We haven’t seen this in over a year and a half: the Bitcoin price has passed the $35,000 threshold. In other words, BTC is up almost 11% over the last 24 hours, and more broadly 107.6% since the start of the year. With most altcoins struggling to keep up, what has caused Bitcoin’s price to surge?

The price of Bitcoin exploded overnight

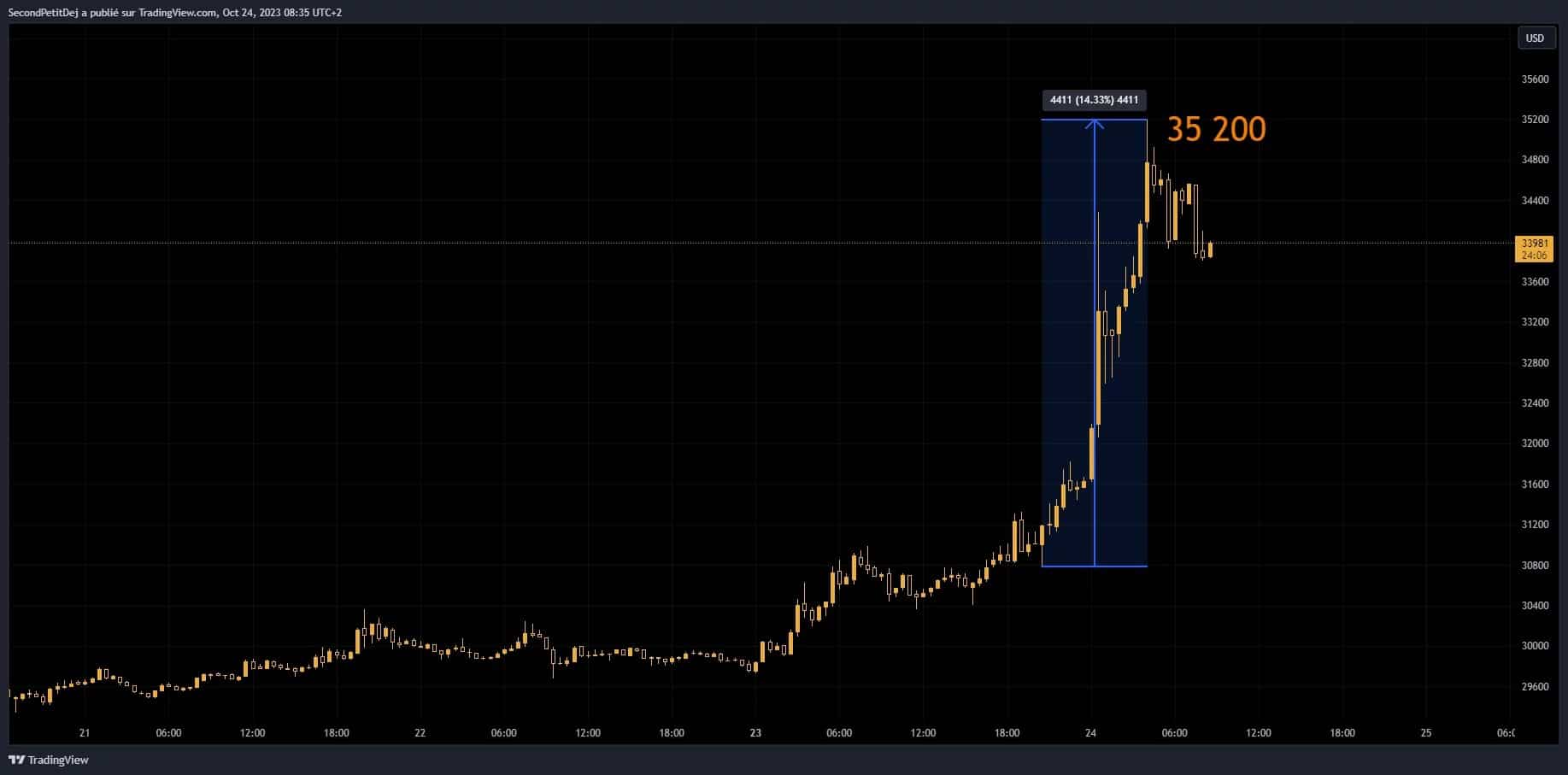

Here’s a rise whose flavor we’d forgotten. Bitcoin’s price exploded overnight, briefly surpassing the $35,000 threshold, a point the king of crypto-currencies hadn’t reached since May 2022, when Terra (LUNA) fell.

Bitcoin (BTCUSD) price evolution

In other words, the Bitcoin price has risen by 10.5% over 24 hours at the time of writing, and by more than 20% over 7 days. If we consider BTC’s progression since the beginning of this year, it has risen by around 105%.

