Almost a year and a half after the bear market began, how is the decentralised finance (DeFi) sector faring? Let’s take a look at some notable statistics on the health of the industry.

Decentralised finance and the bear market

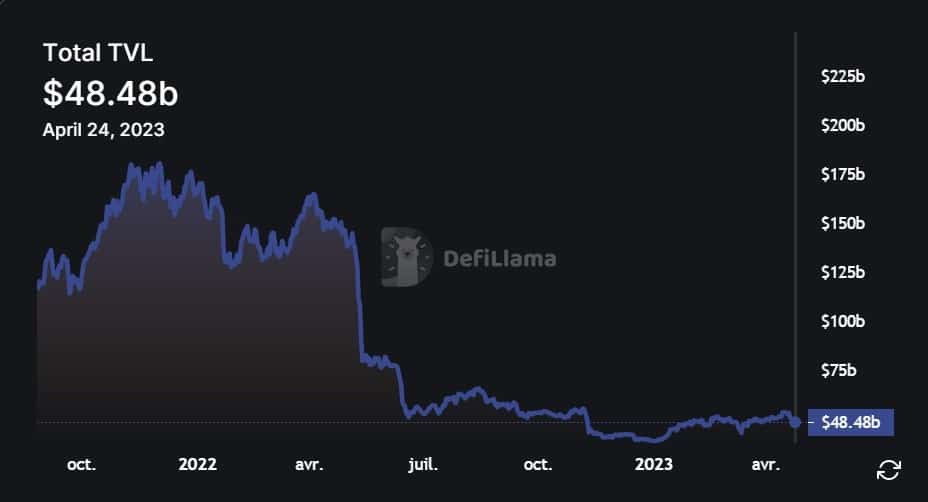

Like many assets since the November 2021 highs, decentralised finance (DeFi) has also been hit hard by the bear market. And for good reason, the total locked-in value (TVL) on the various blockchains is down by about 73% over the period studied.

To estimate this, we referred to data from DefiLlama, which shows that this TVL amounted to $180 billion at its historical high, compared to $48.8 billion at the time of writing:

Figure 1 – Evolution of the DeFi LST

The last low was reached on January 1, with $38.67 billion, showing a rise of just over 25% in recent months for the sector.

Unsurprisingly, the Ethereum blockchain (ETH) is leading the way, with a TVL of $28.71 billion to date compared to $109.67 billion at the ATH on 9 November 2021.

However, the data put forward by DefiLlama does not include some default values. This is the case for example with double counting, i.e. when a user deposits funds on protocol A, retrieves an LP-token and then deposits it on protocol B.

If, for example, the initial deposit was $1,000, then the double counting would count $2,000 with reference to the shares on both protocols, which is not relevant.

However, it may be interesting to integrate some data such as liquid staking, for example with Lido, as well as the different governance token deposits. With these parameters, the TVL thus increases to more than 231 billion dollars at the time of the DeFi ATH against 75.71 today. A drop that remains roughly similar in terms of percentages.

