The Bitcoin (BTC) price has proved surprisingly impervious to the news concerning Binance and its now ex-CEO, Changpeng Zhao. The market remains locked in bullish inertia, a flat calm as US high finance is off on vacation until Monday for Thanksgiving.

The Binance and Changpeng Zhao affair disrupts nothing

Goodbye CZ, welcome to RT! So it’s Richard Teng who has taken over the reins of Binance, the world’s leading crypto exchange platform. To save Binance and, above all, to save himself and probably avoid jail time, CZ has jumped ship and Binance is paying $4 billion to end its legal uncertainty with the United States.

It’s a reminder of the extent to which American justice rules the world, with the omnipresence of the dollar and the importance of the US domestic market often leading international companies to plead guilty with the US justice system in order to negotiate an out-of-court settlement.

With such announcements, the Bitcoin (BTC) price could have floundered, especially as it is up over 115% since the start of the year and the vast majority of short-term traders are in profit. But the latter, after admittedly a little initial volatility, continued to build a sideways transition phase below the major resistance of $38,000.

Interesting are the findings of the BTC/USD liquidity chart. The chart shows that buyers are massively hedged with protective stop orders below $34,000. As for sellers (who have been waiting for 1 year for BTC to fall to $12,000), they have hedged in the short term with protective stops above resistance at $38,000.

Chart representing the liquidity map of the BTC/USD price

This allows us to define the following 2 simple chartist hypotheses:

- The market continues to build a trading range, then breaks resistance at $38,000 before going for $40/42,000;

- The market breaks support at $34,000 and a profit-taking phase begins. The challenge will be to preserve major support at $30,000/$32,000 so as not to threaten the annual uptrend on a technical level.

American institutional investors have gone on vacation for Thanksgiving, so the next few sessions will be very, very technical

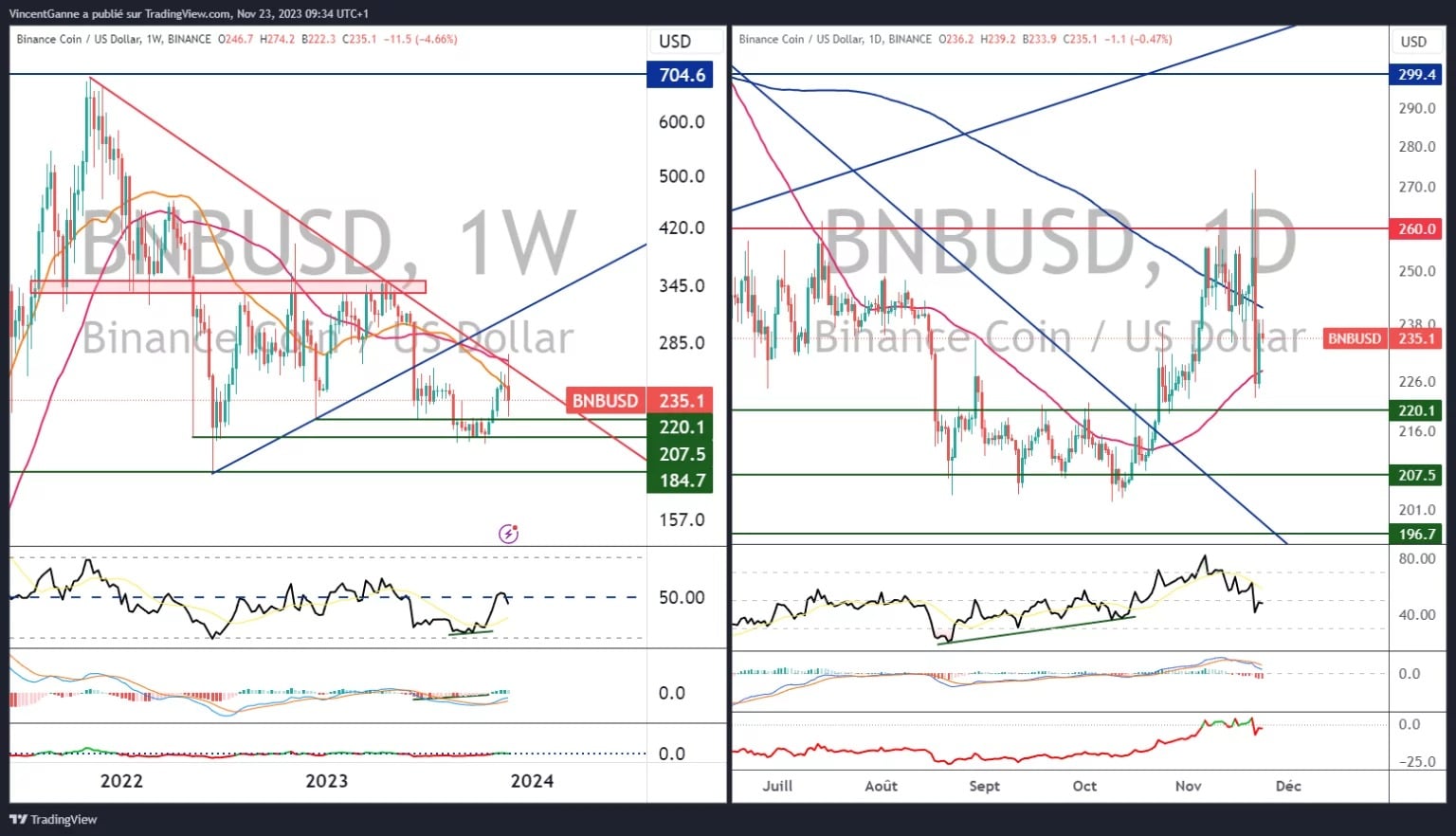

The BNB/USD pair should be kept under close technical surveillance

The BNB token was already an important crypto market barometer to follow, an indicator of confidence in crypto exchanges. It has become even more so with the departure of CZ and the agreement reached with the U.S. Department of Justice.

Remember that the Binance exchange provides almost 50% of the crypto market’s total liquidity, so it’s vital that the company doesn’t suffer any market shocks. To achieve this, the BNB/USD pair must not break support at 200/220 U.S. dollars.

Chart showing Japanese candlesticks in weekly and daily data for BNB/USD