Exchange platform Gemini conducted a survey on the profile of crypto investors and how long they have been in the ecosystem. The results show that many arrived in 2021, and that adoption is going much faster in some regions than others.

Gemini unveils global survey results

US exchange Gemini, founded by the Winklevoss brothers, conducted a survey of nearly 30,000 people in 20 different countries to profile investors in the blockchain world. The survey was conducted in two stages, first on 23 November 2021 and again on 4 February 2022.

It shows that 41% of respondents started in 2021. These figures are even more striking in countries with high inflation, such as Brazil, which recorded 51% on this same criterion. India has a score of 54%, although its inflation is lower.

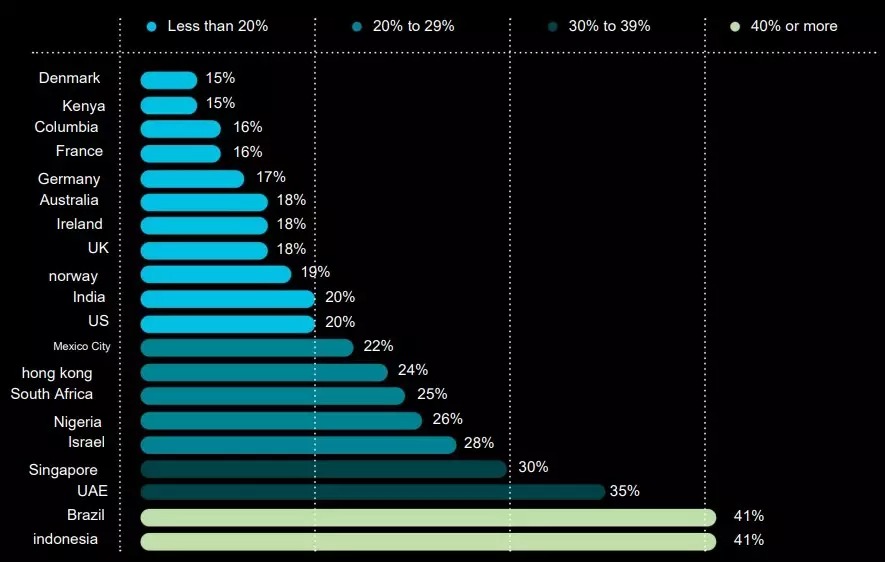

The Gemini survey also found that Brazil and Indonesia were the countries surveyed with the most cryptocurrency holders relative to their population, at 41% each.

Figure 1: Percentage of population holding cryptocurrencies by country

The results are obviously to be put into perspective, as they give France 16% of investors, while a recent study by ADAN and KPMG found half that number. So it is always interesting to cross-check several sources.

The female population in cryptos

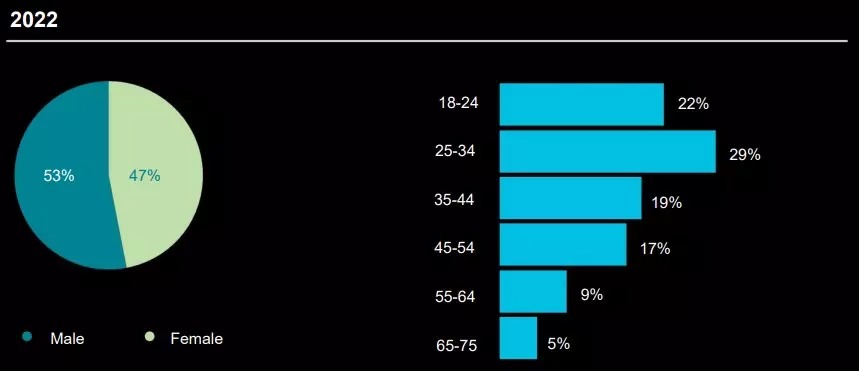

The study also looked at behaviour by gender. It is observed, according to the report, that women owning cryptocurrencies make up a third of the surveyed population, but that this figure varies greatly from country to country. For example, they would only represent 18% in Denmark compared to 51% in Israel.

On the other hand, we can hope to get closer to parity in the sense that, of those surveyed, 47% of those planning to buy cryptocurrencies for the first time in 2022 are women. And unsurprisingly, it is the 25-34 age group that dominates, accounting for 29% of the total result.

Figure 2: People looking to buy crypto assets for the first time in 2022

The reasons that are holding back or motivating people to get started

Gemini’s survey reveals that the more a country sees its currency devalued against the dollar, the more likely its population is to be interested in investing in crypto-assets.

Brazil is again a striking example, with 45% of non-owners surveyed wanting to get in on the act, while the dollar has risen 217.65% on the real. In comparison, only 8% of French non-crypto owners would like to take the plunge, while the euro has risen 14.29% on the dollar over the same period.

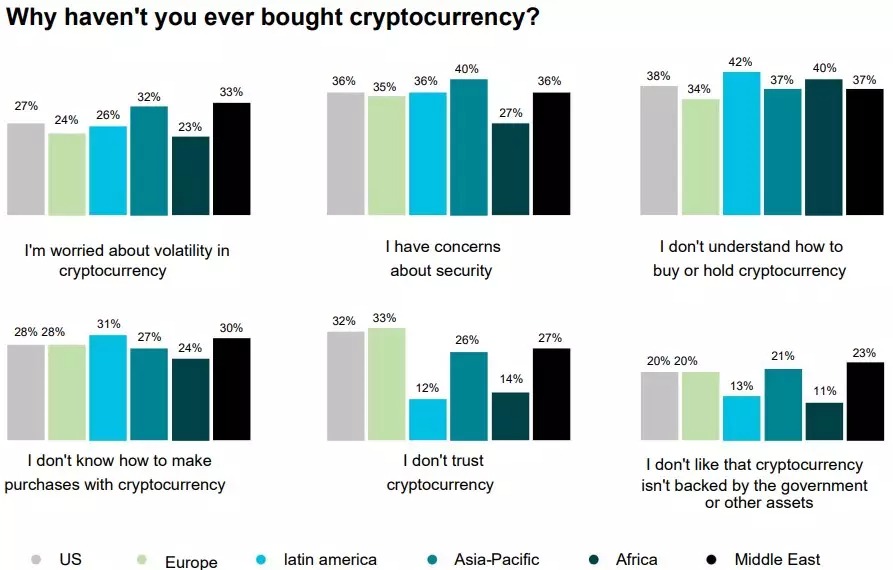

The reasons for not taking the plunge, meanwhile, vary widely, as the infographics below show:

Figure 3: Reasons for not investing

Overall, the results are similar from one region to another. The classic arguments such as the fear of volatility with an average of 27.5%, or the lack of knowledge with 38%, can be found.

However, there are some interesting disparities. While the lack of confidence argument represents an average of 24% overall, for Latin America and Africa, this concern represents only 12% and 24% respectively. These values make sense when one observes that they concern geographical areas that are highly prone to inflation.

While it is obviously difficult to consider the accuracy of this survey to the point, it does reveal some interesting statistics. Blockchain and cryptocurrencies are becoming mainstream, the trend is confirmed year after year, and it is a dynamic that is part of a global trend.