Bitcoin (BTC) is again more capitalised than Visa, after nearing $25,000. For now, the largest cryptocurrency’s rise is mimicking that of 2017. Will it last

Bitcoin more capitalized than Visa, Meta and LVMH

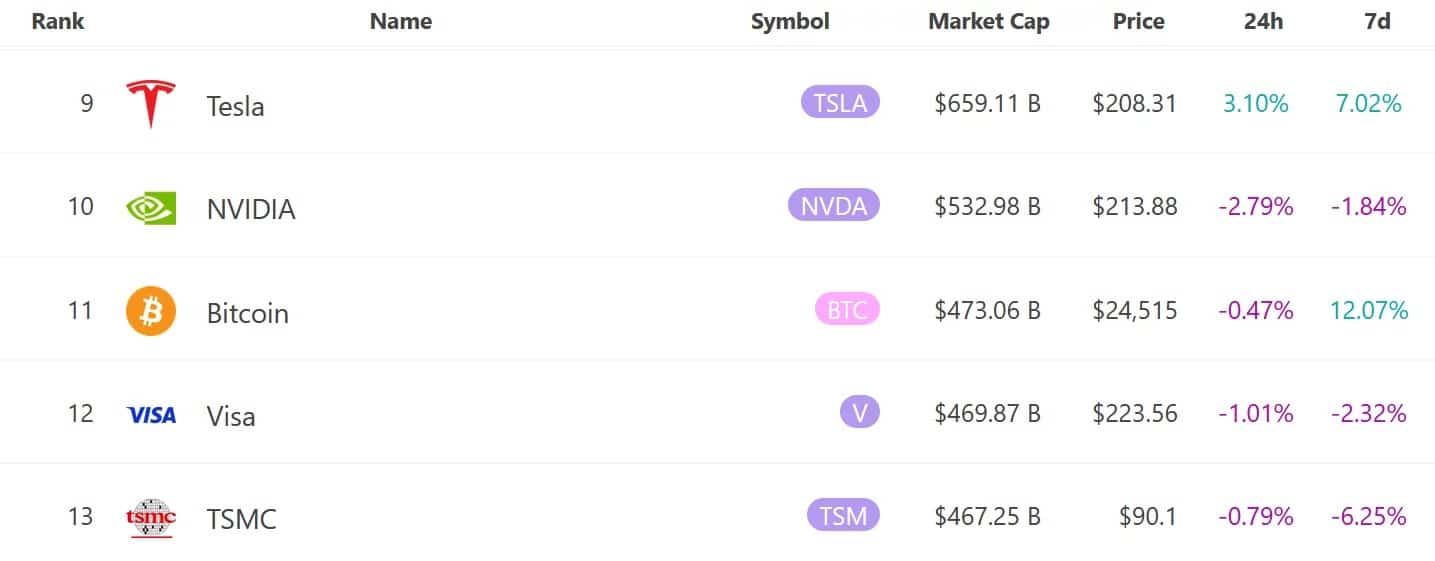

It’s a sign of the growing health of the Bitcoin price. BTC’s capitalization has once again surpassed that of payments giant Visa. The largest cryptocurrency is now the 11th most capitalised asset in the world, behind NVIDIA and Tesla stock:

Ranking of the largest capitalizations at the moment

BTC’s capitalization had surpassed Visa’s stock for the first time in December 2020, when the cryptocurrency touched $25,000 for the first time. That’s just the threshold that Bitcoin’s price is currently running aground on, with two notable crossings this week:

BTC price is trying to break through the psychological $25,000 barrier for good

Although the largest cryptocurrency is hovering around $24,500 this morning, the message seems clear: BTC is in good shape, and is driving some commentators to optimism.

A repeat of 2020

Indeed, it doesn’t take much for some to see it as a repeat of 2020. As a reminder, in December 2020 Bitcoin had crossed the $30,000 threshold, and had soared to nearly $65,000 in April 2021. With the indicators in the green at the moment, investors are dreaming of a new rise for the largest cryptocurrency.

But that goal is still a long way off. As our analyst Tagado reminded us this weekend, BTC needs to break its range from the top – and the infamous $25,000 threshold – in a sustainable way before there is any sign of an extension of the rise. On the other hand, a rejection is also possible:

If this resistance is rejected again, the price of Bitcoin should be expected to return to the middle of its range at $21,500. Moreover, this level must be held or else it will return to visit the $19,000 area. “

What we can say, however, is that the market is in a phase of appetite, after having evolved in a long and uninspiring range. This is also noted in the “Fear and greed” index:

Bitcoin Fear and Greed Index is 58 – Greed

Current price: $24,341 pic.twitter.com/jqEEr9XRtj– Bitcoin Fear and Greed Index (@BitcoinFear) February 20, 2023

So it remains to be seen whether the cryptocurrency will manage to turn this flurry of enthusiasm into a real bull run.