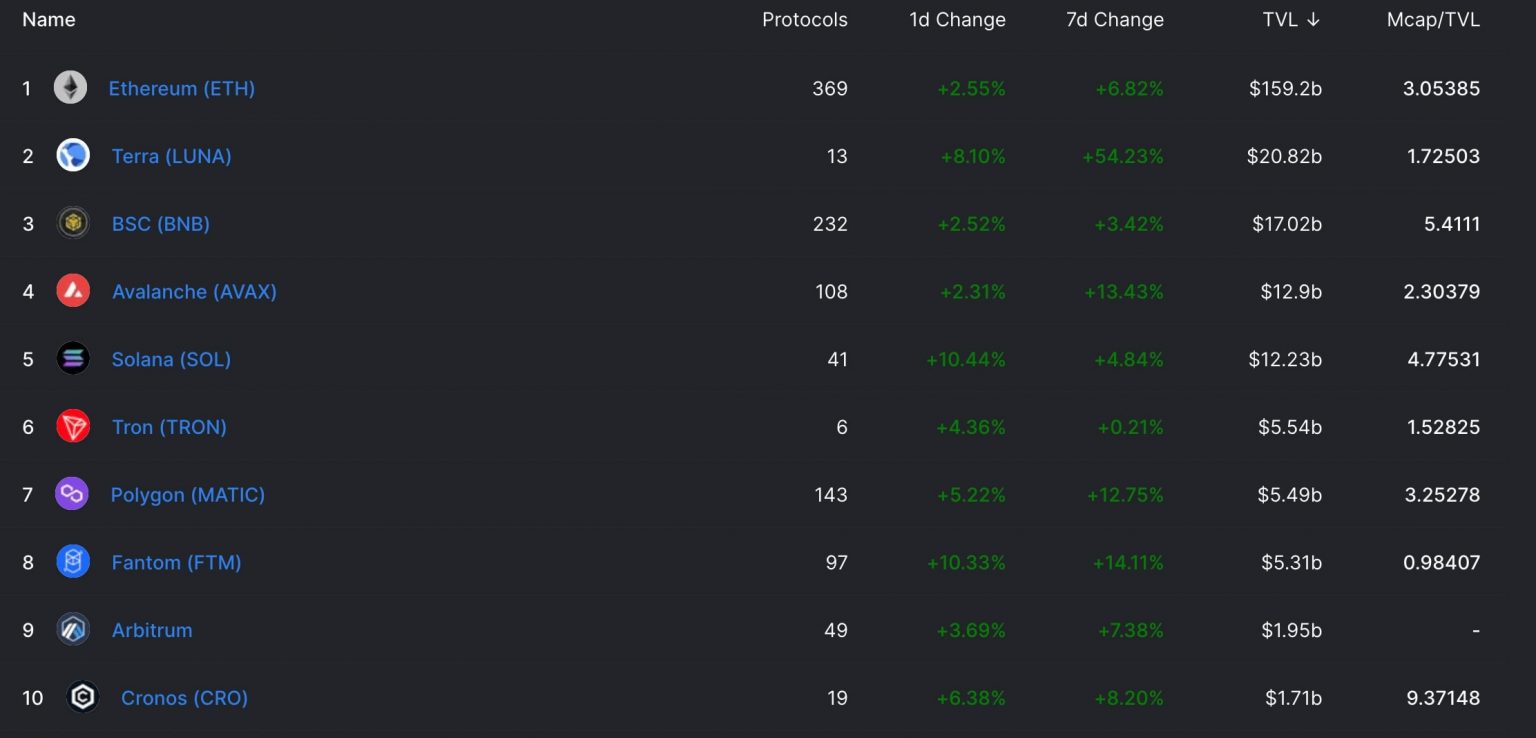

According to data from analytics tool DeFi Llama, LUNA in decentralised finance protocols on Terra recently passed the $21 billion mark, compared to $17 billion for BSC. This makes it the largest DeFi ecosystem after Ethereum.

Ranking of DeFi ecosystems by total value locked (TVL) (Source: DeFi Llama)

The explosion of the ecosystem has brought with it the emergence of certain protocols. Nearly 43% (or over $9 billion) of the total value is locked up in Anchor, a stablecoin-based yield generating application. In addition, the TVL on TerraSwap, a decentralised exchange based on Terra, jumped 81% from last week to over $2 billion.

That said, the Terra ecosystem is still young. Unlike the BSC and its 213 decentralised applications, Terra only supports 13 protocols at the time of writing. That’s over $1.6 billion per protocol on average, compared to $73 million on the BSC.

LUNA prints new ATH at $101

As a Christmas gift to its users, the Terra Network’s native token LUNA surpassed $100 on Friday, December 24. In a rally that began in late November, LUNA printed its first all-time high around $78 before blowing out slightly.

After rebounding to $52, investors took advantage of the announcement of the listing of Terra’s UST stablecoin on Binance to push LUNA to this new $100 ATH. A psychological resistance that seems to have slowed the token’s progress, which is down a few dollars at the time of writing.

LUNA price trend (Source: TradingView)

This represents an increase of more than 163% in its price in the space of a month. This is not the only sign of the ecosystem’s good health, as Terra’s UST recently overtook DAI to become the 4th largest stablecoin capitalization at $9 billion. All of which explains the meteoric rise of USTs on Terra’s protocols.