After selling CRV tokens discounted in OTC, Curve CEO Michael Egorov has finally managed to stay afloat. What’s his current situation?

Curve CEO at risk of liquidation?

It’s been in the news since yesterday: the decentralized finance (DeFi) protocol Curve is in trouble after suffering reantrance attacks following the discovery of certain flaws in several versions of the Vyper programming language.

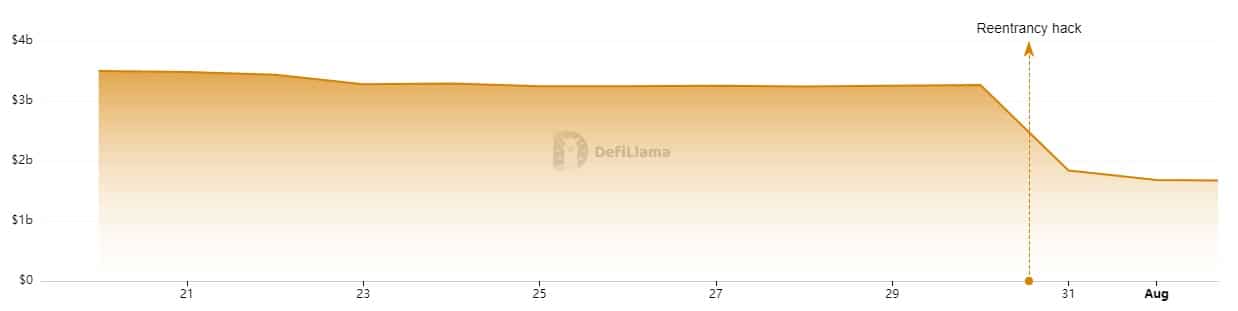

As a result, numerous pools have been emptied by the attacker(s), including Curve’s CRV-ETH pool, Alchemix’s alETH-ETH pool, JPEG’d’s pETH-ETH pool and Metronome’s sETH-ETH pool. The estimated value of the attack on Curve currently exceeds $61.7 million, and this has had the effect of dividing the total locked value (TVL) of the protocol by 2.

Total value locked on Curve

However, and this has never been a secret, Curve’s CEO, namely Michael Egorov, holds the equivalent of over $104 million in loans on Aave V2 exclusively collateralized with CRV. At the time of writing, his position could be liquidated should the CRV price reach $0.36, given that it currently stands at $0.59 after a 7-day decline of 17.5%. With a health rate of 1.64, this position remains perfectly healthy, since it would only be liquidated if the price fell below the fateful threshold of 1.

Looking at his portfolio, Michal Egorov also has 2 MIM token loans outstanding on Abracadabra, 1 loan on Fraxlend, 3 loans on Inverse and 1 loan on Curve. Aside from his position on Curve, with a health factor of 1.09, his other positions range from 1.48 to 1.88, which is rather positive.

In other words, as long as the CRV price doesn’t plummet to $0.36, the risk of liquidation remains unlikely.

How does Curve’s CEO keep his positions afloat?

Well, it seems that Curve’s CEO has made deals with various players, including Justin Sun, Tron’s CEO, in order to obtain liquidity. The latter notably sold him 5 million CRV tokens for $2 million OTC, a discount of $900,000. Justin Sun also announced on X that a stUSDT pool would be opened on Curve.

In parallel, Egorov also reportedly sold CRV to others, including DCF GOD (for $4.25 million), Machi Big Brother ($3.75 million), DWF Labs ($2.5 million) and Cream Finance ($2.5 million).

According to Lookonchain data, Michael Egorov sold a total of $39.25 million in OTC CRVs in exchange for $15.8 million in USDT. In a statement to DL News, Curve’s CEO asserted that the CRVs sold would be locked in for a period of 3 to 6 months, making them unsaleable until then.

The current risk relates more to Frax, where the interest rate on the loan is set to rise gradually and could lead to liquidation irrespective of the CRV price. However, aware of the risks, Michael Egorov has begun to reduce his debt considerably, notably by opening a fFRAX/crvUSD pool on Curve which is already showing around $6 million in TVL, thanks in part to a redistributed reward of $100,000 in CRV to attract liquidity.

By doing so, Egorov was able to reduce FRAX’s utilization rate and thus lower its interest rates.

As a result, Curve’s CEO had no choice but to trade in discounted CRV and use various DeFi-specific strategies to stay afloat. At present, his positions are quite healthy, but he will have to be careful that the CRV price does not fall below $0.36, which currently seems unlikely.