The level of volatility has risen this week on the crypto market as we look ahead to a very important month of May for market fundamentals. Beyond the saying sell in May and go away and after an imposing yearly bullish performance of Bitcoin, it is the next inflation figures and the next monetary decision of the FED that will set the trend of the bitcoin price this May 2023.

Sell in May and go away? Not necessarily

Every year, at the same time of year, the stock market adage “Sell in May and go away” is taken to heart by stock market analysts to indicate at an early stage the risk of seeing risky assets on the stock market correct.

First of all, this adage applies to the equity market, and for this month of May 2023, it is the bullish performance between January and the end of April of the stock market indices (especially the Nasdaq) and cryptos (especially BTC) that are giving rise to fears of a profit-taking phase. Ultimately, this could make sense, particularly given the fundamental uncertainty.

I asked myself a simple question: is selling everything at the end of April to spend May in the warm?

To be honest, this saying doesn’t stand up to statistical reality for very long when you take the time to stick to the maths. Rest assured, we’re talking college-level mathematics here, just calculating the average performance of the bitcoin price in May from its birth 14 years ago to the present day.

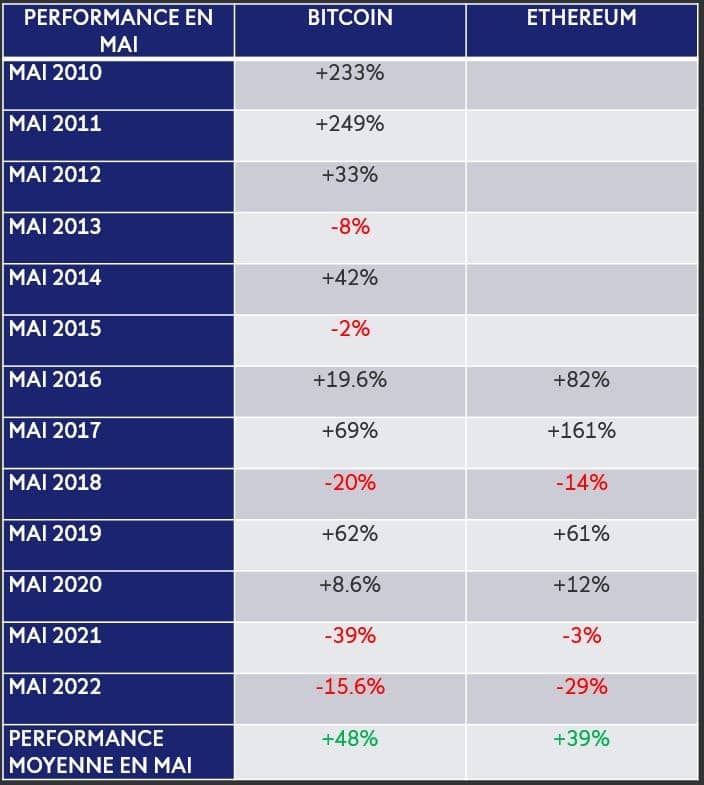

The table below shows the performance in May for Bitcoin since 2010 and for Ethereum (ETH) since 2016, and at the very bottom you have the average performance. The good news is that it is positive for both BTC and ETH! But the number of occurrences is fairly limited and above all the deviation from the average is considerable from one year to the next.

Table showing May performance for Bitcoin and Ethreum since 2010 and 2016 respectively

Finally, I would advise you not to rely too much on this adage, or even on these statistics, because bitcoin’s trend this May 2023 will be the consequence of fundamental and global-macro data, of which this is the core:

- The continuation or otherwise of disinflation in the US and Europe;

- The FED’s next monetary policy decision (Wednesday 3 May);

- The trend of the US dollar on Forex, which is currently testing its annual low;

- The general dynamics of market interest rates;

- The resurgence of the banking crisis and the evolution of the probability of recession in the West.

Bitcoin’s next technical close will be under very close scrutiny

In addition to these fundamental factors, Bitcoin’s trend in May 2023 will also be influenced by the very next monthly technical close expected this Sunday, April 30. To get a close that is an argument for the continuation of the yearly bullish rally, it is imperative that BTC is able to close April at the $28,000 / $29,000 level.

Otherwise, the market would be exposed to a move back to the $25,000 support level, below which the 2023 rebound would be seriously threatened. Lastly, in terms of bitcoin’s short-term trend, the two milestones to watch are at $27,000 and $29,000, and they mark out a trading range whose exit at the daily close will be the starting point for the next impulse.

Chart showing the bitcoin price in monthly Japanese candlesticks and with a logarithmic scale