While October seems to be ending on a particularly positive note for total crypto capitalization, CoinGecko has taken a look at the “Uptober” effect. What can we say about this term, according to which prices appreciate in October?

“Uptober”: the effect that crypto currencies rise in October

It will have escaped no crypto investor’s notice that October was a particularly positive month in terms of valuation, so much so that in recent days the term “Uptober” has resurfaced.

Indeed, whether in cryptocurrencies or any asset class, financial markets are fond of superstitions and adages, such as the famous “sell in may”. In October, for example, the crypto market traditionally enjoys a bull run.

To gauge the veracity of these “predictions”, analysis site CoinGecko has published a study, in which it reviews the performance of total crypto capitalization in recent years in October.

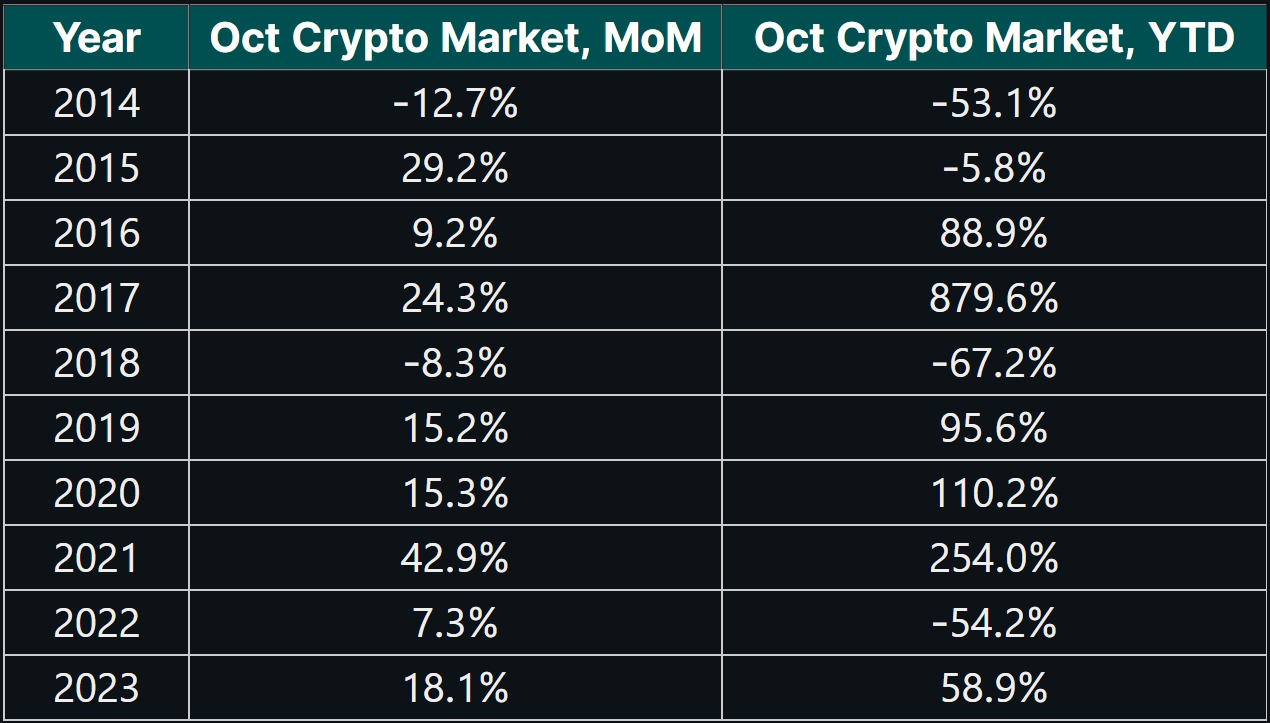

In 10 years of the market, only 2 months in October have recorded a negative performance, namely 2014 and 2018, at -12.7% and -8.3% respectively. Even 2022 saw a market rise of 7.3%, just before the FTX scandal.

However, when you look at the year-on-year figures, they don’t necessarily reflect a steady rise, with 4 of the 10 October months studied in negative territory over a 12-month period:

Evolution of crypto capitalization in October over the last 10 years

In addition, it’s also worth pointing out that just because a month ends positively doesn’t mean the days that make it up are positive too. For example, CoinGecko reports that in 2022, the month of October counted 21 negative days out of 31. In the same vein, the current month was down on last year by 0.4% to 2.9% from October 10 to 16.

While 2023 thus seems to have vindicated the “Uptober” effect, it should be noted that there is still one trading day left. On the other hand, no matter how favorable the statistics, there’s no guarantee that they’ll be repeated from one year to the next. For example, the price of Bitcoin (BTC) had never fallen below the all-time high (ATH) of its previous bull run until last year.