The fall of the USDC to $0.9 has dragged other stablecoins in the market with it. We try to explain this contagion, while Tether’s USDT seems to be benefiting from investor confidence

The USDC is taking other stablecoins with it

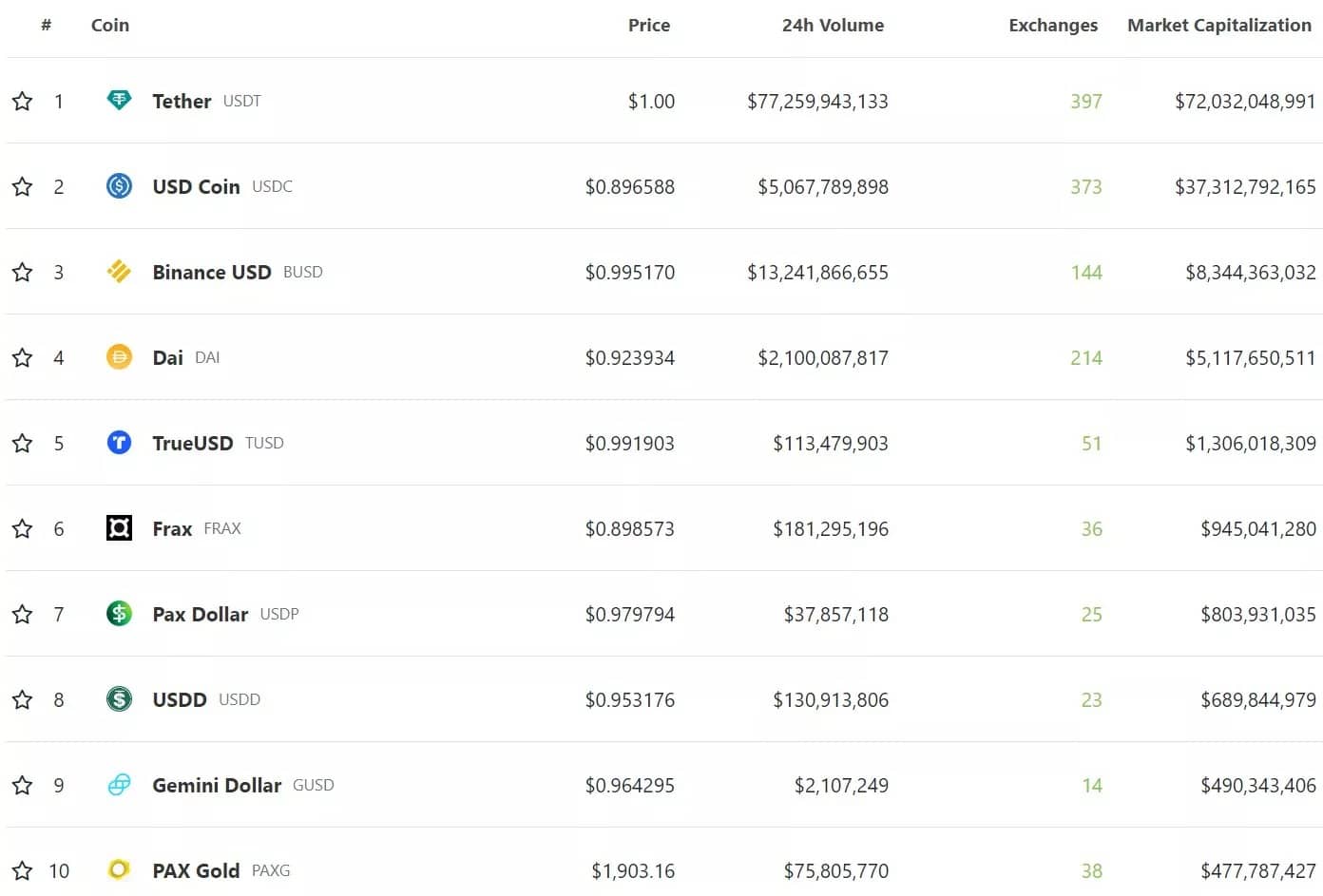

With the USDC’s current loss of a dollar peg, other stablecoins in the market are currently in the red. Indeed, if we refer to CoinGecko’s current top10, only the USDT, BUSD and TUSD can boast of being at parity, or at least close to it:

Figure 1 – Top10 stablecoins by capitalisation

Although we have already returned to the case of the DAI this morning by discussing the consequences of this depeg for decentralised finance (DeFi), other stablecoins are also suffering from this panic.

