In the second quarter of 2023, revenue for BTC miners reached $2.5 billion. According to Bitcoin’s on-chain data, this figure was driven in particular by transaction fees, which exploded following the introduction of the Ordinals protocol and the BRC-20 token craze.

2.5 billion in 3 months

In an upward trend since November 2022, Bitcoin (BTC) miners’ revenues saw a slight inflection in June 2023. Despite this, on-chain data tells us that the activity brought in $2.5 billion over the second quarter of the year.

In reality, this figure is by no means a record. In March 2021 alone, miners had generated $1.75 billion in revenue for their contribution to the operation of the Bitcoin network. So why the particular interest?

For the simple reason that miners’ revenues have been particularly buoyed by transaction fees over the past three months. Transaction fees have accounted for $184 million, the highest figure since the spring of 2021.

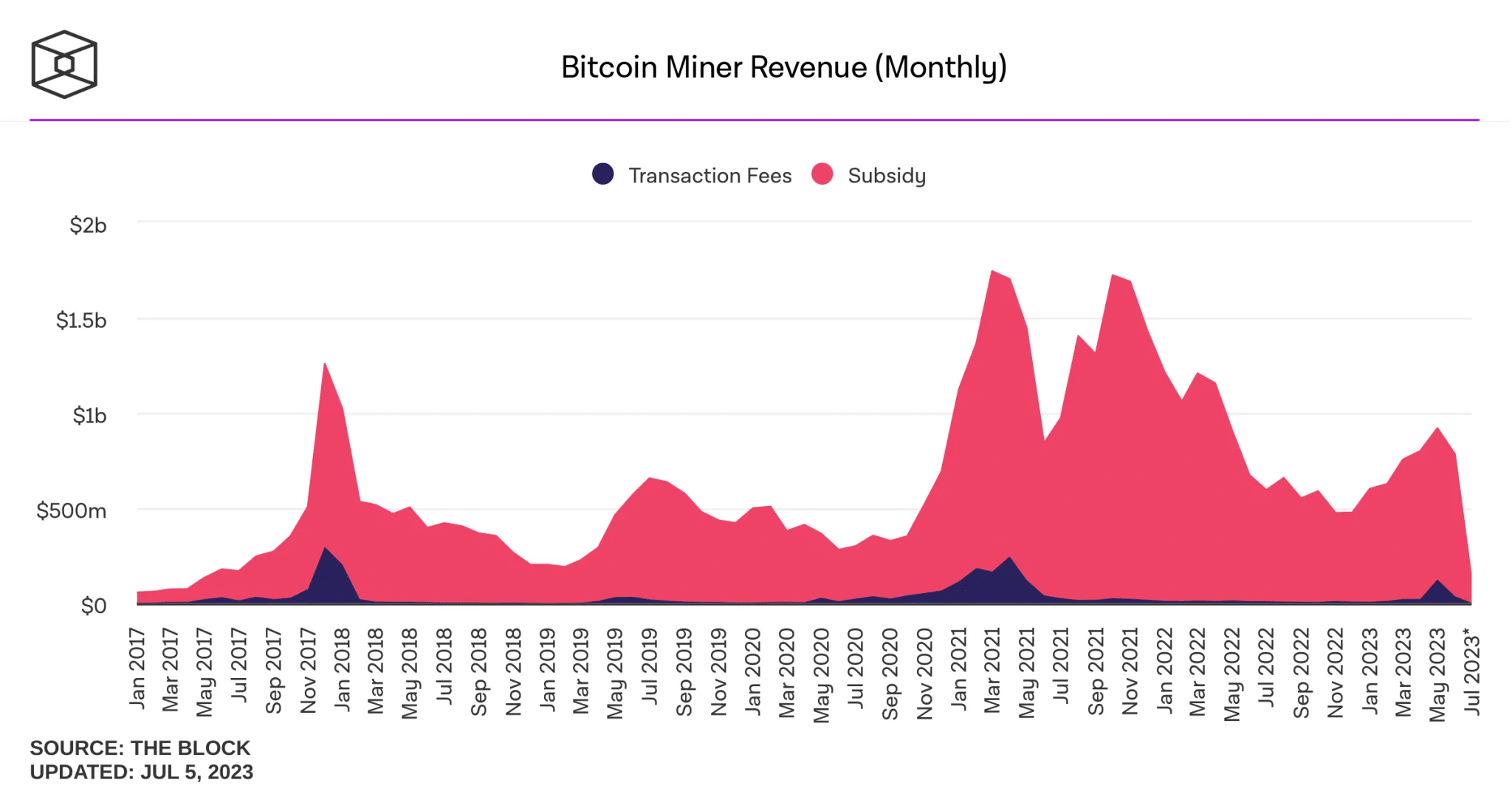

Evolution of Bitcoin miners’ revenues since 2017

As a reminder, Bitcoin miners’ income is divided into two categories. On the one hand, the basic income corresponding to 6.25 BTC per block mined. On the other hand, there are the network transaction fees, which vary according to activity and the willingness of users to pay more to go faster.

As this graph from The Block shows, transaction fees often peak when the Bitcoin price is particularly high and activity on the network is booming. However, none of this happened in the second quarter of 2023, so how do you explain this data?

Ordinals, NFTs and BRC-20 boost Bitcoin

In fact, miners can thank the trend for NFTs on Ordinals and BRC-20 tokens. Although often decried, it has generated significant interest and helped attract a huge number of new users to Bitcoin, generating increased demand for fast transactions and prompting users to pay higher transaction fees.

Introduced in early 2023, Ordinals is a protocol for writing data to individual satoshis, the smallest units of bitcoin currency. In short, users have mostly used it to create assets similar to non-fungible tokens (NFTs) on the Bitcoin blockchain.

In March, the BRC-20 standard was introduced (well inspired by Ethereum’s ERC-20 standard). It is based on the Ordinals protocol, which means that the data entered are tokens and not images, as in the case of NFTs. BRC-20s quickly became exceptionally popular, with their market capitalisation reaching more than $240 million since their launch, according to CoinGecko.

So much so that many investors were fighting to be the first to buy a particular BRC-20 token. Some were prepared to pay higher fees, simply to validate the transaction faster than others. It was this behaviour that led to escalating fees, much to the delight of miners.

For some, Ordinals is seen as a way of circumventing Bitcoin’s limits and represents a threat of attack on Bitcoin. For others, it is a boon for miners and further proof of the success of Satoshi Nakamoto’s prediction. What do you think

?