With the news of the last 24 hours surrounding Binance, the cryptocurrency exchange has seen $1 billion withdrawn from its platform. Who benefits from this investor flight

Binance suffers major withdrawals from its platform alongside the latest news

While the last 24 hours have been particularly eventful for Binance and its now ex-CEO Changpeng Zhao (CZ), the platform is also suffering collateral damage from massive fund withdrawals.

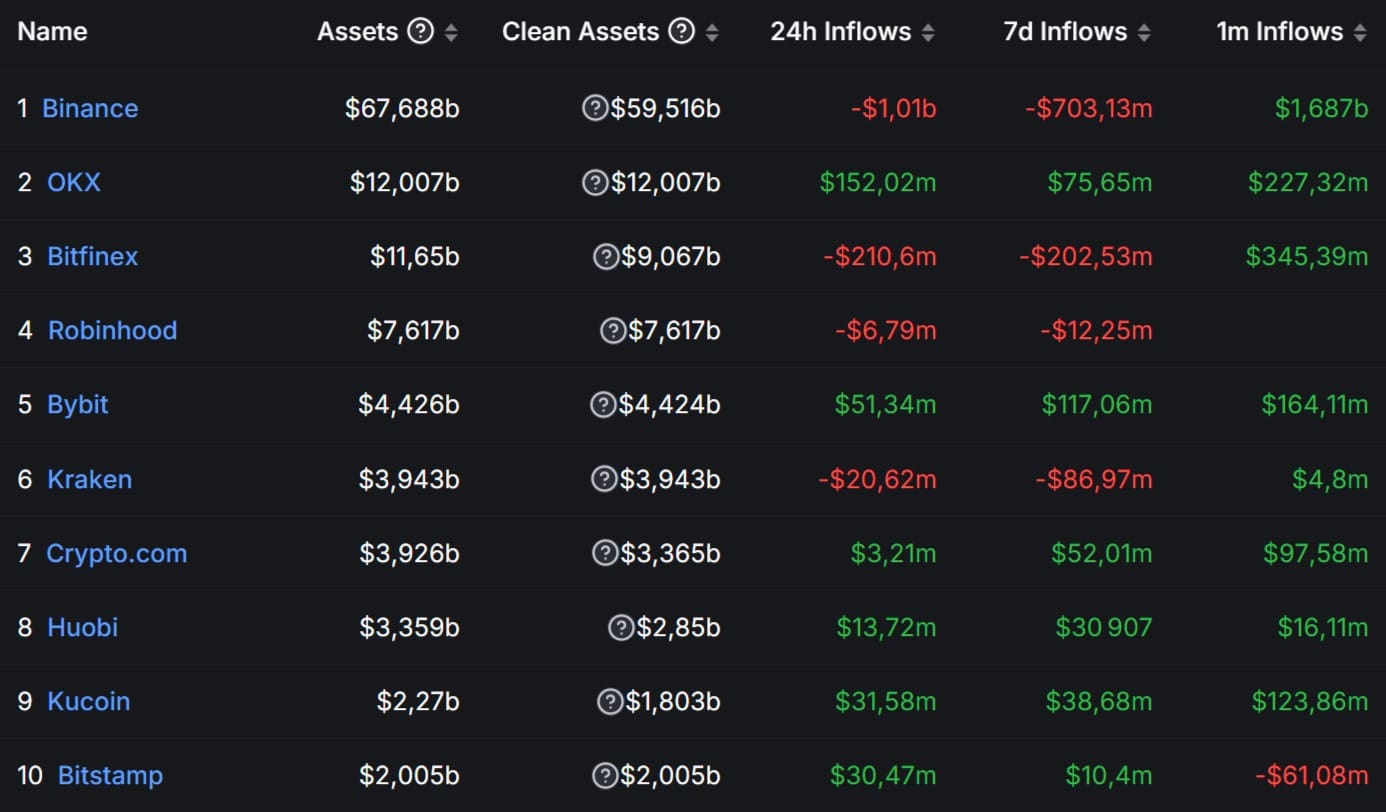

Indeed, in the space of 24 hours, the net balance between the exchange’s inflows and outflows resulted in withdrawals of $1 billion worth of cryptocurrencies, according to data from DefiLlama:

Balances between crypto exchange inflows and outflows

It’s interesting to note in the above top 10 that OKX benefits mostly from Binance’s outflows, but the $152 million in inflows aren’t enough to offset all the centralized platform’s outflows.

To a lesser extent, this may also slightly benefit Bybit, Bitstamp or KuCoin, but the figures still suggest that the majority of withdrawn funds may have been redirected to self-hosted wallet addresses.

A transitional blow to move forward

Since the beginning of the year, we’ve been following Binance’s setbacks with regulators in various parts of the world.

This has not been without consequences for the platform’s growth, for beyond the resignations and withdrawals from certain countries, the inflow/outflow balance we’ve just studied has only been positive to the tune of 95 million since January 1.

With $67.5 billion in assets under management, Binance is of course still the world’s largest cryptocurrency exchange, but over the period under review, we can see that some competitors have experienced strong growth.

OKX, for example, welcomed almost $2.77 billion in additional assets, for nearly $12 billion in assets under management. With an additional $1.63 billion, Bybit also saw strong growth compared to its $4.42 billion in assets.

To date, Binance has always bounced back from hard knocks, and while these massive withdrawals are a direct consequence of the latest news, there’s no indication that this is an end in itself.

With the appointment of Richard Teng as CEO, a new era is dawning for the platform, and important as these sanctions are, they nevertheless remove some of the vagueness from which the company has been suffering until now.

Meanwhile, the price of BNB was $234 per unit at the time of writing, down 9% over 24 hours.