Although the crypto market has shown its resilience after Changpeng Zhao’s departure, Binance is facing a determined Securities and Exchange Commission (SEC) that sees the settlement with the US Department of Justice (DOJ) as strengthening its own case. The SEC is suing Binance for allegations of securities fraud and misleading investors and regulators.

Removement within Binance and Binance.US

Binance’s recent affairs will have escaped no one’s notice: after many years of tug-of-war between the cryptocurrency exchange giant and the U.S. Department of Justice (DOJ), Changpeng Zhao finally stepped down as CEO, and even more recently was forced to step down as chairman of the board of Binance.US, the exchange’s U.S. arm.

After having to pay a record fine of $4.3 billion, Binance saw Richard Teng succeed “CZ”, who is forced to remain on US soil pending his trial scheduled for next February, the judge fearing that the interested party might try to escape his fate by taking refuge in the United Arab Emirates.

Be that as it may, while the departure of Changpeng Zhao, an emblematic figure in the crypto ecosystem, could have caused a significant drop in the cryptocurrency price, it was quite the opposite. Instead, investors saw the rebound as an opportunity for Binance to get back on track after the sword of Damocles wielded by the US DOJ and Commodity Futures Trading Commission (CFTC) had eclipsed.

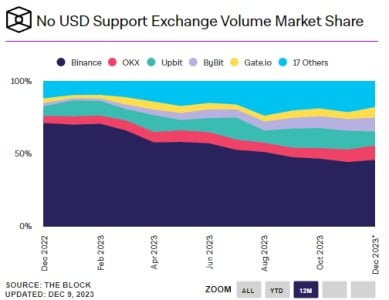

But although the crypto market has once again shown its resilience, Binance still has a long way to go before it can hope to touch its previous golden age. Indeed, while the platform accounted for 70% of market share at the start of 2023, it now accounts for just 45% of the market.

Market shares of crypto exchanges outside the US dollar

But it wasn’t just the DOJ that had scores to settle with Binance.

Gary Gensler’s SEC doesn’t intend to leave it at that

The Securities and Exchange Commission (SEC), the U.S. federal agency headed by Gary Gensler, intends to make its voice heard. According to a Bloomberg report, the SEC declared yesterday, Friday December 8, that the agreement between Binance and the DOJ “strengthened” its own case.

What case are we talking about? At the beginning of June, the crypto market went into the red after the SEC announced that it was suing Binance and its ex-CEO Changpeng Zhao for allegations of securities fraud and for allowing its American customers to use its international platform rather than its local branch, a charge also levelled against it by the US Department of Justice.

This case, which is still ongoing, alleged that the cryptocurrencies BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS and COTI should be considered as securities.

Although the SEC has not explicitly explained what led it to believe this, it is most likely based on the fact that Changpeng Zhao has pleaded guilty to the charges against him. The next date to look out for in this regard will probably be February 24, 2024, when the former Binance CEO will be sentenced.