In CoinGecko’s latest study on the volume of decentralised exchanges over the last 6 months, we can see Uniswap’s dominance over all other DEX. What about all this data

?

Uniswap dominates DEX trading volume

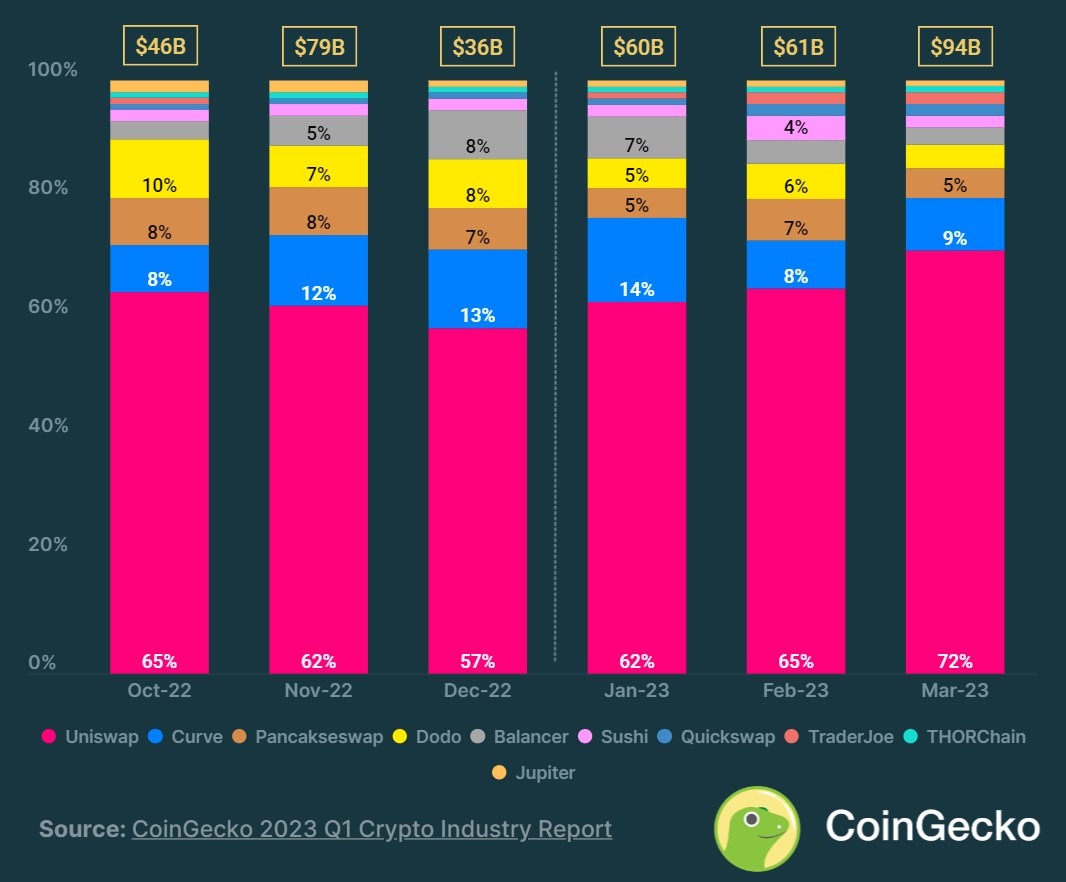

In its latest survey, CoinGecko has studied the trading volume of the 10 largest decentralised exchanges (DEX) in decentralised finance (DeFi) over the last 6 months. The first noticeable fact is that Uniswap (UNI) comes out on top.

Indeed, this DEX occupied 72% of the market share in March, and the lowest month was last December with 57%:

DEX trading volumes

Interestingly, Curve (CRV), which is most often the second most traded DEX, only recovers 8-14% of the volume, even though it has the most liquidity. Indeed, its total locked-in value (TVL) amounts to USD 4.44 billion according to DefiLlama, compared to USD 4.16 billion for Uniswap.

The likely explanation for this is that Curve remains a highly specialised DEX, with a significant proportion of its liquidity redirected to stablecoins and the ETH/stETH pool. In contrast, Uniswap is a much more generalist DEX, with many crypto-currencies listed, which tends to attract a much wider audience.

Volumes on the rise

Looking at the numbers offered by the DEXs more broadly, we can see that the average volume is almost $63 billion.

Zooming in on this, a first peak can be seen in November with $79 billion, a direct consequence of the FTX affair after which many investors turned to decentralised solutions. However, this volume fell back to USD 36 billion in December, reflecting the sharp market slowdown that followed.

Then, the figures start to rise again, with a strong acceleration in March to $94 billion, in the wake of the positive momentum the cryptocurrency market has been experiencing since the beginning of the year.

Among the various DEXs, Trader Joe is showing the biggest growth. After joining the top 10 last February at the expense of Serum, the platform is enjoying a 792.4% increase in volumes in 6 months, i.e. less than 243 million in October against 2.16 billion in March. The reason for this is its recent deployment on Layer 2 Arbitrum (ARB).

So, it will be interesting to see whether or not all this rising data will be confirmed by the end of the current quarter.