Since the beginning of its dispute with the SEC, Coinbase has always defended itself by opposing the regulator’s attacks. However, the case has just taken a new turn: Brian Armstrong’s company has just appealed to a Manhattan court judge to reject the accusations made against it. Coinbase is denouncing the SEC’s abuse of power, claiming that it is conducting illegal operations against the cryptocurrency industry.

Coinbase seeks to dismiss SEC complaint

Recently, US exchange Coinbase filed a motion to invalidate the Securities and Exchange Commission (SEC) complaints made against it. In addition, the Web3 behemoth will shortly be asking a judge to assess the relevance of the lawsuit brought by the regulator

As a reminder, on 6 June 2023, the institution dedicated to the American financial markets took Brian Armstrong’s company to court. It accused the company of failing to comply with current securities laws by allowing trading in a dozen or so crypto-currencies considered to be securities. Its staking programme also came in for heavy criticism from the regulator.

In a letter filed in Manhattan federal court on Wednesday evening, Coinbase rejected the SEC’s accusations, arguing that the crypto-currencies available on its platform are not securities. At the same time, the company points out that there is too great a discrepancy between the legislation in place and the interpretation made by the US regulator:

“Rather than test a new point of view by developing opinions and comments, the SEC has chosen to deploy its aggressive agenda through punitive retroactive enforcement actions. The agency’s enforcement power is significant but not unlimited. The SEC’s action here is beyond those limits and illegal. “

The cryptocurrency exchange denounces an abuse of power by the SEC, endangering the competitiveness of the US market to the benefit of other regions of the world like Europe and Asia.

In its lengthy 177-page document, the American company states that it is in favour of regulating cryptocurrencies and their technologies. However, the latter must be clear and precise in order to limit “regulatory loopholes” allowing abusive interpretation of the law.

SEC spills on Coinbase stock and crypto market

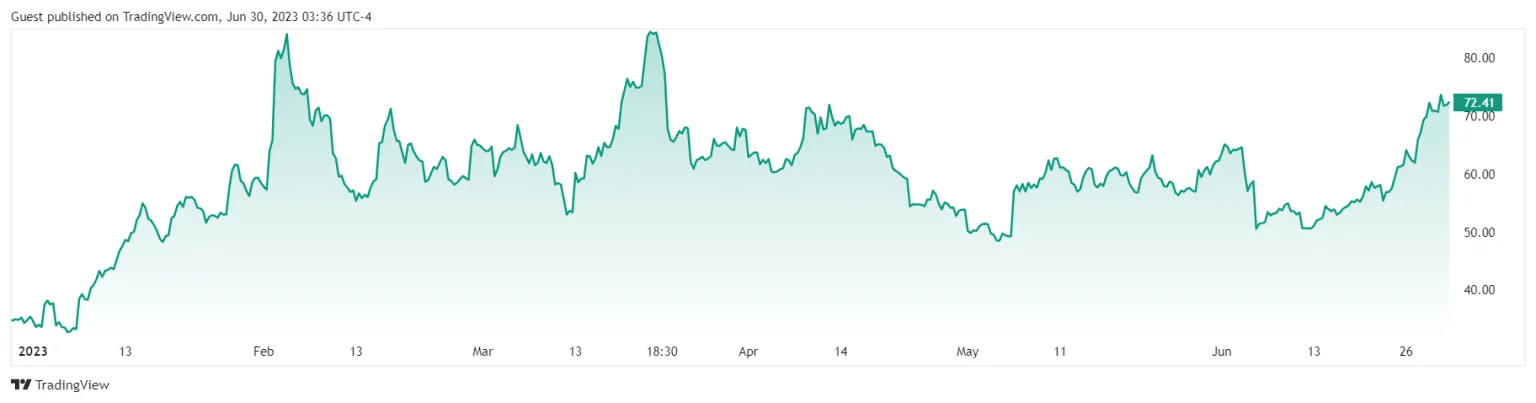

What does this mean for Coinbase’s share price? At $64 a share at the beginning of June, its price fell rapidly when the SEC launched its proceedings against Coinbase and its main rival Binance. In just two days, its share price fell by 22%.

However, as its shares are correlated with the cryptocurrency market, the company took advantage of the recent rise in Bitcoin (BTC) to not only offset its losses, but also bounce back on an upward trend. Currently, its price stands at $72, its highest since March 2023.

Coinbase (COIN) share price over the last 6 months

For its part, the cryptocurrency market is marked by a record dominance of Bitcoin (BTC) not seen since the previous bullrun. Today, the king of cryptocurrencies accounts for more than 50% of total market capitalisation.

This dominance reflects a growing interest in Bitcoin at the expense of altcoins, which, after a temporary surge, returned to near record lows in the wake of the SEC proceedings.

As a result, while BTC has grown by 84% since January 2023, MATIC, BNB and ADA are down 22.5%, 2.5% and 12% respectively. The sluggish prices of these cryptocurrencies are linked to the SEC case: by treating them as securities, their prices have fallen by 20% to 30% each.

ETH is distinguished from altcoins by the ubiquity of the Ethereum ecosystem on the Web3 and the SEC’s current confusion over the regulations to be applied to it. As a result, Ether has not been affected by these legal cases, and its share price has risen by 50% over the past 6 months.