Is the tide turning in Coinbase’s favour? After coming under fire from the SEC, the US giant is suddenly enjoying a resurgence of interest thanks to its involvement in the Bitcoin Spot ETF that BlackRock and Nasdaq are looking to roll out. Its share price, meanwhile, is at its highest level since March 2023.

Coinbase at centre of Bitcoin spot ETFs

Last week, the Securities and Exchange Commission (SEC) lawsuits had rocked Coinbase, the largest US platform dedicated to cryptocurrency trading. However, Brian Armstrong’s company has not said its last word.

After having filed an initial application for registration of a Bitcoin spot ETF, the Nasdaq company has reiterated the operation in order to incorporate certain clarifications requested by the SEC. According to the new document, Coinbase has signed a supervisory agreement for BlackRock’s future Bitcoin ETF, called “Spot BTC SSA”.

“On June 8, 2023, Nasdaq signed an agreement with Coinbase, Inc (“Coinbase”) to enter into a surveillance sharing agreement (“Spot BTC SSA”), and the associated document became effective on June 16, 2023. “

With this revelation, BlackRock is showing its seriousness to the SEC by responding positively to its requests, while choosing one of the most serious players in the field on US territory.

At the same time, other Bitcoin ETF applications have been updated in response to the SEC’s requests. These show that Coinbase is a major player in the cryptocurrency sector, even among institutional investors.

The Chicago Options Exchange (CBOE) has indicated that Brian Armstrong’s company will work with it, on the same terms as the Nasdaq, if any of its ETF applications are approved by the regulator. The CBOE is working with US financial giant Fidelity to issue a Bitcoin spot ETF.

A breath of fresh air for the COIN share

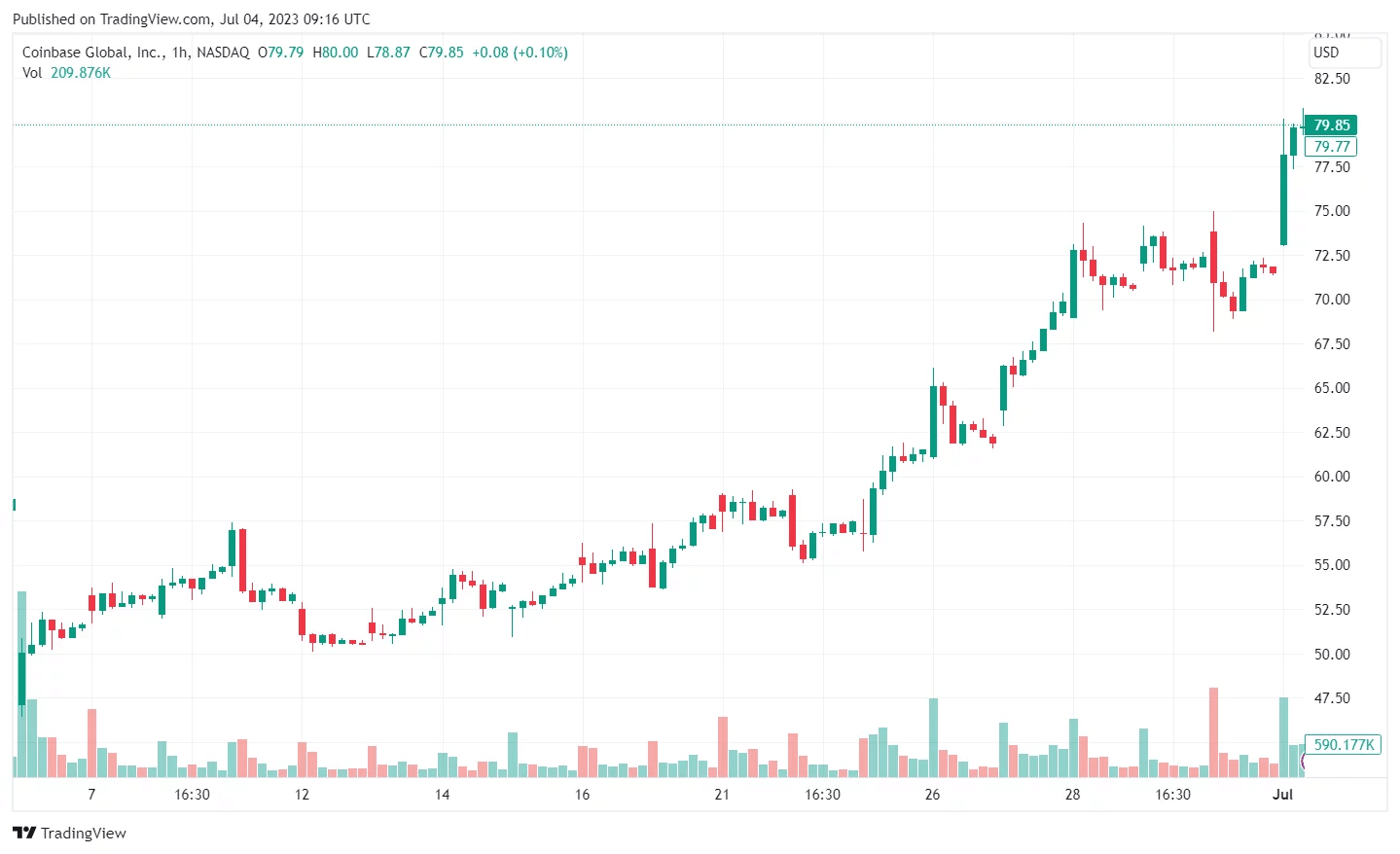

All of these announcements have boosted Coinbase’s image after the SEC case. Since the Nasdaq’s announcement in favour of BlackRock’s ETF, its share price has been sent up by a succession of green candles: COIN has risen by 12% over the past 24 hours.

Over the medium term, this rise has been amplified by the recent rise in the Bitcoin (BTC) price to the $30,000 mark. The share price has risen by a staggering 70% since 6 June 2023, the day its dispute with the US regulator broke out.

COIN share price between 6 June 2023 and today, rising from $47 to $80

Whether in traditional markets or cryptocurrencies, few assets can claim such growth over such a short period from a company with global influence in its sector.

Even so, Coinbase is still a long way from catching up with the highs reached during the previous bullrun. A few months after its listing on the stock exchange, COIN touched the $370 mark in November 2021, before falling precipitously in correlation with the cryptocurrency market. At the time of writing, its shares are valued at $79.85 each.

e this case, especially as it is the first time a community of NFT holders has sued its founder via a DAO.