DeFi protocol Abracadabra is taking steps to limit the risks associated with loans from Curve CEO Michael Egorov. After Egorov took out large loans using the CRV token as collateral, Abracadabra is proposing to increase interest rates to reduce these positions. A governance proposal has also been filed on Aave to limit future risks.

Abracadabra takes action on Curve CEO’s loans

As we reported yesterday in our columns, all eyes are currently on the various positions held by Curve’s CEO within decentralized finance (DeFi). Currently, Michael Egorov holds various positions in the Aave, Abracadabra, Fraxlend and Inverse protocols, all collateralized in CRV, the token of the Curve protocol.

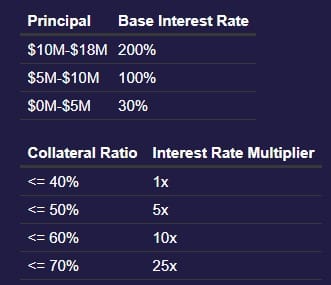

Faced with the potential risks of these loans – although mitigated thanks to the interested party’s OTC trading – the Abracadabra protocol decided to take action. In a new governance proposal, an Abracadabra member proposed to apply massive interest rates based on CRV collateralizations in order to feed the protocol’s treasury.

“Part of this hack involved the CRV/ETH pool, draining most of the chain’s liquidity for CRV, significantly altering the liquidity conditions that led to CRV being listed as collateral on Abracadabra. […] This has had an impact on both the price of CRV and the liquidity around the token. Thus, we suggest increasing the interest rate in order to reduce Abracadabra’s total exposure to CRV to around $5 million borrowed from MIM. “

In other words, this measure is designed to dissuade Michael Egorov from holding such a position in Abracadabra, since liquidation would be potentially fatal to the protocol due to bad debt. In fact, Egorov finds himself obliged to repay his loan quickly or face extremely high charges.

The proposal received an almost unanimous positive response from voters, and already seems to be bearing fruit. Indeed, as we can see from the Curve CEO’s portfolio, he has begun repaying his loan on Abracadabra using USDT obtained by selling CRVs on OTC, as he was able to do yesterday with Justin Sun, among others.

Given the urgency of the situation, the governance vote will end tomorrow morning, Thursday August 3.

Aave takes the lead to limit future risks

Gauntlet, an entity specializing in risk optimization in decentralized finance (DeFi), has filed a governance proposal on the Aave protocol forum to prevent future collateralized CRV loans from being contracted on Aave V2.

” Gauntlet has reviewed the risk profile of 0x7a16ff8270133f063aab6c9977183d9e72835428 [Michael Egorov, Editor’s note]. This account borrows around 54 million USDT against 158 million CRV at 01/08/2023. We recommend setting CRV’s LTV at 0 to prevent additional borrowing against existing CRV collateral due to CRV’s recent decrease in liquidity. “

LTV, for “Loan-to-Value”, is a measure for comparing the amount of a collateralization with the amount of the loan requested. A zero LTV simply means that a loan is impossible with the asset concerned, in this case the CRV.

Unlike the Abracadabra proposal, the one issued on Aave would not constrain Curve’s CEO directly, but would prevent him from opening a similar position on the Aave V2 market. Voting begins this afternoon and closes on August 5,