In order of capitalisation, we can focus on the case of FRAX among these notable falls. FRAX works in a hybrid way, combining algorithmic technology with collateralisation. A portion of these reserves being USDC, this was enough to trigger risk aversion among investors, and upset the stablecoin price, so that FRAX is also trading at around $0.9.

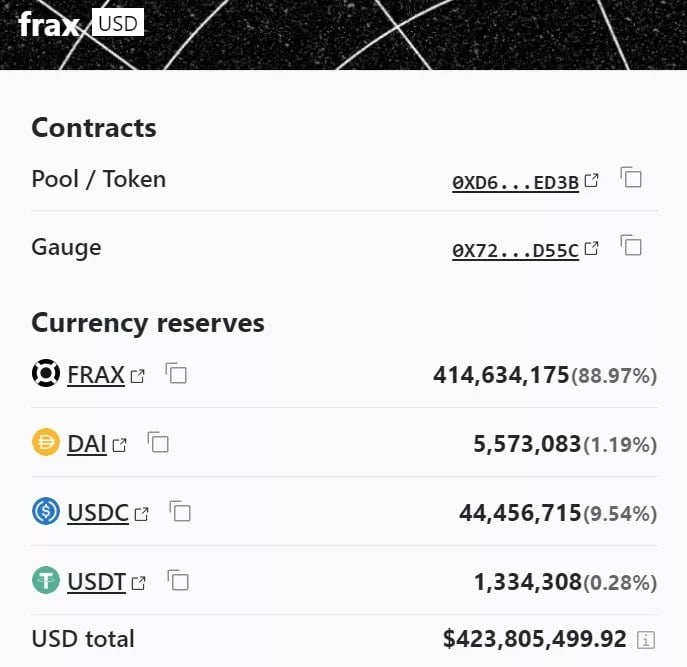

On the Decentralised Exchange (DEX) Curve (CRV), while the FRAX/USDC liquidity pool is in relative balance, the FRAX/DAI/USDC/USDT pool is not. And for good reason, out of a total locked-in value (TVL) of nearly $424 million, it is nearly 89% represented by this stablecoin, which strongly impacts its liquidity:

Figure 2 – FRAX pool status on Curve

The curious case of the USDD and the resilience of the USDT

Of all the troubled stablecoins, the Tron Ecosystem USDD (TRX) is also experiencing a notable loss of peg: $0.953.

Yet, according to the official reserves, the collateralisation of this stablecoin has only 0.16% of USDD. This is indicative of the psychological state of the market in the face of this crisis:

Figure 3 – USDD Collateralisation

Tether’s USDT is benefiting from the crisis, as liquidity flows into stablecoin. Also note that like Paxos, Tether has indicated it has no exposure to Silicon Valley Bank (SVB):

tether doesn’t have any exposure to SVB

– Paolo Ardoino (@paoloardoino) March 10, 2023

However, it should be noted that while Circle specifies the names of the banks where its reserves are held in these audit reports, this is not a priori the case for Tether.

In any case, the market is currently in a state of panic, with reactions that are out of proportion to the information publicly available: almost 9% of Circle’s reserves are blocked at SVB. This justifies the current price of the USDC, but does not fully explain the contagion to all other stablecoins on a fundamental level.

However, one should remain cautious and not take unnecessary risks. Indeed, the market has already shown us several times in the space of a year that “impossible events” can happen. Nevertheless, there is every chance that this crisis will be a learning experience and that the ecosystem will emerge stronger once the storm has passed.