Cryptocurrency trading in Ukraine has risen sharply since the Russian military invaded. After the first strikes, a Ukrainian exchange recorded unusual trading volume. Investors reacted massively to the limitations on bank withdrawals and the fall in value of the national currency, the hryvnia (UAH).

Ukrainian exchange sees surge in trading

The volume of transactions recorded on Kuna, a Ukrainian cryptocurrency exchange, surged after the first Russian strikes in Ukraine, according to data from CoinGecko. On this Thursday, 24 February 2022, the platform’s trading volume briefly rose above $4.8 million.

Evolution of trading volume on Kuna during the week of the Russian invasion

In the days leading up to the Russian invasion, between February 20 and 23, trading volume ranged from $775,000 to $2.4 million. Kuna had not seen such trading volume since May 2021, when the price of Bitcoin (BTC), and most altcoins, suffered a severe correction. On the morning of Friday 25 February, the volume contracted to around $2 million.

The Ukrainian population has always been very attracted to cryptocurrencies. According to a study by Chainalysis, Ukraine is the 5th most used country for crypto-assets. One of the reasons for this is the low level of banking among Ukrainians, especially in the most rural areas.

Aware of Ukrainians’ interest in the sector, the government recently adopted a law aimed at offering legal status to crypto-currencies. This legislation, which is very different from El Salvador’s Bitcoin law, puts in place a clear regulatory framework around crypto-assets in order to promote the emergence of specialised businesses in the country.

A reaction to banking restrictions and the decline of the national currency

The sudden increase comes after the Central Bank of Ukraine imposed restrictions. In order to curb possible capital flight, the body has drastically restricted bank withdrawals and banned Forex withdrawals throughout the country. The National Bank of Ukraine said that these measures were “temporary, but necessary” to maintain financial stability. It also froze the official exchange rate of the national currency.

Following the Russian invasion, the hryvnia (UAH), the country’s national currency, had fallen sharply in value. The currency collapsed to $0.033 on Friday 25 February 2022. In response, Ukrainian investors have been converting fiat currency into cryptocurrency en masse. As CoinGecko shows, internet users visibly bought stablecoins to protect their assets.

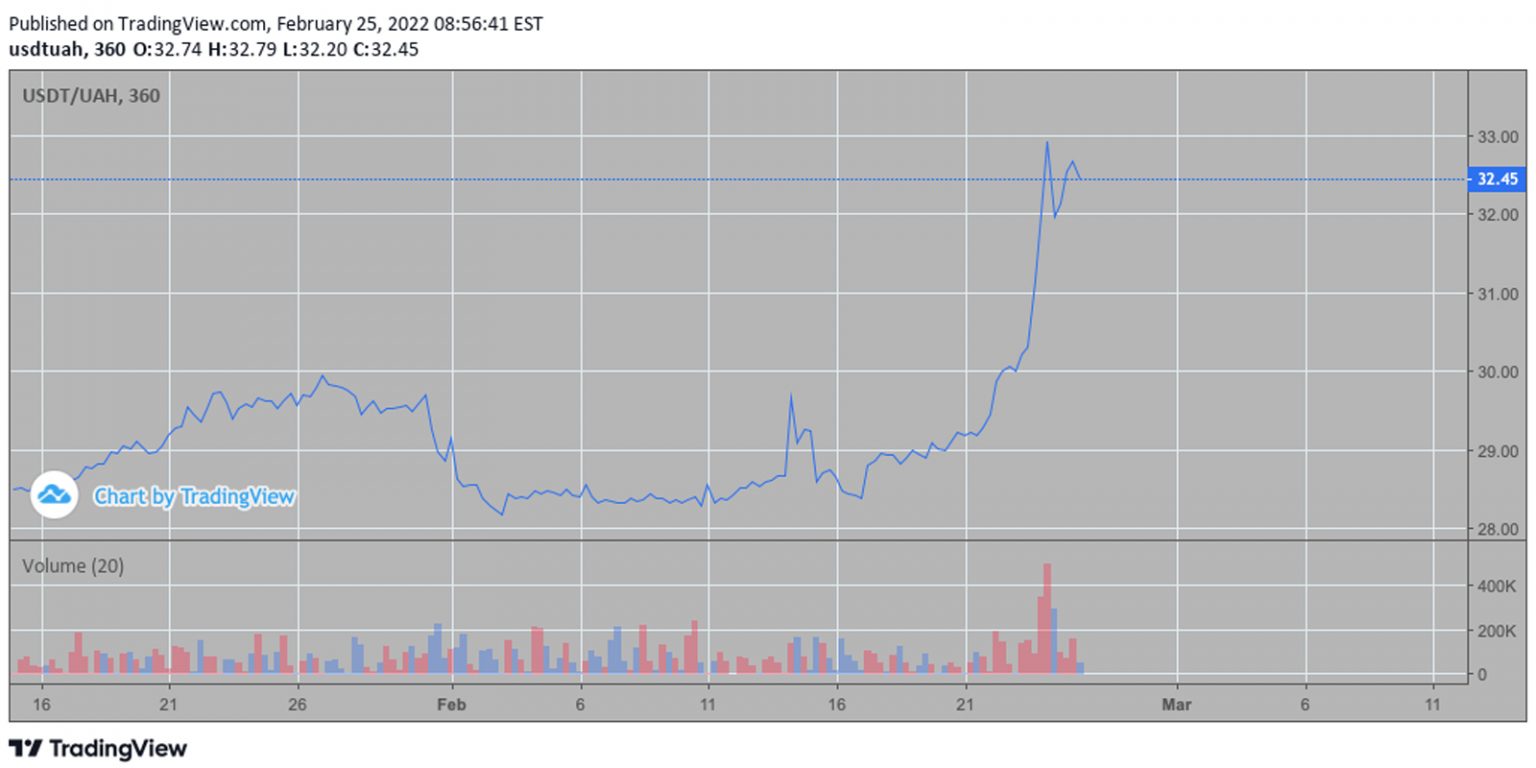

USDT/UAH price evolution during the Ukraine invasion

On Kuna, the USDT price of Tether actually briefly rose above 36 hryvnias before stabilizing around 33 hryvnias. The price of the pair remains much higher than its usual level.

A few days before the conflict, the USDT was still trading around 28 hryvnias. The conversion rate of the USDT was even higher than that of the US dollar with the hryvnia, which did not exceed 30 units.

At the same time, the support organisations of the Ukrainian army have received many donations in cryptocurrencies since the attack. Through NGOs, the Ukrainian army received the equivalent of $400,000 in digital currencies in 24 hours, Elliptic recently reported. Organisations such as Come Back Alive have managed to raise large sums of money through crowdfunding campaigns.