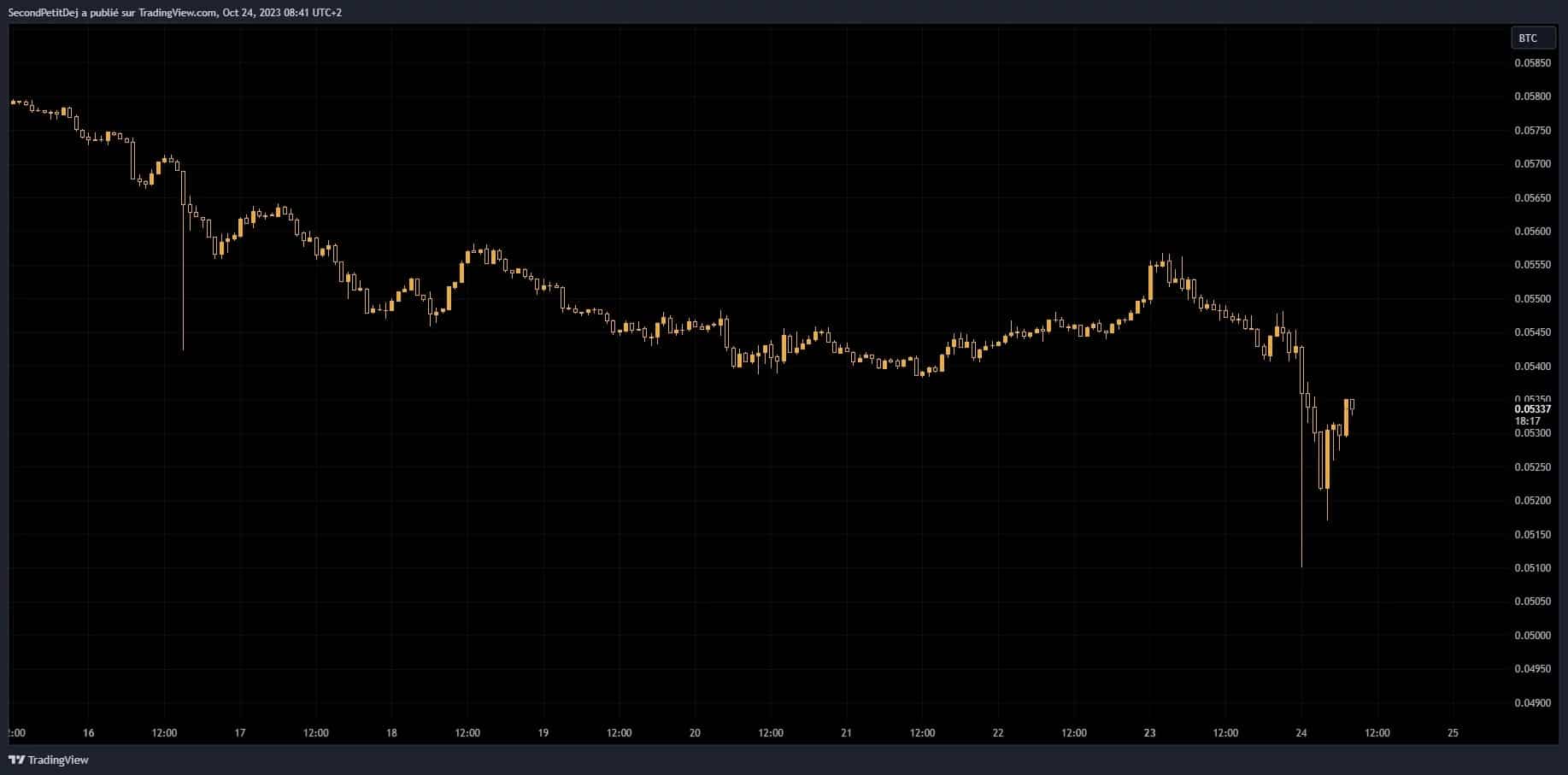

We can also observe that Ether, although also on the rise (7% over 24 hours), is struggling to match Bitcoin’s progression. This is particularly noticeable on the ETH/BTC pair, on which Ether had already been lagging for some time:

Evolution of the ETHBTC pair

This difference can also be observed on the altcoin market. The dominance of Bitcoin, which measures the weight of BTC capitalization in relation to the rest of the market, exceeded 54.4%, whereas it had already reached its highest point in 2.5 years 2 days ago (52.6%).

Lastly, on the liquidation front, $400 million has been liquidated in the last 24 hours, including $300 million in shorts, according to Coinglass data.

What are the reasons for this sudden rise?

This rise seems above all correlated to the narrative surrounding the imminent arrival of a Bitcoin cash ETF on US soil. Yesterday, 2 important pieces of news fueled investors’ already high expectations.

Firstly, the U.S. Court of Appeals ordered the Securities and Exchange Commission (SEC) to rule on the conversion of Grayscale’s Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF. In other words, if the SEC wants to deny Grayscale’s request once again (a decision deemed arbitrary and capricious by the Court), it will have to clearly explain its motivations.

Secondly, the iShares Bitcoin Trust, the future Bitcoin spot ETF from the giant BlackRock, has appeared on the website of the Depository Trust and Clearing Corporation (DTCC), a US organization that plays a key role in the financial sector, particularly in the areas of securities clearing, settlement and depository. In theory, the addition of a ticker on the DTCC means the imminent launch of trading in this or that asset.

In other words, BlackRock expects its Bitcoin spot ETF to be approved soon.

A view supported by Eric Balchunas, ETF analyst at Bloomberg:

“[This] tends to happen just before launch. It’s hard not to see it as a signal that approval is certain/imminent. “

Through a post on X, he also added that BlackRock “must have had the green light signal”.

So, the recent news testifies to 2 things: firstly, this rise in Bitcoin proves the extent to which investors are placing their expectations on the imminent arrival of a Bitcoin cash ETF in the US. Secondly, this is the closest we’ve ever come to the probable approval of a spot BTC ETF by the SEC.

A recipe that should work, but whose timing is difficult to predict. According to some observers, the first Bitcoin ETF to be approved by the SEC could be within the next few weeks, or even before the end of October for the most optimistic.

James Seyffart and Elliott Stein, 2 analysts at Bloomberg Intelligence, declared that “approval of a Bitcoin ETF seems inevitable”.