Four years ago, Invictus Capital launched its famous Crypto20 (C20), the world’s first tokenized index fund based on crypto-currencies. On the occasion of this anniversary, let’s take a look back at this product that allows you to gain exposure to twenty of the most capitalised crypto-currencies on the market, how it works and how it performs.

Invictus Capital, from 2017 to today

In 2017, investing in the cryptocurrency market was not as easy as it can be today. New projects were born every day and raised several million dollars; it was the Initial Coin Offering (ICO) craze.

It was difficult to differentiate between fraudulent projects and real nuggets. In fact, most of the cryptocurrencies that raised the most money in 2017 are no longer part of the current industry landscape.

Faced with this observation, Invictus Capital had the ambition to “make investing in the financial markets more affordable”, especially in digital assets. Thus Crypto20 (C20) was born, the first index fund in history based on cryptocurrencies. By offering exposure to twenty of the most capitalised assets in the market, and with an adjustable allocation, investors no longer have to worry about managing their assets on a daily basis.

Since 2017, Invictus has launched many other funds, including Margin Lending on the dollar (IML), Bitcoin Alpha (IBA), Hyperion VC for blockchain startups (IHF), or Crypto10 (C10), an evolved version of its older brother. Of course, the Crypto20 is still available and has not lost its interest. On the occasion of its four-year anniversary, we take a look at this index fund and how it works

Crypto20 (C20), a token to invest globally in crypto-currencies

The cryptocurrency market is evolving at a rapid pace. From Dash (DASH) and Monero (XMR) to Solana (SOL) and Terra (LUNA) today, the ranking of the most capitalised crypto-currencies in the market is not the same as it was 4 years ago. And so are the components of the C20. Thanks to it, investors benefit from a scalable exposure to this flourishing asset class.

The C20 fund follows a passive strategy, more suited to “medium to long-term investors”. Each week, the twenty assets in the portfolio are reallocated according to the evolution of their capitalisations. If a new asset enters the top 20 most capitalised crypto-currencies (excluding stablecoin), it replaces the one that exited in the C20 portfolio.

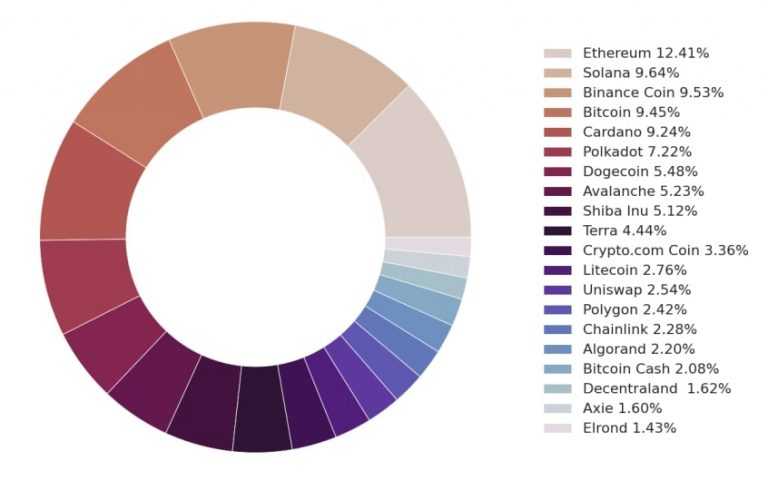

C20 portfolio breakdown as of November 30, 2021 (Source: Crypto20 Fact Sheet)

Each crypto-currency and its market capitalization evolves at its own pace and can upset the initial allocation. If one of them exceeds a certain ceiling – a maximum of 10% of the total portfolio – the difference is redistributed equally among the other assets.

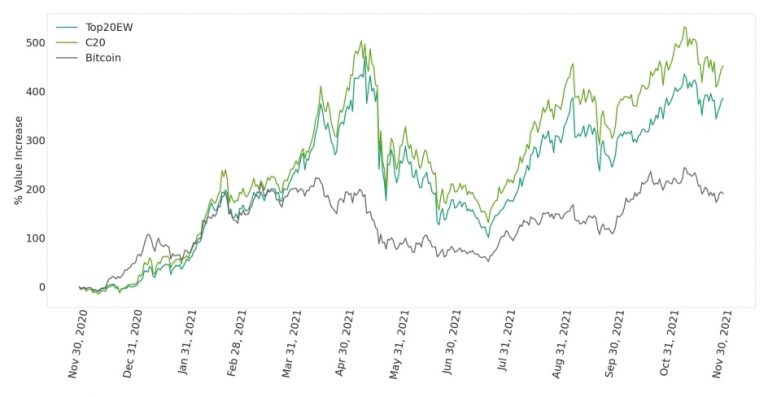

Over a rolling one-year period, from November 2020 to November 2021, the C20 product offered an annual return of 453%. A great performance, far outperforming the statistics of a portfolio made up of equal parts of the top 20 cryptocurrencies, showing a return of 412%.

However, C20 has proved far less resilient to market volatility than Bitcoin (BTC) itself, as the following graph shows:

Comparison of Bitcoin, C20 and top 20 average performance (Source: Crypto20 Fact Sheet)

Over the course of 2020, Invictus Capital has made significant improvements to the management of the C20 fund. Through the use of futures contracts, combined with the exploitation of blockchain technologies, Invictus Capital is able to offer investors the same underlying exposure at a lower overall cost, with reduced volatility and higher returns.

Indeed, the assets of the Crypto20 fund are now being used to employ lending, staking or similar methods to generate additional returns. In particular, this would cover a good part of the transaction costs, even in bearish or sideways periods.

In conclusion

There is no doubt that the cryptocurrency market has offered and continues to offer exceptional returns. That said, if you don’t want to be demoralised by the volatility, it’s best to take a long-term view. Who hasn’t bought an asset at a local peak, or sold at the beginning of an exponential rise? This is part of the risk of being an investor in cryptocurrencies.

In this context, C20 offers investors the peace of mind of a portfolio managed directly by a team of industry experts. It allows for “diversification, minimal costs, transparency and the benefit of generating additional returns on the underlying assets, all managed by the experienced fund management team.”

Like its advanced version, the Crypto10, the C20 is a really interesting option to gain exposure to the market without worrying personally about volatility. To learn more, feel free to read the whitepaper of the first index fund in the history of cryptocurrencies and connect to Invictus’ various social networks.