Statistics from a user perspective

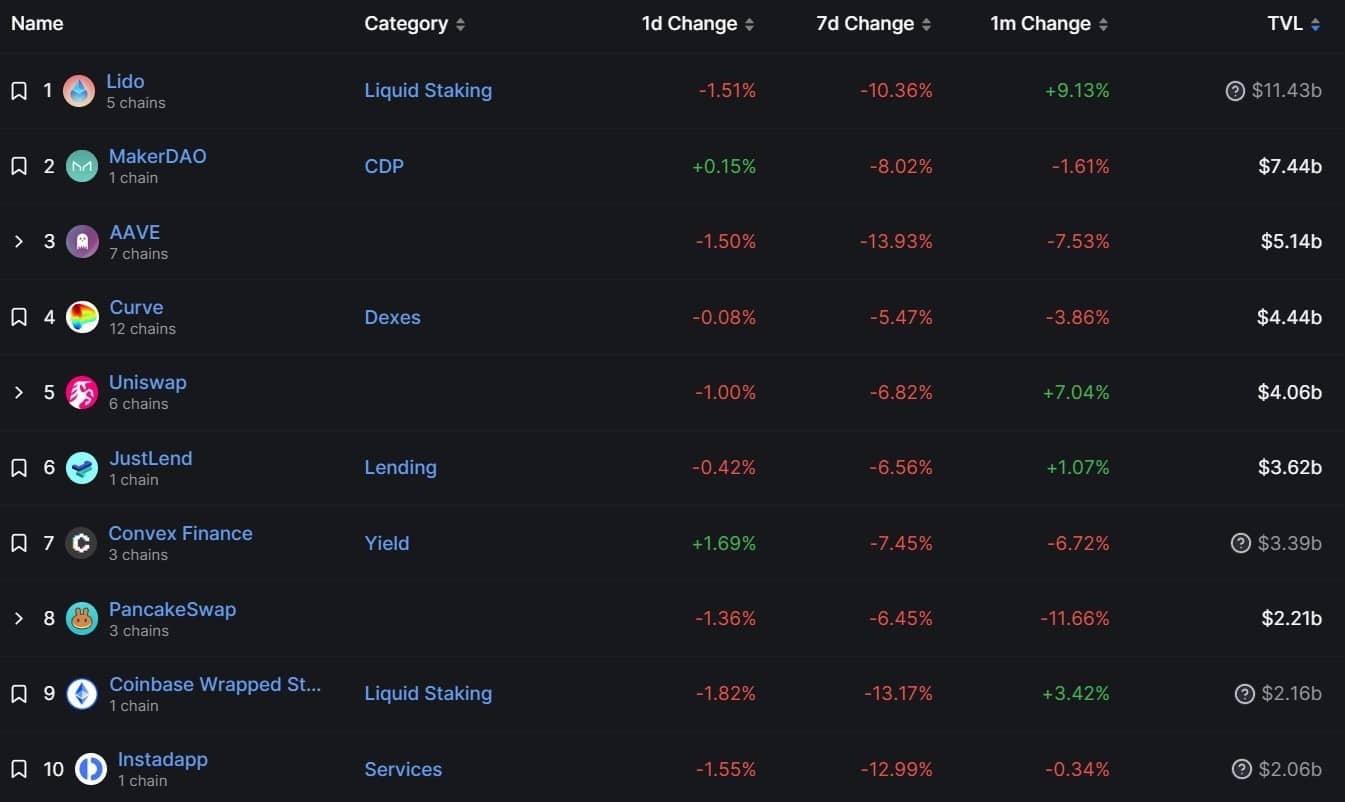

Zooming in on the data to focus on the protocols, the podium is occupied by Lido, MakerDAO and Aave. The top10 shows that the first protocol that has nothing to do with an Ethereum Virtual Machine (EVM) enabled environment is JustLend from the Tron ecosystem, in 7th place with $3.62 billion:

Figure 2 – Top10 largest DeFi protocols

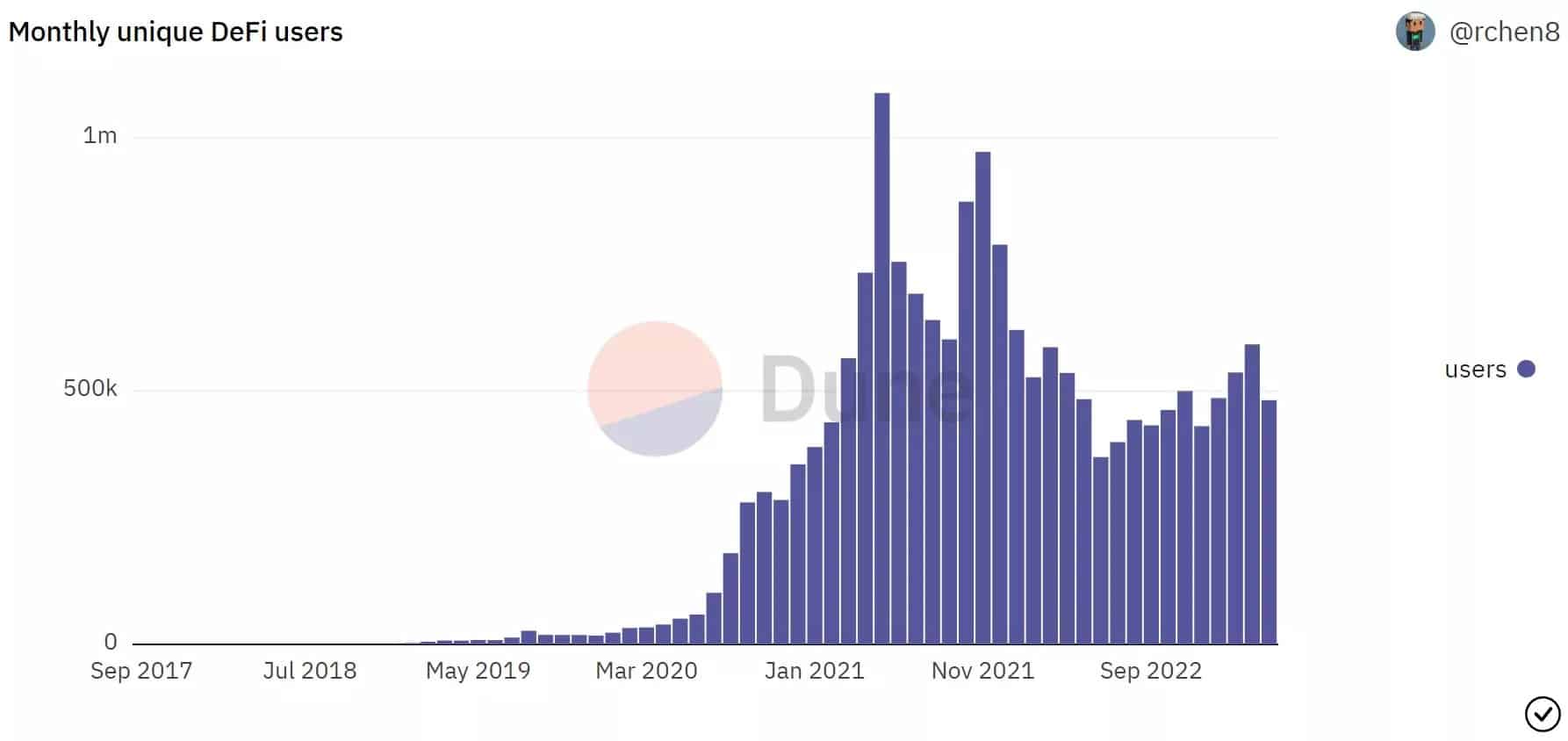

On the other hand, it would be easy to say that the fall of TVL is because people have run away from DeFi. While there have indeed been withdrawals, the reality is more subtle. And for good reason, if the price of ETH falls, for example, this mechanically decreases the value locked in on all DeFi protocols.

In fact, according to a query by Richard Chen on Dune, the number of monthly active users has decreased by about 50% since November 2021, from 972,000 to 492,000. On the other hand, it will be interesting to note that this ATH of users would have been reached in May 2021 with almost 1.09 million active addresses:

Figure 2 – Monthly active users in DeFi

In addition, the lowest level of activity was reportedly reached in June 2022, and seems to be slowly recovering since then.