Coinbase has published its quarterly results showing a 22% increase in revenue since the previous quarter. However, this is 37% less than the first quarter of 2022. Let’s look at all this in detail to judge the health of the company.

Coinbase’s revenues back on an upward path

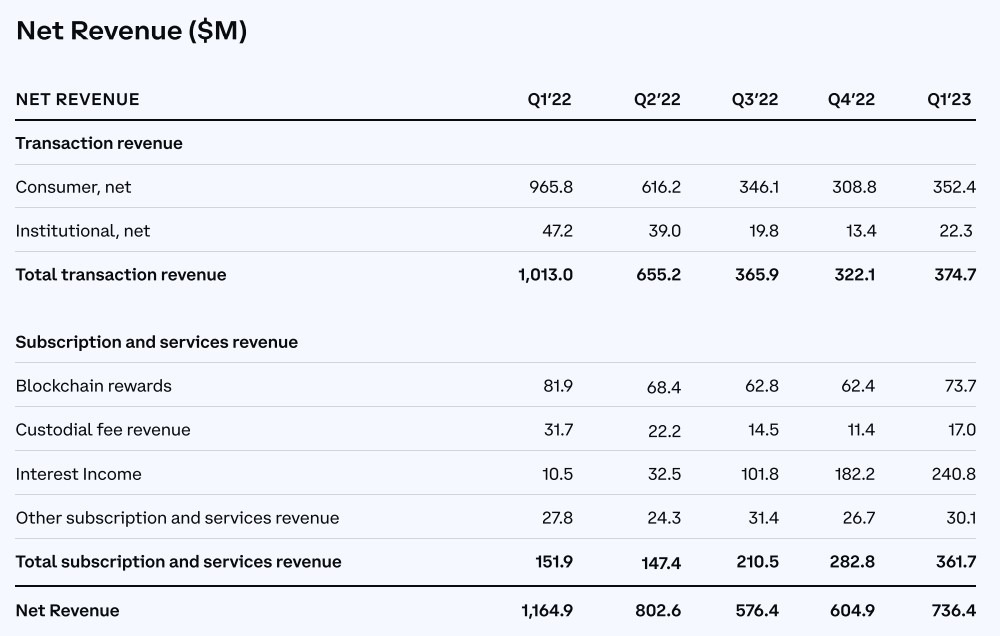

In its quarterly results published yesterday, Coinbase showed that its revenues were up 22% between the last quarter of 2022 and the first of this year, rising from $604.9 million to $736.4 million:

Figure 1 – Coinbase quarterly revenues

As we can see, however, these revenues are down year on year. At more than $1.16 billion in the first quarter of 2022, the company is down 37%. But these figures need to be put into context: at the end of March 2022, Bitcoin (BTC) was still trading at $46,000 and the market had no idea of the crises that lay ahead.

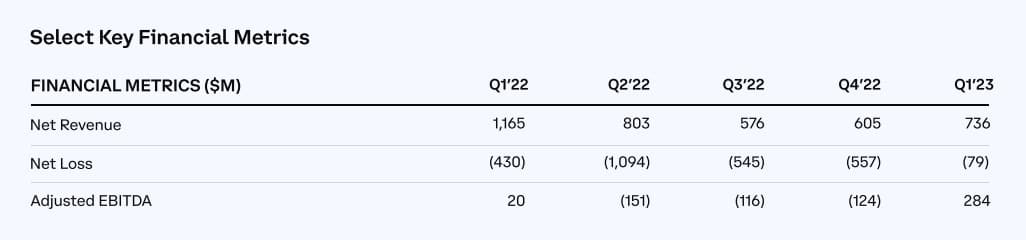

Compared with other quarters, there are other interesting statistics. Net losses fell sharply to $79 million, and earnings before interest, tax, depreciation and amortisation (EBITDA) also surpassed the previous four quarters:

Figure 2 – Extract from Coinbase’s quarterly balance sheet

The need to build solid foundations

After a difficult year in 2022 for Coinbase and a number of redundancies, the objective was to clean up the accounts in order to build a solid foundation for the future:

This quarter was a turning point in our drive to build a more efficient and financially disciplined business; one that can do more with less. We have reduced costs, doubled operational excellence and risk management, and continue to drive product innovation and regulatory clarity. “

These results were also positively received, with the share price up 9.20% in after-hours trading, from $49.22 to $53.75.

Among other noteworthy information from the results, we learn that over the past quarter, Bitcoin accounted for 32% of volumes and 36% of transaction revenues, while ETH’s statistics on these same metrics are 24% and 18%.

Retail investors generated $21 billion in volumes, and $124 billion for institutional investors.

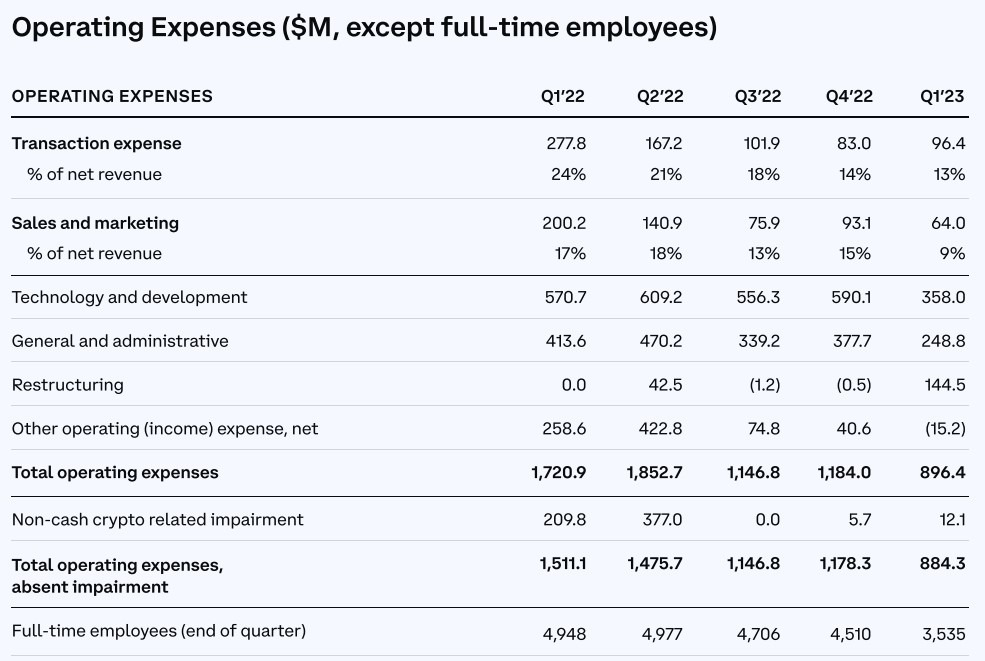

In terms of operating expenses, the balance sheet shows, for example, a sharp rise in restructuring costs to $144.5 million, and a fall in investment in technology and development to $358 million.

Ultimately, these operating expenses are down, and Coinbase ends the first quarter of 2023 with 3,535 full-time employees:

Figure 3 – Coinbase operating expenses

As we’ve seen this week, Binance remains far ahead in the centralised cryptocurrency platform market. Nevertheless, after Coinbase’s regulatory efforts over the past few months and its restructuring, it has probably not said its last word.