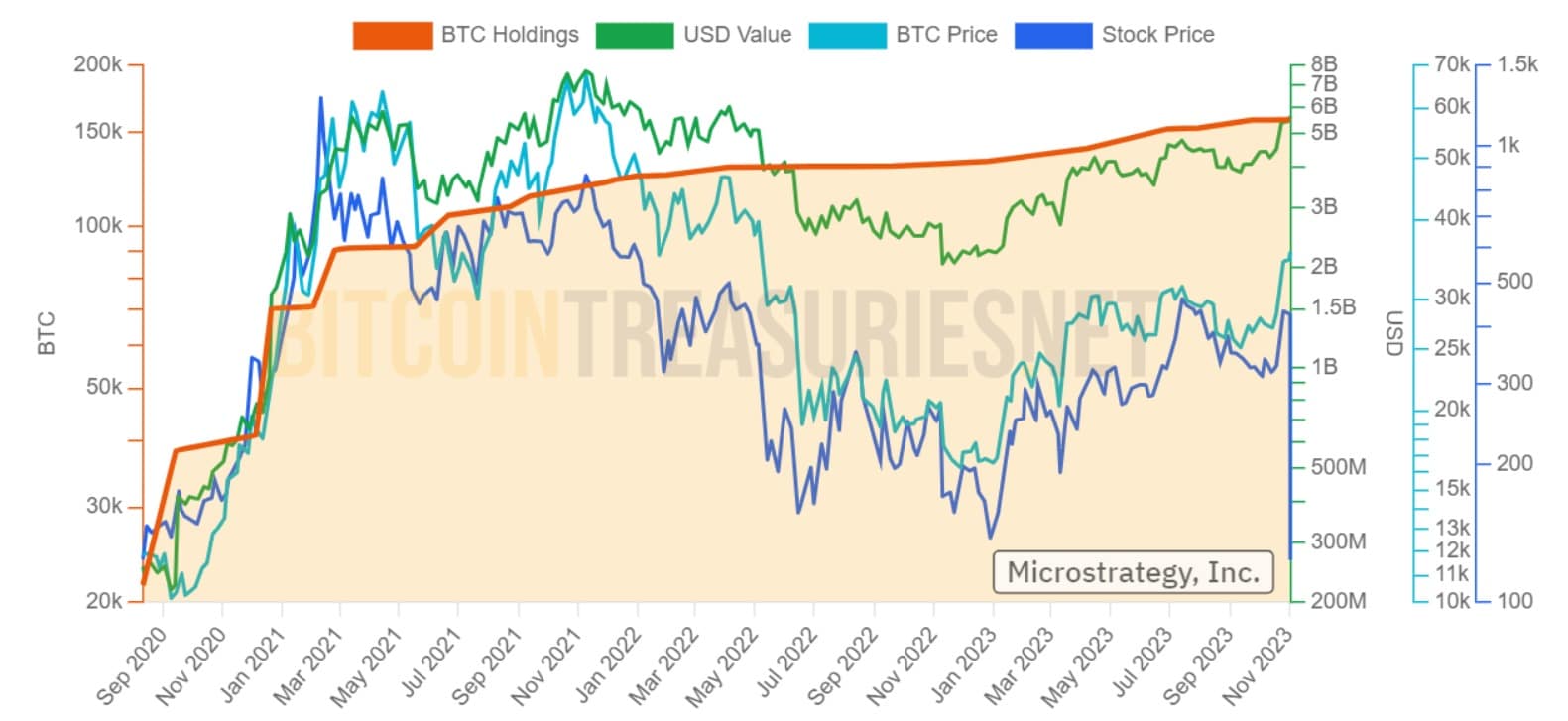

With Bitcoin’s (BTC) new attempt to exceed $35,000, MicroStrategy’s unrealized capital gain is $900 million. A look back at the company’s investment, which is now valued at over $5.58 billion.

MicroStrategy continues its Bitcoin investment strategy

On Wednesday, MicroStrategy presented its results for Q3 2023 and took the opportunity to provide an update on its Bitcoin (BTC) reserves.

A total of 6,067 BTC were acquired between June and September 2023, for an average purchase price of $27,531 per unit and a total of $167 million.

Alongside these results, Michael Saylor also announced an additional acquisition of 155 new bitcoins during the month of October, bringing the company’s holdings to 158,400 units:

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for BusinessIntelligence and Bitcoin $MSTR https://t.co/w7eRUcGobi

– Michael Saylor⚡️ (@saylor) November 1, 2023

Thus, MicroStrategy holds over $5.58 billion worth of BTC, acquired for just under $4.69 billion at an average price of nearly $29,586.

Andrew Kang, the company’s CFO, commented on this ongoing investment:

“We have further increased our total bitcoin holdings to 158,400 bitcoins, an additional 6,067 bitcoins since the end of the second quarter. Our commitment to acquiring and holding bitcoins remains strong, particularly in the promising context of potential increased institutional adoption. “

While the company had returned to profitability on its investments last week, all these figures bring its unrealised capital gain to $900 million, while Bitcoin again attempts a breakthrough above $35,000.

On the other hand, the orange curve on the chart above shows the evolution of MicroStrategy’s Bitcoin holdings:

MicroStrategy’s BTC purchases over time

In addition to its performance with Bitcoin, the company also returned to its commercial results, with revenues of $129.5 million recorded in Q3, up 3% compared to the same period in 2022.

Among these figures, software licenses accounted for $45 million, up 16% year-on-year, and subscription services for $21 million, up 24%. Meanwhile, MicroStrategy shares are trading at $426.67, up 207% year-to-date.

ockchain. Indeed, Zengo is a wallet that can be used to interact with decentralized applications and protocols on numerous blockchains, and it is therefore also essential to secure this type of particularly high-risk operation as much as possible. To find out more about Theft Protection, find a comprehensive FAQ on the Zengo website.